Shale Daily | E&P | NGI All News Access | Permian Basin

Alpine High Natural Gas Secures New Permian Outlet with Altus Startup

Apache Corp.’s No. 1 global target, the Permian Basin’s Alpine High, is seeing some pent-up relief for its natural gas supply with the start up of the first of three cryogenic processing plants at Altus Midstream Co.’s Diamond Cryo Complex.

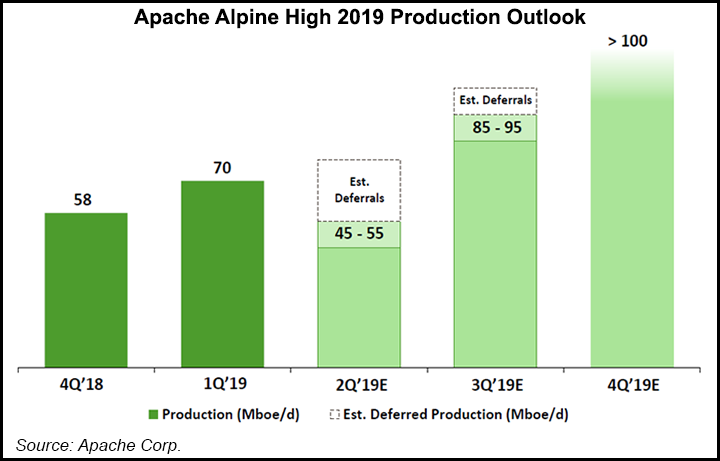

Apache in late March had begun deferring about 250 MMcf/d gross volumes from the Delaware sub-basin play in response to “extremely low prices at Waha hub.” Gas at the hub has traded in negative territory off and on for several months.

Altus, created last year to handle most of Apache’s gas processing, said the Diamond complex is turning to sales natural gas liquids (NGL) and residue gas. All three units are scheduled to begin operations this year, with aggregate nameplate capacity of 600 MMcf/d. The complex is designed to produce an estimated 60,000-75,000 b/d of NGLs for Apache.

“We are thrilled to have the first unit of the Diamond Cryo Complex in service and quickly increasing volumes toward nameplate capacity of 200 MMcf/d,” said CEO Clay Bretches. “This is just the beginning for Altus.

“By the end of 2019, we expect to triple our cryogenic processing capacity at Alpine High with the in-service of Train No. 2 in July and Train No. 3 in the fourth quarter of this year.” The second and third trains are on budget and on schedule, he added.

The cryogenic processing facilities feature state-of-the-art processing technology, supplemental rectification with reflux, aka SRX, which optimizes processing economics, “with better NGL recoveries in both ethane recovery and rejection mode versus more commonly used processing methods in the Permian Basin,” Bretches said.

“Better recoveries will drive enhanced netbacks for Apache and provide a competitive advantage to Altus for third-party business.”

Altus also has exercised an option to acquire a 26.7% stake in the 2 Bcf/d Permian Highway Pipeline (PHP), which when completed would deliver supply to the Gulf Coast. The 42-inch diameter pipeline last September was given the all-clear by other joint venture (JV) partners Kinder Morgan Texas Pipeline LLC and EagleClaw Midstream Ventures LLC.

A final investment decision to advance PHP, unveiled last year, could put the pipeline in service by late 2020. PHP would move gas through a 430-mile pipeline from Waha to Katy, west of Houston, with connections to the Gulf Coast and Mexico markets.

“We are very excited to participate in the Permian Highway Pipeline,” Bretches said Thursday. “This is a high-quality project supported by take-or-pay contracts with creditworthy counterparties.”

Shippers already committed to the project besides EagleClaw include Apache and XTO Energy Inc., a subsidiary of ExxonMobil Corp.

Net to the Altus ownership interest, the exercise price of the option is about $161 million, Bretchese said, which includes the proportional share of capital spent by the JV partners.

“Exercising the PHP option in advance of the September deadline minimizes this financing charge, which reduces our capital requirements by approximately $8 million relative to what was included in our 2019 guidance,” he noted.

The ownership split on the estimated $2.1 billion long-haul pipeline now is 26.7% each by Altus Midstream Processing, KMTP and EagleClaw, with the remaining 20% owned by an anchor shipper affiliate.

Altus, a pure-play, Permian-to-Gulf Coast midstream C-corporation, owns or has the option to own JV equity interests in five Permian pipelines, four of which go to various points along the Texas coast.

The current Permian gas pipeline queue of PHP and Gulf Coast Express, set to begin operations by October, “provides only temporary relief for the Waha market as we anticipate 2 Bcf/d of annual residue gas growth resulting in status quo oversupply over the next two years,” Tudor, Pickering, Holt & Co. analysts said Thursday.

“With regional pricing languishing in negative territory and growing industry aversion to flaring, recent upstream commentary suggests increased willingness to commit to takeaway,” with the proposed 2 Bcf/d Whistler Pipeline Project “potentially the next project to see positive FID.”

Meanwhile, Altus also is searching for a COO as Craig Collins has resigned to accept a position with a “large public” exploration and production company, Bretches said. Collins’ departure “is not related to any legal, operational or financial concerns or any disagreements with Altus or Apache management.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |