NGI Weekly Gas Price Index | Markets | NGI All News Access | NGI Data

Southeast Heat Can’t Erase Weakness in Weekly Natural Gas Spot Prices

The prospect of record Southeast heat provided the lone bright spot for natural gas bulls in the spot market during the week ended May 24; with widespread discounts in the lead-up to Memorial Day, the NGI Weekly Spot Gas National Avg. tumbled 17.5 cents to $2.035/MMBtu.

Forecasts showing temperatures climbing into the 90s and possibly even triple digits in the southeastern United States supported higher spot prices in the region for week. Transco Zone 4 added 4.0 cents to $2.595, while Transco Zone 5 picked up 7.0 cents to $2.650.

West Texas prices veered well into negative territory once again during the week, with pipeline maintenance issues applying additional downward pressure on the already constrained Permian Basin producing region. El Paso Permian averaged minus 55.0 cents on the week, a decline of $1.075.

Also coinciding with maintenance-related constraints, two Midcontinent points set new all-time lows during the week, logging negative trades of their own. NGPL Midcontinent fell 57.0 cents to average $1.360 on the week, including trades as low as minus $1.000. OGT traded as low as minus 25.0 cents on the way to averaging $1.520 on the week, a 26.5-cent discount compared to the week prior.

The natural gas futures market turned in a quiet day of trading Friday as the latest readings on fundamentals didn’t offer much to excite traders and peel them away from their holiday plans. The June Nymex futures contract notched 2.0 cents to settle at $2.598. Week/week the front month contract fell 3.3 cents after settling at $2.631 the previous Friday.

The midday Global Forecast System data carried over the “impressive early season heat” for the southeastern United States from previous guidance, NatGasWeather said.

“Again, this southeastern U.S. heat would be a much bigger deal if it wasn’t for exceptionally comfortable temperatures expected from Chicago to New York City most days through early June,” the forecaster said. “The hot southeastern U.S. ridge is forecast to weaken” by the middle of the upcoming week and into the start of June, “decreasing coverage of 90s.

“However, the weather data has found ways to gradually add demand over time the past several weeks, which could again occur over the long weekend break.” Trade coming out of the Memorial Day holiday “should be quite volatile with the June 2019 expiration and with the markets factoring in long weekend temperatures and production trends.”

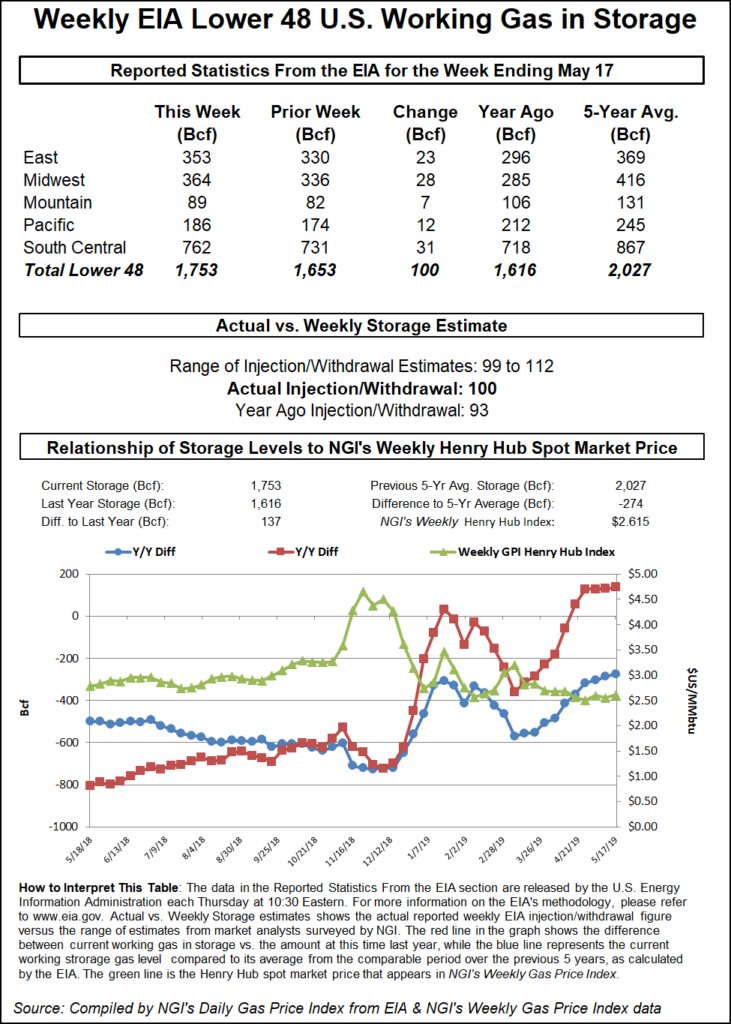

Meanwhile,the Energy Information Administration (EIA) on Thursday reported a 100 Bcf weekly injection into U.S. natural gas stocks, a figure on the low side of estimates that elicited a fairly muted reaction from the futures market.

The 100 Bcf injection, recorded for the week ended May 17, compares with a 93 Bcf injection in the year-ago period and a five-year average 88 Bcf build. The number continues a run of above-average builds stretching back to March. Injections have topped the comparable five-year average every week since the season’s first net injection, recorded for the period ended March 29, EIA data show.

Estimates prior to the report had pointed to yet another above-average shoulder season storage injection a few Bcf higher than the actual figure. Surveys as of Wednesday had shown a consensus prediction in the low triple digits, with estimates ranging from 99 Bcf to 112 Bcf. NGI’s model predicted a 105 Bcf build.

According to Bespoke Weather Services, “Balance-wise, this is similar to last week’s 106 Bcf build, with the two-week average versus the five-year average balance implying just under 3.9 Tcf at the end of the season, though weather adjusting can be more difficult in these lower demand times of the year. That still suggests that we need to see material improvement in balances to avoid a large storage total heading into winter.”

The report marks the third build to top the 100 Bcf mark so far this injection season, but it might not be the last. According to various projections and estimates shared during a weekly storage discussion on energy chat platform Enelyst, two or more 100 Bcf-plus builds could be coming from EIA over the next few weeks.

Total Lower 48 working gas in underground storage stood at 1,753 Bcf as of May 17, 137 Bcf (8.5%) above last year’s stocks but 274 Bcf (minus 13.5%) lower than the five-year average, according to EIA.

By region, the South Central posted the largest build for the week at 31 Bcf. That included a 9 Bcf injection into salt stocks, along with a 22 Bcf build into nonsalt. The Midwest refilled 28 Bcf for the period, while the East refilled 23 Bcf. Further west, the Mountain region saw a net 7 Bcf build, while the Pacific injected 12 Bcf, according to EIA.

Analysts with Raymond James & Associates said the 100 Bcf build implies the market was 1.7 Bcf/d looser versus the same week last year, excluding weather-related demand. Over the past four weeks, the market has averaged 2.4 Bcf/d looser year/year, according to the firm.

Genscape Inc. analysts viewed the 100 Bcf injection as about 3.7 Bcf/d looser versus the five-year average when compared to degree days and normal seasonality.

Tudor, Pickering, Holt & Co. (TPH) analysts observed that inventories have sat at a 9% surplus to year-ago levels throughout the month of May, with builds continuing to track above the five-year average.

“Total degree days came in 8% above the five-year average, and the weather-adjusted oversupply is sitting at 3 Bcf/d (up from 2 Bcf/d last week),” the TPH team said. Liquefied natural gas (LNG) “export volumes continue to ramp, reaching an all-time high of 5.98 Bcf/d late last week…we see strong LNG exports as key to temporarily balancing the market in 3Q2019. A preliminary look at next week has inventories building by 103 Bcf, compared to a five-year average 95 Bcf build.”

A maintenance event restricting northbound flows through Kansas on Natural Gas Pipeline Co. of America (NGPL) appeared to cause significant and, in some areas, unprecedented weakness for spot prices in West Texas and the Midcontinent Friday.

NGPL declared a force majeure Thursday due to a “pipeline anomaly” discovered on the Amarillo #3 mainline in its Midcontinent Zone. NGPL said it would be reducing the maximum operating pressure through the area, resulting in a constraint on northbound capacity through Compressor Station 194 in Ellsworth County, KS.

“This change was reflected in intraday and timely cycle data that showed 614 MMcf/d in nominations being revised down” for Thursday’s intraday cycles and for Friday’s timely and evening cycles, according to Genscape analyst Matt McDowell. “Flow out of NGPL’s 365 MMcf/d Permian leg also saw decreases day/day as nominations were backed up along the Amarillo mainline.”

Prices throughout West Texas posted hefty losses, resulting in widespread negative pricing that has become all-too-familiar for Permian Basin producers in recent months. Waha plunged $2.415 to average minus $2.305.

This price weakness migrated further north Friday, resulting in new all-time lows for NGPL Midcontinent and OGT amid all the congestion in the region. NGPL Midcontinent averaged minus 6.0 cents on the day, a $1.720 day/day drop and the lowest average ever recorded at the location, Daily GPI historical data show. The lowest individual trade at NGPL Midcontinent Friday was also a new record at minus $1.000. Trading at OGT set new lows for that location also, with prices dropping 74.5 cents to 89.0 cents, including single trades as low as minus 25.0 cents.

Elsewhere, the unofficial start of summer didn’t threaten enough heat to stir significant buying interest for delivery over the long Memorial Day weekend. Prices throughout the Southeast, Gulf Coast, Midwest, Northeast and Appalachia generally traded within a nickel of even.

The National Weather Service (NWS) was calling for “a very active weather pattern” to continue through the central part of the country into the weekend.

“This is in response to an anomalous upper level trough situated over the Intermountain West and a large upper level ridge anchored over the southeastern U.S.,” the NWS said. “A clash of air masses from the southern Plains to the Ohio Valley region will support multiple episodes of bad weather in the general vicinity of a slow-moving frontal boundary with waves of low pressure developing along it.

“…In terms of temperatures, readings will continue to be below average for the Rockies and extending westward across the Great Basin and into California…Across the Deep South and the Carolinas, record high temperatures” were possible over the weekend “with highs soaring well into the 90s and perhaps close to 100 degrees for some areas.”

For the western United States, spot prices sold off heavily heading into the holiday weekend. Malin dropped 29.0 cents to $1.605, while Kern River fell 27.0 cents to $1.575. Northwest Sumas slid 22.5 cents to $1.405.

Northwest Pipeline’s Jackson Prairie storage facility has refilled to levels that are unprecedented for this time of year, relieving upward pressure on Northwest Sumas forwards for the second half of 2019, according to Genscape analyst Joe Bernardi.

“Jackson Prairie’s inventory rose above 20 Bcf” as of May 19, “the earliest date in the year for it to have done so in 10-plus years,” Bernardi said. “The previous earliest date for inventories to reach this mark was June 5, and on average these inventories haven’t risen above 20 Bcf until early August. This is a noteworthy turnaround…given that Jackson Prairie had fallen below the 10-year lows back in mid-March. Jackson Prairie’s working inventory capacity is just under 25 Bcf, so it is now more than 80% full.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |