NGI The Weekly Gas Market Report | E&P | Infrastructure | NGI All News Access

Two Natural Gas Rigs Exit U.S. Patch; Oil Count Climbs

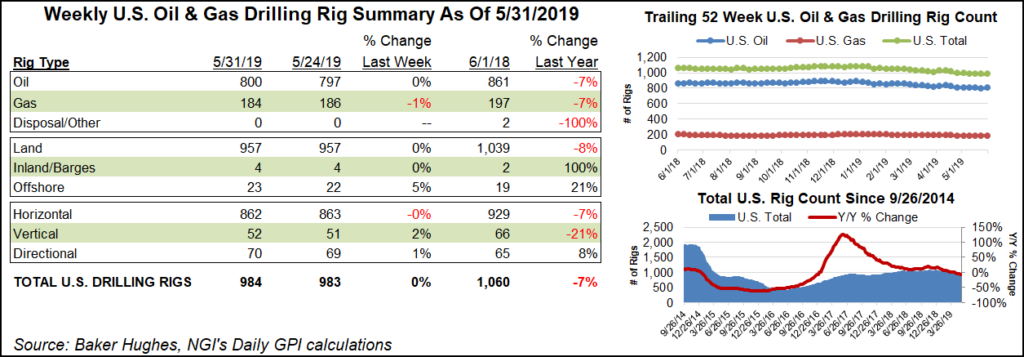

The U.S. natural gas rig count dropped two units to finish at 184 for the week ended May 31, while an uptick in oil drilling nudged the overall domestic count higher, according to data from Baker Hughes, a GE Company (BHGE).

Three oil-directed rigs returned to action in the United States during the week, growing the total U.S. count to 984, 76 units behind the year-ago total of 1,060.

Land drilling held steady at 957 rigs, while one unit was added in the Gulf of Mexico, bringing its total to 23. One directional unit and one vertical unit was added, offsetting the loss of one horizontal rig, according to BHGE.

Canada, meanwhile, added seven rigs for the week, six oil-directed and one gas-directed, increasing its total to 85, down from 99 in the year-ago period. The combined North American rig count ended the week at 1,069, versus 1,159 active rigs at this time last year.

Among plays, BHGE reported no major changes week/week. The Haynesville Shale and Permian Basin each added one rig to their respective totals. Meanwhile, in Appalachia, the Marcellus and Utica shales each dropped one unit, falling to 61 and 18 rigs, respectively. As of Friday, the Marcellus had outpaced its year-ago count of 56, while Utica activity lagged behind the 24 rigs running in the play at this time last year.

Among states, New Mexico added two rigs on the week, while Louisiana added one. Ohio, Oklahoma, Texas and West Virginia each dropped one net rig, BHGE data show.

Nearly 90% of U.S. unconventional operators are burning cash, and many have not achieved a positive cash flow balance, according to a recent study of the financial performance of 40 companies.

Rystad Energy’s analysis of the exploration and production companies, issued earlier in the week, focused on cash flow from operating activities (CFO). CFO is cash available to expand the business via capital expenditures (capex) that help to reduce debt or to return to shareholders.

Only four companies in Rystad’s peer group reported a positive cash flow balance in 1Q2019, reducing the share of E&Ps with a positive balance from the recent norm of around 20% to only 10%.

Total CFO fell from $14 billion in 4Q2018 to $9.9 billion in the first quarter.

“That is the lowest CFO we have seen since the fourth quarter of 2017,” said senior analyst Alisa Lukash, who is part of Rystad’s North American Shale team. “The gap between capex and CFO has reached a staggering $4.7 billion. This implies tremendous overspend, the likes of which have not been seen since the third quarter of 2017.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |