Back-to-Back Bearish Storage Surprises Open Floor for Natural Gas Futures

One week after delivering a massively bearish storage injection, the Energy Information Administration (EIA) reported another triple-digit whopper that sets the stage for more downside in natural gas futures prices.

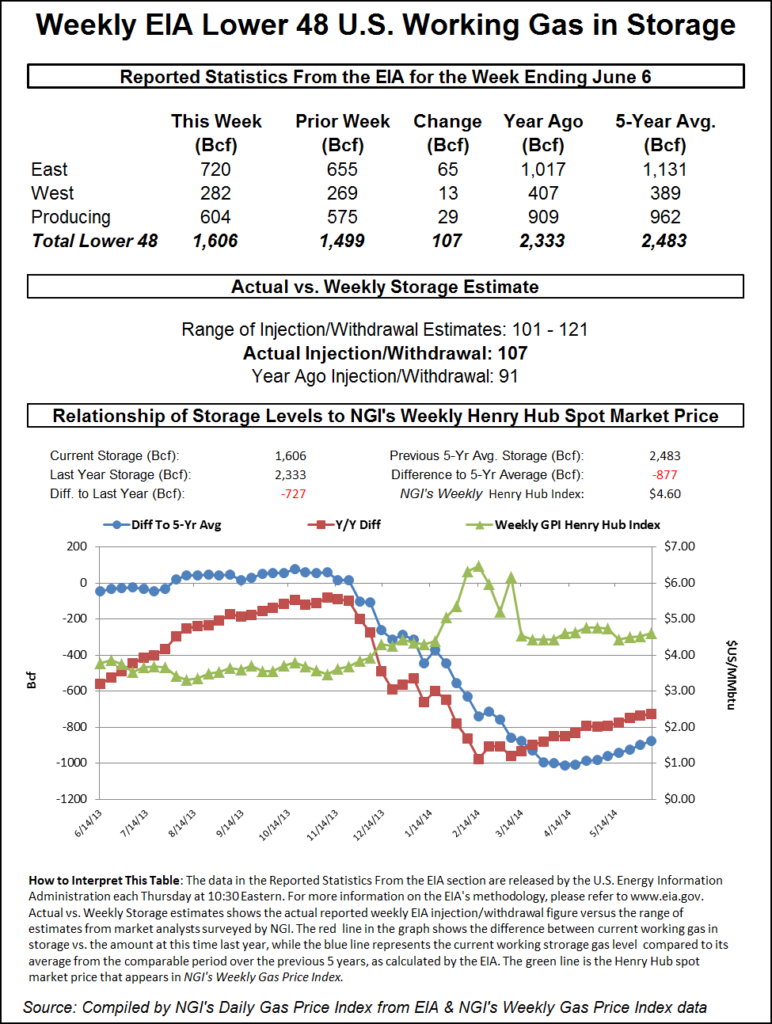

The EIA reported a 119 Bcf injection into storage inventories for the week ending May 31. The build was well above last year’s 93 Bcf injection and the five-year 102 Bcf average build.

Ahead of the report, analysts had expected a build closer to 110 Bcf. A Bloomberg survey of 16 analysts showed injections ranging from 103 Bcf to 121 Bcf, with a median of 109 Bcf. A Reuters poll of 19 analysts had a range reflecting a build between 104 Bcf and 124 Bcf, with a median of 109 Bcf. Intercontinental Exchange settled Wednesday at a 110 Bcf injection. NGI projected a 111 Bcf build.

“I think there was Memorial Day impact. Just didn’t see it in the scrapes I saw. Shouldn’t have assumed it away,” said Flux Paradox LLC President Gabriel Harris on Enelyst, an energy chat room hosted by The Desk.

Nymex gas futures responded swiftly to the EIA data. The July contract was trading about a penny higher day/day at around $2.39 about 10 minutes ahead of the EIA’s 10:30 a.m. ET report. The prompt month then fell to $2.354 as the print hit the screen. By 11 a.m. ET, the July contract was down to $2.333, down 4.5 cents on the day.

While some analysts believe prices are already nearing a bottom with little room for additional downside ahead, Harris said he didn’t see a reversal on the recent price trend until August becomes the prompt month. “Anyone who will get desperate for supply in July is already in decent shape.”

Balance wise, the 119 Bcf build is barely tighter than last week’s extremely loose 114 Bcf print, indicating that there is simply more supply in the market than what the data is showing, according to Bespoke Weather Services. The firm had projected a build of 110 Bcf.

“Given the improvement we have seen in balance data for the current week, we still believe next week’s number will reveal tightening has occurred, but it is harder to trust given the perceived supply inaccuracies in the data,” Bespoke chief meteorologist Brian Lovern said.

Broken down by region, 37 Bcf was injected into Midwest facilities, 31 Bcf was added in the East and 15 Bcf was injected into the Pacific region, according to EIA. The South Central saw 28 Bcf added to inventories, including 25 Bcf into nonsalt facilities and 3 Bcf into salts.

Total working gas in storage as of May 31 stood at 1,986 Bcf, which is 182 Bcf above last year and 240 Bcf below the five-year average, EIA said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |