NGI Mexico GPI | Markets | NGI All News Access

Stout Natural Gas Supplies Send Futures Down Another Notch

Hefty natural gas supplies were on full display Thursday after the Energy Information Administration (EIA) reported another massive storage injection that sent futures prices tumbling to a fresh low. Spot gas prices also softened amid only small pockets of heat that were on tap for the rest of this week, namely in the West. The NGI Spot Gas National Avg. fell 5.5 cents to $2.00/MMBtu.

With little hot weather on the radar for June, all eyes were on Thursday’s EIA storage report. Just last week, the EIA shocked the market with a reported injection that was at least 10 Bcf higher than what most analysts had expected.

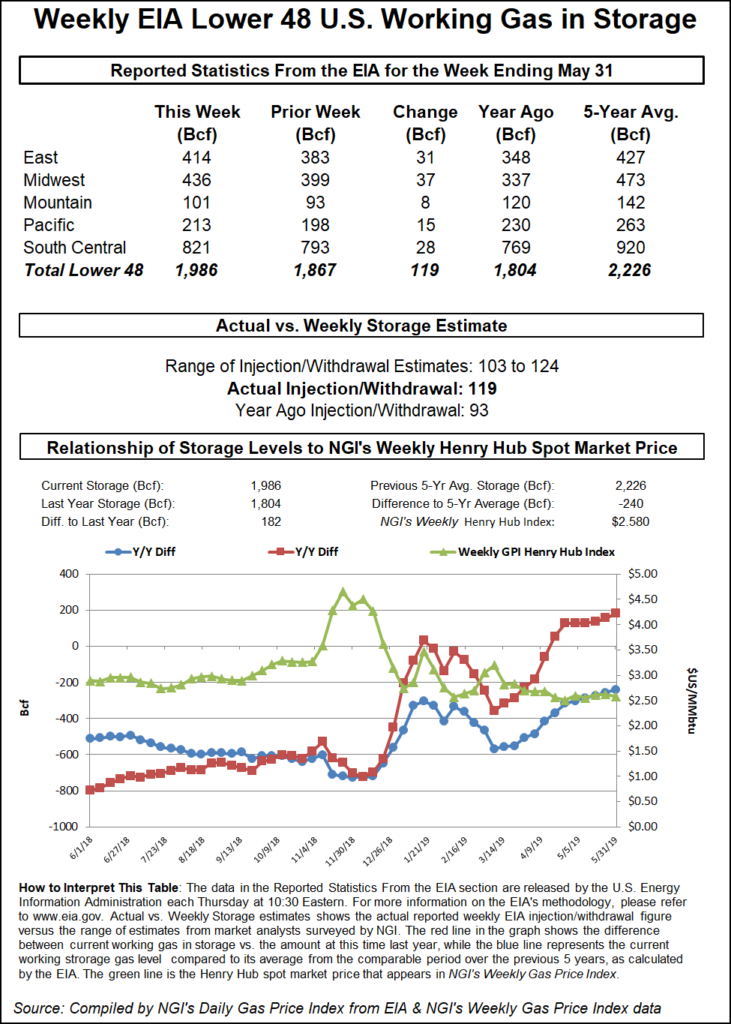

On Thursday, the EIA reported another whopping 119 Bcf build into inventories for the week ending May 31. The reporting week included the Memorial Day holiday, which analysts pegged as the primary reason for the large miss.

“Just didn’t see it in the scrapes I saw. Shouldn’t have assumed it away,” said Flux Paradox LLC President Gabriel Harris on Enelyst, an energy chat room hosted by The Desk.

The July Nymex gas futures contract reached a new three-year low of $2.305 before going on to settle at $2.324, down 5.4 cents on the day. August fell 5.6 cents to $2.324.

The reported storage build was well above last year’s 93 Bcf injection and the five-year 102 Bcf average build. Balance-wise, the 119 Bcf build is barely tighter than last week’s extremely loose 114 Bcf print, indicating that there is simply more supply in the market than what the data is showing, according to Bespoke Weather Services. The firm had projected a build of 110 Bcf.

“Given the improvement we have seen in balance data for the current week, we still believe next week’s number will reveal tightening has occurred, but it is harder to trust given the perceived supply inaccuracies in the data,” Bespoke chief meteorologist Brian Lovern said.

Broken down by region, 37 Bcf was injected into Midwest facilities, 31 Bcf was added in the East and 15 Bcf was injected into the Pacific region, according to EIA. The South Central saw 28 Bcf added to inventories, including 25 Bcf into nonsalt facilities and 3 Bcf into salts.

Total working gas in storage as of May 31 stood at 1,986 Bcf, which is 182 Bcf above last year and 240 Bcf below the five-year average, EIA said.

Meanwhile, summer heat is expected to remain elusive throughout much of June, with weather models this week continuing to peel back demand from outlooks. The latest midday American data was little changed through mid-June but continues to tease a hotter pattern trying to gain momentum around June 18-20, but still needing more evidence, according to NatGasWeather.

“Until the weather data does show more ominous heat building across the southern and eastern United States, weather patterns will maintain a bearish bias going forward,” the forecaster said.

As for Lower 48 production, output climbed to 89 Bcf but remains a couple Bcf below all-time highs. Power burns were weather-adjusted strong above 33 Bcf, while exports were flat with liquefied natural gas (LNG) exports of around 5.3 Bcf and Mexico exports at 4.8 Bcf, according to NatGasWeather.

For its part, Energy Aspects expects power burns to average 30.8 Bcf/d or so for June. Its modelling indicates an incremental 1.5 Bcf/d of gas burn under a 10% warmer-than-normal scenario and 0.8 Bcf/d more gas burn under a 5% warmer-than-normal scenario.

“Given the mild start to the month, the swing on weather assuming the 15-day forecast is realized will not move the needle on end-month inventories tremendously,” Energy Aspects said.

Meanwhile, the firm is expecting nearly 5.9 Bcf/d of feedgas use for LNG exports in June. That figure assumes Cameron LNG running at near nameplate capacity and allows for some incremental volumes to continue at Freeport LNG.

The first cargo from Cameron LNG’s export terminal in Hackberry, LA, set sail last month, while Freeport’s Train 1 is scheduled for commercial startup in 3Q2019. Full three-train commercial operations are expected by mid-2020.

Furthermore, the recent softness in the global gas market is not expected to impact U.S. LNG exports, according to Energy Aspects. Given the LNG market is a 60-day forward market, offtakers from Cheniere Energy Inc.’s Sabine Pass and Corpus Christi export terminals would have had to declare their intention not to lift June cargoes earlier this shoulder season.

Despite Dutch Title Transfer Facility prices near $4.00/MMBtu, “we still anticipate June cargoes will be exported,” Energy Aspects said.

The firm also expects stronger exports to Mexico once the Sur de Texas pipeline in Mexico enters service later this summer, as well as modest sequential industrial demand growth.

“Production remains the wildcard,” Energy Aspects said.

Several exploration and production (E&P) companies, particularly in Appalachia, have already cut planned spending for 2019 in a bid to improve results in a weak pricing environment. Although production guidance for many of these companies continues to reflect growth, the pace of growth is expected to be somewhat softer than in 2018.

In a sea of red, West Texas cash prices continued to strengthen Thursday, with major pricing hubs trading well above $1.

El Paso Permian spot gas traded as high as $1.30 but averaged just 91 cents. Waha similarly moved well above the $1 threshold but averaged a few cents back.

Permian Basin pricing has improved significantly in the last few days following the end of a pair of maintenance events on Natural Gas Pipeline Co. of America and El Paso Natural Gas. Further price improvement is expected once Kinder Morgan Inc.’s (KMI) Gulf Coast Express pipeline enters service this fall. Although rumors of an early start have been spreading for weeks, KMI executives have stuck to their planned October in-service date.

“The possibility of new takeaway capacity materializing in the weeks ahead, earlier than expected, has renewed hope among some market participants that the Permian gas price woes will soon be a thing of the past,” RBN Energy analyst Jason Ferguson said. “The Permian gas market continues to keep us on our toes.”

Outside of West Texas, spot gas prices were mostly lower. The majority of pricing hubs in the Midcontinent slipped a few cents on the day, while Panhandle Eastern tacked on 11.5 cents to average $1.43.

Midwest prices came off no more than a nickel, while Appalachia prices slid as much as 14.5 cents at Millennium East Pool.

Similar losses were seen at Algonquin Citygate, which plunged to $2.155, while other Northeast points dropped less than a dime on the day.

Prices across the West posted substantial declines despite some of the hottest weather situated in the Southwest. El Paso S. Mainline/N. Baja next-day gas plunged 32 cents to $1.64.

Most other points in California and the Rockies were down between 15 and 40 cents.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |