Natural Gas Futures See Modest Bounce as Latest Injection Lighter Than Estimates

A weekly inventory build on the low side of estimates and a warmer-leaning early June outlook supported a small bounce in natural gas futures prices Thursday. In the spot market, heat in the Southeast and cooler temperatures in the West did little to impress buyers; the NGI Spot Gas National Avg. eased 0.5 cents to $2.075/MMBtu.

The June Nymex futures contract gained 3.5 cents to settle at $2.578, recovering some of the losses recorded earlier in the week. Further along the strip, July picked up 3.3 cents to $2.592, while August settled at $2.604, up 3.0 cents.

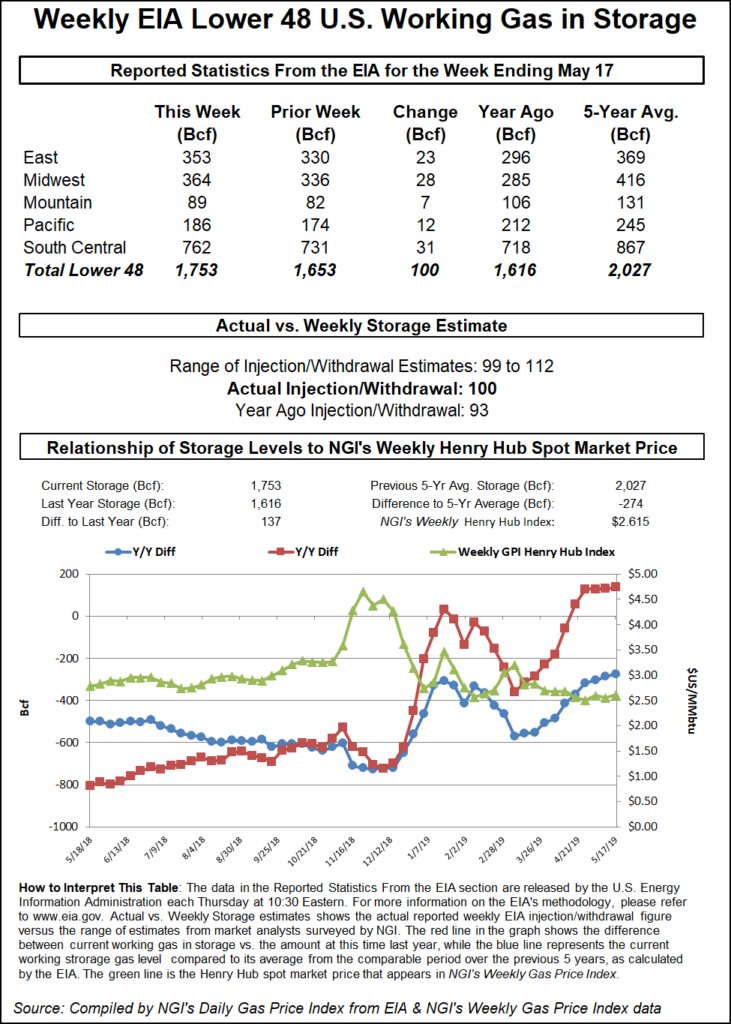

The Energy Information Administration (EIA) on Thursday reported a 100 Bcf weekly injection into U.S. natural gas stocks for the week ended May 17, versus a 93 Bcf injection in the year-ago period and a five-year average 88 Bcf build. The number continues a run of above-average builds stretching back to March. Injections have topped the comparable five-year average every week since the season’s first net injection, recorded for the period ended March 29, EIA data show.

Estimates prior to the report had pointed to yet another above-average shoulder season storage injection a few Bcf higher than the actual figure. Surveys as of Wednesday had shown a consensus prediction in the low triple digits, with estimates ranging from 99 Bcf to 112 Bcf. NGI’s model predicted a 105 Bcf build.

The report marks the third build to top the 100 Bcf mark so far this injection season, but it might not be the last. According to various projections and estimates shared during a weekly storage discussion on energy chat platform Enelyst, two or more 100 Bcf-plus builds could be coming from EIA over the next few weeks.

Total Lower 48 working gas in underground storage stood at 1,753 Bcf as of May 17, 137 Bcf (8.5%) above last year’s stocks but 274 Bcf (minus 13.5%) lower than the five-year average, according to EIA.

By region, the South Central posted the largest build for the week at 31 Bcf. That included a 9 Bcf injection into salt stocks, along with a 22 Bcf build into nonsalt. The Midwest refilled 28 Bcf for the period, while the East refilled 23 Bcf. Further west, the Mountain region saw a net 7 Bcf build, while the Pacific injected 12 Bcf, according to EIA.

As for the weather outlook, the midday data Thursday showed some additional heat for the first week of June, according to Bespoke Weather Services.

“That has been a subtle trend over the last couple of days, with models tending to weaken the early June cool push, or, at the least, lessening its impact on the southern half of the nation,” Bespoke said. “Nonetheless, we do still anticipate overall demand lowers closer to normal levels as we enter the month of June.

“From there, we will be monitoring the status of El Nino to see if it is able to re-strengthen, or if it stays weak and closer to a non-signal, which would open the door to some hotter risks in the eastern half of the nation for summer as a whole.”

Meanwhile, after securing approval from FERC Monday to begin exporting volumes produced during commissioning activities, the Cameron liquefied natural gas (LNG) export facility continues to show signs of progress toward full commercial service, according to Genscape Inc.

“Average estimated liquefaction volumes sit at approximately 190 MMcf/d after factoring in commissioning fuel use,” analysts with Genscape’s LNG team said in a note to clients. “Genscape assumes that fuel use during commissioning is less efficient than when a facility has entered commercial service.”

Prior to Wednesday, deliveries to the facility had begun to fall off, averaging around 50 MMcf/d lower than the previous week’s daily average. Nominations for Wednesday jumped to around 460 MMcf, the highest daily gas receipt total observed at the facility to date, according to Genscape.

On Tuesday, “Genscape’s maritime antenna network intercepted the destination code ”US CMU’ in the BW Everett’s automatic identification signal,” the analysts said. “We believe that this code references the Port of Cameron, which is supported by the vessel’s westbound heading.”

With new LNG export capacity coming online this year, the upcoming hurricane season could have significant new implications for Lower 48 demand. Forecasters at the National Oceanic and Atmospheric Administration (NOAA) said Thursday they expect the 2019 Atlantic hurricane season, which officially begins next week, to be a near-normal one.

NOAA expects nine to 15 named storms to form in the Atlantic Basin during the June 1-Nov. 30 hurricane season, with four to eight becoming hurricanes, including two to four major hurricanes (Category 3 or higher). An average hurricane season produces 12 named storms, of which six become hurricanes, including three major hurricanes.

The spot market saw generally small day/day adjustments Thursday, with many locations across the eastern two-thirds of the Lower 48 trading within a nickel of even. Day-ahead prices at benchmark Henry Hub shed 4.5 cents to drop to $2.565.

The muted price action came as forecasts continued to call for strong early-season heat for the nation’s southeastern quadrant. The National Weather Service (NWS) on Thursday called for “near record heat and dry weather” in the region.

“Across portions of the Tennessee Valley, the Deep South and the Southeast, very dry conditions and near record high temperatures will be possible Friday and well into the Memorial Day weekend as high pressure overhead will yield high temperatures soaring well into the 90s to locally near 100 degrees,” the NWS said.

Despite the sustained heatwave, Southeast spot prices eased slightly Thursday. Florida Gas Zone 3 dropped 2.5 cents to $2.605, while Transco Zone 4 slipped 2.0 cents to $2.545.

Transcontinental Gas Pipe Line (Transco) on Wednesday reported unplanned maintenance at its Station 83 on the Mobile Bay Lateral in Mobile County, AL, and notified shippers that as a result volumes through Milepost (MP) 20 on the pipeline would be limited to firm transportation only.

“There are no supply and demand locations between the mainline through MP 20, so it is likely that no flows will be affected,” Genscape Inc. analyst Josh Garcia said. “However, if this outage affects the rest of the lateral, it could impact net demand of around 380 MMcf/d when comparing locations with firm capacity to recent flows.

“Of the locations with firm capacity, the Gulfstream Coden interconnect has enough firm capacity to cover all of its recent demand, and Bay Gas Storage’s 220 MMcf/d of firm capacity covers most of its obligations, but the Tubular Bells platform would likely be shut in,” Garcia said.

As of early Thursday, nominations did not reflect impacts to supply and demand locations, according to the analyst.

Elsewhere, the NWS was calling for stormy conditions through the center of the country.

“A very active weather pattern is forecast to continue across the central part of the nation through the end of the week and the first part of the weekend,” the forecaster said. “This is in response to a strong upper level trough situated over the Intermountain West and a large upper level ridge anchored over the southeastern U.S.

“A clash of air masses from the southern Plains to the Ohio Valley region will support multiple episodes of severe weather along with the threat for additional flash flooding in the general vicinity of a slow moving frontal boundary where multiple waves of low pressure will be developing along it.”

Temperatures should remain “well below average” for the Rockies and westward into California, according to the NWS.

“In some cases, temperatures will be as much as 10 to 20 degrees below normal, and it will be cold enough across the higher terrain for some additional accumulating snowfall,” the NWS said.

Price moves were mixed for western locations Thursday. In the Rockies, Cheyenne Hub added 5.5 cents to $1.845, while Northwest Sumas slid 6.5 cents to $1.630.

In constrained West Texas, prices continued to strengthen Thursday after dropping well into the negatives earlier in the week. The weaker pricing coincided with a maintenance event on the Northern Natural Gas system that affected Permian Basin volumes.

Waha added 10.0 cents to average 11.0 cents Thursday. By recent West Texas standards, that’s positively bullish, as the location had averaged minus 55.5 cents in Tuesday’s trading.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |