Shale Daily | Bakken Shale | E&P | NGI All News Access

North Dakota Power Load Driven Up by Oil, Gas Activity, Report Says

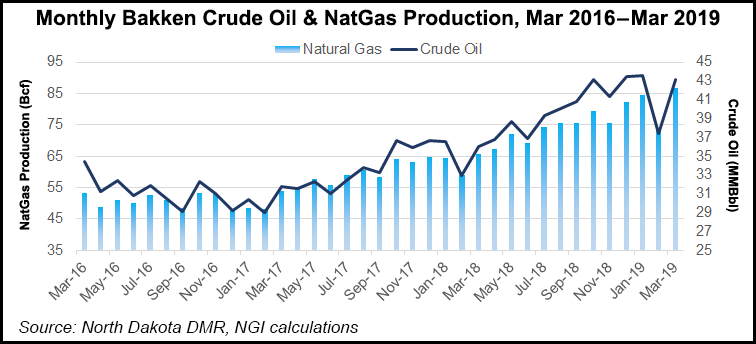

North Dakota will need a 71% increase in electric generation over the next 20 years to keep up with the robust oil and natural gas development in the Bakken Shale concentrated in the western half of the state, according to the North Dakota Industrial Commission (NDIC).

The state’s utilities should be developing “plans that include generation sources that best match the types of loads and capacity factors involved in the production and transportation of oil and gas,” the NDIC said.

Although some wellsite self-generation options can be considered, oil/gas operators for the most part are looking to local rural cooperatives to supply the added power, said John Weeda, director of the North Dakota Transmission Authority (NDTA).

“At this point in time, most of the operators are finding that it is better for both economic and logistic reasons to take service from the local utilities,” Weeda said. The push for better gas capture technologies to help reduce flaring has some onsite generation aspects, but none of them amount to large enough volumes of generation, he said.

“Excess gas moves around the field, so you need to have a technology that moves with the available gas supplies.”

The consensus and low-growth scenarios in a recent NDTA-commissioned study used models that included variations in commodity prices, regulations, technology advancements and other potential factors. The low scenario estimated 44% growth through 2038, while the consensus pointed toward a 71% increase, meaning total consumption would reach 18,000 GWh.

“The new forecast predicts that somewhere between 670 MW and 1,000 MW of new generating capacity will need to be built in the next 20 years to meet the oil/gas industry’s growing consumption rate,” Weeda said.

With its relatively small population and rural character, North Dakota is a net exporter of electricity, with more than 3,000 MW of wind power in place and added capacity likely to be developed. When the NDTA was formed in 1990 it was to assure the state had adequate transmission to export up to 70% in-state generation, but with the shale boom and the growth of the Bakken to more than 1 million b/d, power exports have dropped to about 50%, Weeda said.

“Utilities have been steadily making transmission additions in the oilfields to meet this growing electric load,” said Weeda. The annual growth of power use in the sector is projected to average more than 3% over the next two decades.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |