Regulatory | NGI All News Access | NGI The Weekly Gas Market Report

Mexico Needs to Take Advantage of U.S. Natural Gas Opportunity Now, Experts Say

To bolster energy security and fuel economic development, Mexico needs to quickly take full advantage of the surplus and inexpensive natural gas being produced in the southern United States, according to experts on the subject.

Four top professionals spoke earlier this month at the Mexican Energy Forum in Mexico City organized by Energy Dialogues LLC.

“It’s clear that natural gas globally is the fuel that is going to sustain the penetration of renewable energy,” said independent energy analyst Rosanety Barrios, who was head of the Industrial Transformation Policy Unit at the Mexican Energy Ministry during the previous administration.

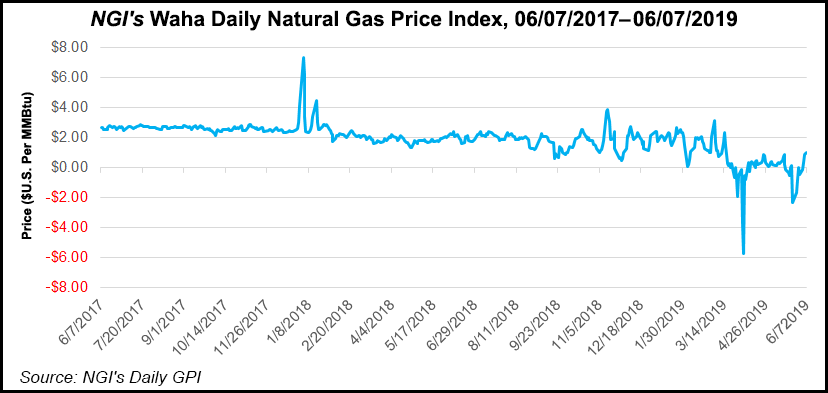

Barrios said with the impending growth of liquified natural gas (LNG) exports from the United States, Mexico will be one of the few regions able to take advantage of the comparatively lower prices of piped gas from Texas.

“If Mexico continues to import at the rate it does from the United States, it will represent one-third of all U.S. exports in 2022, and price differences will be key between LNG and piped gas.”

Infraestructura Energética Nova’s (IEnova) Areli Covarrubias, commercial director for natural gas, said U.S. natural gas is the path to economic opportunity.

“We need to recognize the role of natural gas as a central part of growth in Mexico,” she said. “Look at Baja California. Baja built natural gas pipelines through private companies in conjunction with the state. What happened? Natural gas arrived in 1996 and now there are steel, paper, glass and other manufacturing plants. Baja is a leader in the northern region in growth. Another similar example is Monterrey.”

However, she said overall infrastructure development for natural gas in Mexico has been “very slow. If in 10 years we have basically doubled pipeline infrastructure, we still haven’t gasified the country. If we compare Mexico and the U.S. in terms of pipelines, the difference is brutal. The U.S. has 400,000 kilometers of pipelines and in Mexico we have 20,000 kilometers.

“We need to make sure that infrastructure development doesn’t stop,” she said.

Beyond new pipelines, key projects have been delayed in Mexico, including the 2.6 Bcf/d Sur de Texas-Tuxpan, 886 MMcf/d Tuxpan-Tula, 886 MMcf/d Tula-Villa de Reyes, and 510 MMcf/d Guaymas-El Oro pipelines.

“We have to separate the political discussion from what needs to get done,” Covarrubias said.

Energy consultant Tania Rabasa argued that timing was key. “We need to do various things at different time periods. One of them is take advantage now of prices from the U.S., and another is to increase infrastructure, storage, and develop our own natural gas fields.”

The head of the national data repository at the Comisión Nacional de Hidrocarburos (CNH), Oscar Roldán, argued that increasing imports from the United States has created concerns around vulnerability to external events. He said the focus of the new administration should be on developing domestic sources of natural gas.

“Mexico is the most vulnerable nation in the world in terms of natural gas,” he said. “Last year we imported 88% of the gas we used without counting what Pemex uses,” referring to state-owned Petróleos Mexicanos. “This year we are going to go over 90%, and all of that from Texas. The levels of vulnerability are extremely high.”

Roldán said the current Mexico administration is talking about many things, but not about gas.

“The interesting thing in the new administration is that they don’t talk about natural gas,” he said. “They focus on refineries and gasoline. We have gas-rich basins. The potential is there. The question is, how do we get it out? In this government we want to be energy self-sufficient, but how are we going to do this? In natural gas we don’t see the attention needed. And it’s going to get worse.”

Barrios suggested energy needs can’t be seen as uniform across Mexico.

“Our best strategy is to develop our natural resources but also attain energy security. There are numerous ”Mexicos.’ There is no question that the north needs to take advantage of the opportunity of imports now.

“The governors of each state need to get involved, and the industrialists. The government wants to grow at 4%, and the government needs industry to invest to get us there.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |