Shale Daily | E&P | NGI All News Access | Permian Basin

Encana Credits STACK in Propelling Strong 2Q Growth

Calgary-based Encana Corp. has increased its second quarter outlook on better-than-expected results from the myriad stacks in Oklahoma’s Anadarko Basin.

In the interim update issued Monday, Encana also said it is holding the line on capital spending and repurchasing more shares.

Total liquids production in the second quarter to date has averaged 320,000 b/d, or about 10% higher sequentially. Increased liquids volumes are being driven by strong oil and condensate volumes from core growth assets in the Anadarko, Permian and Montney basins, which overall are expected to be 13-15% higher than in 1Q2019.

“Despite severe weather incidents in each of these regions during the second quarter, production impact has been minimal,” management said. “Performance from recent wells in the Anadarko Basin has been strong,” with production benefiting from a focus on the oil window of the Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties, i.e. STACK.

During the first quarter conference call in late April, CEO Doug Suttles said well costs in the Anadarko had fallen by about $1 million since completing the Newfield Exploration Co. takeover in February.

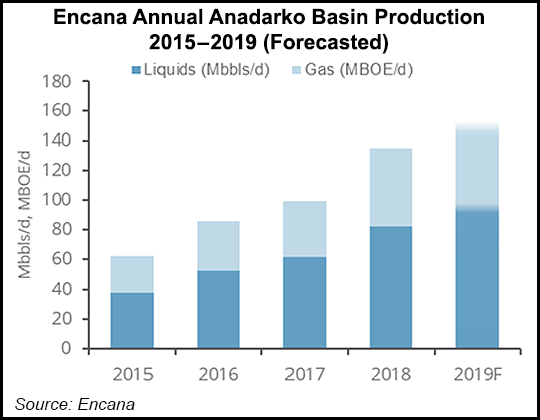

“Anadarko Basin production in the second quarter to date has averaged a record level of more than 160,000 boe/d, representing a double-digit increase over the first quarter of 2019,” management said. “Importantly, oil and condensate production quarter to date has averaged about 60,000 b/d, an increase of nearly 20% from its first quarter pro forma 2019 average.

STACK production quarter to date has averaged about 48,000 b/d, up more than 30% from 1Q2019, with gains tied in part to the Newfield purchase.

“Since closing our Newfield acquisition in mid-February, we have driven a significant reduction in well costs and delivered strong performance from new wells in the STACK,” Suttles said. “We have pumped our high-intensity completion design on more than two dozen wells with development spacing of six to eight wells per section.

“Results from these wells have been very strong. When our industry-leading well costs are combined with our favorable royalty structure (less than 20%) and agreements to access preferred oil and gas markets, we can deliver strong and competitive returns in the STACK.”

Combined with the record production levels in the Anadarko and sequential growth in the Permian and Montney, Encana expects 2Q2019 production will be 585,000-595,000 boe/d, 54% weighted to liquids.

Capital spending this year remains geared to $2.7-2.9 billion. Full-year output remains at the original target of 560,000-600,000 boe/d, which includes a planned exit from China. Encana has an agreement to terminate a production sharing contract with Chinese National Offshore Oil Corp., which is taking over operations at the end of July.

“We are delivering on our key objectives and expect to generate significant free cash this year even if recent oil prices are sustained through year end,” Suttles said. “Our results are driven by profitable liquids growth, strong performance from new wells across the portfolio and our never-ending focus on costs and efficiencies.

“In addition, our risk management program is reducing the impact from recent oil price volatility.” As of May 31, Encana has hedged 128,000 b/d of expected oil and condensate production at an average price through 2019 of $58.39/bbl. The company also has 951 MMcf/d of its expected remaining 2019 natural gas production hedged at an average price of $2.74/Mcf.

Meanwhile, Encana said it has repurchased 10% of outstanding shares so far this year and plans to begin an additional buyback for up to $213 million to complete a planned $1.25 billion share buyback program.

Since beginning the buybacks in March, Encana said it has invested $1.037 billion to purchase 149.4 million common shares, the maximum allowed by the Toronto Stock Exchange under the normal course issuer bid program, at an average price of $6.94/share.

“We see compelling value in Encana shares today, and we intend to fulfill our commitment to return cash to shareholders,” Suttles said. “This is part of our sustainable business model, which profitably grows liquids, generates free cash and returns significant cash to shareholders through dividends and opportunistic buybacks.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |