NGI All News Access | E&P | Infrastructure

U.S. Adds Two Natural Gas Rigs; Steep Drop for Oil Patch

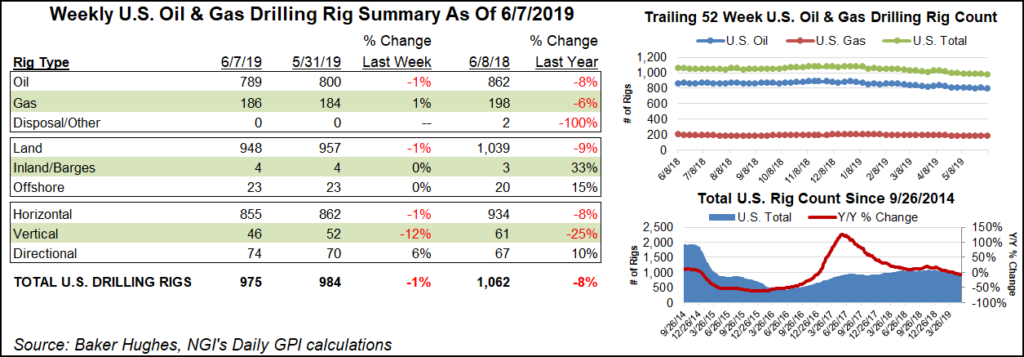

The U.S. natural gas rig count gained two units to reach 186 for the week ended June 7, but a drop in oil drilling drove a sharp pullback in the overall domestic drilling tally, according to the latest data from Baker Hughes, a GE Company (BHGE).

Thanks to a net loss of 11 oil-directed rigs, the U.S. rig count fell nine units to finish the week at 975, down 87 units from the 1,062 rigs running at this time last year.

Four directional rigs were added in the United States, while seven horizontal units and six vertical units packed up shop. Gulf of Mexico activity held steady at 23 rigs for the week, up from 19 in the year-ago period.

Canada saw a healthy bump in activity for the week, adding 18 rigs, including 15 oil-directed and three gas-directed, to finish at 103. That’s down slightly from 112 units a year ago. The combined North American rig count added nine rigs for the week to reach 1,078, down from 1,174 in the year-ago period.

Among plays, the Permian Basin accounted for the lion’s share of the declines on the week. The West Texas and Southeastern New Mexico play dropped six rigs week/week to fall to 446, down from 480 a year ago. The Marcellus Shale also experienced a notable drop in activity as three rigs packed up to leave the gassy play with 58 active rigs, roughly in line with 56 in the year-ago period.

Also among plays, the Haynesville Shale added two rigs, while the Granite Wash added one. The Cana Woodford, Denver Julesburg-Niobrara, Eagle Ford Shale and Williston Basin each dropped a rig from their respective totals, according to BHGE.

Among states, a net loss of seven rigs in Texas countered a net gain of four rigs in Louisiana. Pennsylvania dropped two rigs on the week, while Alaska, North Dakota, Oklahoma and West Virginia each dropped one.

Oil and natural gas production in Ohio’s Utica Shale declined in the first quarter as operators pared activity heading into the year in response to a variety of factors that are likely to see the trend continue.

Utica gas production came in at 609.5 Bcf during the first three months of the year, down 8% from a record set in 4Q2018, according to the Ohio Department of Natural Resources. Sequential oil production, meanwhile, also declined by 13% to about 5 million bbl. Ohio law does not require separate reporting for natural gas liquids or condensate, which are included in the oil and gas totals.

Meanwhile, total Canadian oilsands production is projected to approach 4 million b/d by 2030, nearly 1 million b/d more than current output, though the rate of growth is set to slow compared to previous years, according to a new 10-year production forecast published by IHS Markit.

The firm expects Canadian oilsands output to average 100,000 b/d of year/year growth over the next decade, down from a growth rate of more than 150,000 b/d over the current decade. The slower growth is being driven by transportation constraints that have created price uncertainty and discouraged new large-scale investments in oilsands development, according to IHS.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |