NGI All News Access | Infrastructure | Markets

EIA’s 114 Bcf Injection ‘Quite the Bearish Print,’ Prompts NatGas Futures Sell-Off

The Energy Information Administration (EIA) on Thursday reported a much larger-than-expected 114 Bcf injection into U.S. natural gas stocks, adding to bearish momentum in the futures market.

The 114 Bcf build, reported for the week ended May 24, overshot estimates by a wide margin, and the number easily tops both the 95 Bcf build recorded in the year-ago period and the five-year average 97 Bcf injection.

The Nymex July futures contract was already down several cents in early trading Thursday. When the bearish EIA figure crossed trading screens at 10:30 a.m. ET, the front month quickly shed another 3.0 cents or so, dropping from $2.580/MMBtu down to around $2.550.

But as traders spent the next half hour mulling the implications of such a large bearish miss, prices stabilized. By 11 a.m. ET, July was trading around $2.556, down 6.8 cents from Wednesday’s settle.

Prior to the EIA report, consensus had formed around a build in the high 90s to low 100s Bcf. A Bloomberg survey had pointed to a median prediction of 98 Bcf, based on estimates ranging from 94 Bcf to 104 Bcf. The 114 Bcf figure topped even the highest estimate submitted to this week’s Reuters survey, which had called for a 101 Bcf injection based on a range from 91 Bcf to 110 Bcf. Intercontinental Exchange EIA Financial Weekly Index futures settled Wednesday at 100 Bcf, while NGI’s model predicted a 98 Bcf build.

During a weekly natural gas storage chat on Enelyst, Het Shah, managing director for the platform, called it “quite the bearish print. Next week is bound to be a mess as well with the long weekend.”

Shah pointed to the Midwest and South Central regions as the areas where estimates missed the mark this week.

“I think it’s the timing of the heat that threw off the number,” Shah wrote. “This late-May heat resembled something we’d see in late June.”

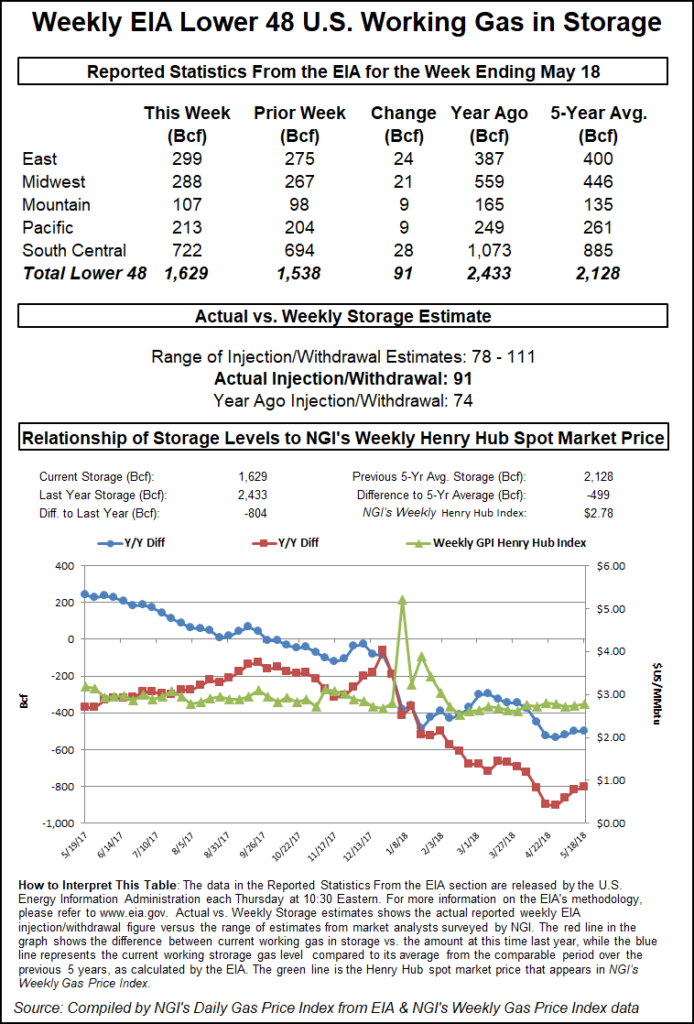

Total Lower 48 working gas in underground storage stood at 1,867 Bcf as of May 24, 156 Bcf (9.1%) higher than year-ago levels but 257 Bcf (minus 12.1%) below the five-year average, according to EIA.

By region, EIA recorded a 35 Bcf build in the Midwest and a 30 Bcf injection in the East. Further west, the Mountain region refilled 4 Bcf for the week, while 12 Bcf was injected in the Pacific.

The South Central region posted a 31 Bcf weekly build, including 27 Bcf injected into nonsalt and 4 Bcf into salt stocks, according to EIA.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |