NGI The Weekly Gas Market Report | Infrastructure | NGI All News Access

Apache’s Alpine High Natural Gas Deferrals Get Some Relief as Altus Ramps Processor

Houston-based Altus Midstream Co. has started up the first of three cryogenic processing trains at the Diamond Cryo Complex in West Texas, helping to alleviate Alpine High natural gas shut-ins by its primary customer Apache Corp.

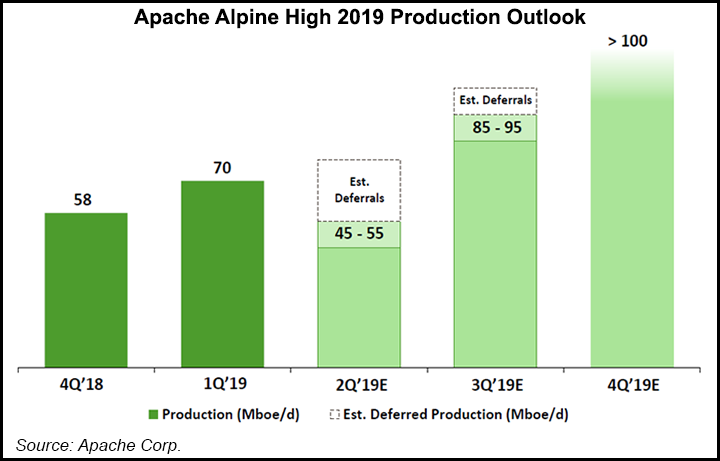

Apache in late March began deferring gas production volumes from the Permian Basin play in the Delaware sub-basin in response to “extremely low prices at Waha hub.” Gas at the hub has traded in negative territory off and on for several months.

Apache’s shut-ins at the time represented 250 MMcf/d of gross output.

Altus, created last year initially to handle most of Apache’s gas processing specifically in its No. 1 play, said the Diamond complex is turning to sales natural gas liquids (NGL) and residue gas.

All three units are scheduled to begin operations this year, with aggregate nameplate capacity of 600 MMcf/d. The complex is designed to produce an estimated 60,000-75,000 b/d of NGLs for Apache.

“We are thrilled to have the first unit of the Diamond Cryo Complex in service and quickly increasing volumes toward nameplate capacity of 200 MMcf/d,” said CEO Clay Bretches. “This is just the beginning for Altus.

“By the end of 2019, we expect to triple our cryogenic processing capacity at Alpine High with the in-service of Train No. 2 in July and Train No. 3 in the fourth quarter of this year.” The second and third trains are on budget and on schedule, he added.

The cryogenic processing facilities feature state-of-the-art processing technology, supplemental rectification with reflux, aka SRX, which optimizes processing economics, “with better NGL recoveries in both ethane recovery and rejection mode versus more commonly used processing methods in the Permian Basin,” Bretches said.

“Better recoveries will drive enhanced netbacks for Apache and provide a competitive advantage to Altus for third-party business.”

Altus also said it is searching for a COO as Craig Collins has resigned to accept a position with a “large public” exploration and production company, Bretches said. Collins’ departure “is not related to any legal, operational or financial concerns or any disagreements with Altus or Apache management.”

Meanwhile, Altus has exercised an option to acquire a 26.7% stake in the 2 Bcf/d Permian Highway Pipeline (PHP), which when completed would deliver natural gas from West Texas to the Gulf Coast. The 42-inch diameter pipeline last September was given the all-clear by other partners Kinder Morgan Texas Pipeline LLC and EagleClaw Midstream Ventures LLC. A final investment decision to advance PHP, unveiled last June, could put the pipeline in service by late 2020.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |