NGI The Weekly Gas Market Report

NGI The Weekly Gas Market Report | Forward Look | Markets | NGI All News Access

Production Trumps Rising Demand as Natural Gas Forwards Plunge

After a breather last week, natural gas forwards made a splash during the May 16-22 period as a sizeable chunk of production returned to the market and sent prices along the curve down by double-digits, according to NGI’s Forward Look.

Nymex futures led the way as the June gas contract fell around 10 cents to $2.543 as of Wednesday. July dropped to $2.559.

The sudden downturn occurred as Genscape Inc. said flow data Tuesday indicated that operational capacity at the Equitrans Meter 24605 had been fully restored following a recent force majeure related to issues at the MarkWest Mobley Plant in West Virginia. As of Tuesday’s timely cycle, Equitrans flows from the Mobley facility had rebounded back up to 550 MMcf/d, higher than the prior 14-day average, according to analyst Anthony Ferrara.

Elsewhere in the region, Columbia Gas Transmission (TCO) notified shippers Tuesday that operational issues associated with an outage on a line feeding the Hopedale Fractionation Plant had been resolved. The outage temporarily reduced supply on the TCO system by around 2.1 million Dth, according to the pipeline’s estimates.

While production remains off highs, the return of supply in Appalachia was a key driver of this week’s losses. A milder weather outlook for early June also pressured gas prices during the May 16-22 period as scorching temperatures on tap for parts of the United States during the next couple of weeks were expected to ease by the early part of next month.

The latest weather models failed to deviate from that outlook, holding hot conditions with high temperatures in the 90s across the southeastern United States into the middle of next week for strong power burns. However, the data also maintained a rather bearish set up for the start of June due to high pressure weakening to more seasonal levels across the southern part of the country, according to NatGasWeather.

“Regionally, the southeastern U.S. will set some record highs with highs of mid-90s, but it would be more intimidating if it wasn’t for Chicago to New York City being quite comfortable with highs of upper 60s to 80s,” the weather forecaster said.

For weather patterns to turn bullish, a much hotter upper ridge would need to show up in the weather maps for June compared to what the data currently predicts, according to the firm. Furthermore, with production running at strong levels, storage deficits are expected to improve to 200 Bcf before more ominous heat arrives in mid-to late June, it said.

The Energy Information Administration (EIA) on Thursday reported a 100 Bcf injection into storage inventories for the week ending May 17. The reported build was a few Bcf below what analysts had called for but was a triple-digit injection nonetheless.

Balance-wise, the 100 Bcf build is similar to last week’s 106 Bcf injection, with the two-week average versus the five-year average balance implying just under 3.9 Tcf at the end of the season, according to Bespoke Weather Services. The firm noted, however, that weather adjusting can be more difficult in these lower demand times of the year.

“That still suggests that we need to see material improvement in balances to avoid a large storage total heading into winter,” Bespoke chief meteorologist Jacob Meisel said.

The report marks the third build to top the 100 Bcf mark so far this injection season, and analysts expect more ahead. According to various projections and estimates shared during a weekly storage discussion on energy chat platform Enelyst, two or more 100 Bcf-plus builds could be coming from EIA over the next few weeks.

Total Lower 48 working gas in underground storage as of May 17 stood at 1,753 Bcf, 137 Bcf (8.5%) above last year’s stocks but 274 Bcf (minus 13.5%) lower than the five-year average, according to EIA.

By region, the South Central posted the largest build for the week at 31 Bcf. That included a 9 Bcf injection into salt stocks, along with a 22 Bcf build into nonsalt. While coming in ahead of other regional builds, the South Central injection was markedly lower than it had been in recent weeks when record injections were made.

“The salt injections have slowed down over the past couple of weeks. With the extreme heat hitting the Southeast over the next couple of weeks, I can see salt inventories staying low entering the July-August time frame,” Enelyst managing director Het Shah said.

Out in the Midwest, 28 Bcf was added to stocks, while the East refilled 23 Bcf. Farther west, the Mountain region saw a net 7 Bcf build, and the Pacific injected 12 Bcf, according to EIA.

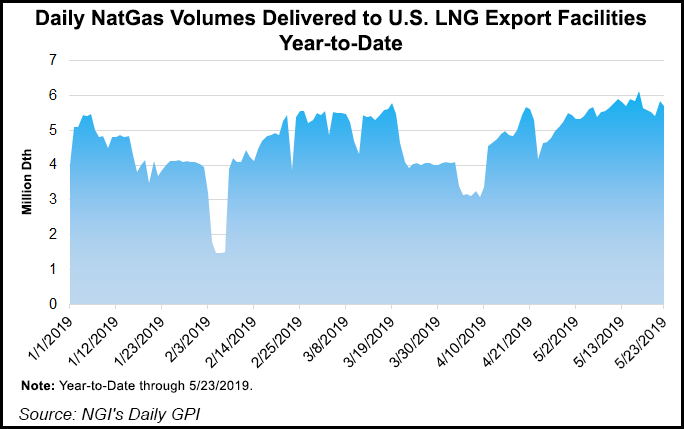

Looking ahead into the core summer months, liquefied natural gas (LNG) exports are set to ramp up, with federal regulators on Monday authorizing Sempra Enegy’s Cameron LNG to begin commissioning cargoes at the export facility. Average estimated seven-day liquefaction volumes sit at approximately 190 MMcf/d after factoring in commissioning fuel use, according to Genscape. The firm assumes that fuel use during commissioning is less efficient than when a facility has entered commercial service.

Until Wednesday, deliveries to the facility had begun to fall, with daily deliveries averaging about 50 MMcf/d less than last week’s daily average. Nominations for May 22 jumped to the facility’s highest ever gas receipt at around 460 MMcf.

On Tuesday, Genscape’s maritime antenna network intercepted the destination code “US CMU” in the BW Everett vessel’s automatic identification signal. Analysts believe that this code references the Port of Cameron, which is supported by the vessel’s westbound heading.

RBN Energy, meanwhile, indicated earlier this week that the Marvel Crane vessel could be headed for Cameron, with tanker data also pointing to “US CMU” as its destination.

Regardless, feed gas demand for Cameron and other Gulf Coast export projects is set to increase, rising from around 3 Bcf/d in 2018 to more than 7 Bcf/d this year. In fact, many analysts have built in just 0.5-0.8 Bcf/d of LNG shut-ins this summer, according to EBW Analytics.

“If the market remains stronger than analyst expectations, however, incremental demand could present a bullish catalyst for Nymex futures,” the firm said.

After weeks of sitting comfortably in positive territory, Permian Basin forward prices are now hanging on by a thread after a week of steep sell-offs in the cash market.

Regional spot cash prices began softening late last week, with losses accelerating on Monday and kicking into high gear on Tuesday when El Paso Permian plunged to an average of minus 58.5 cents. Waha dropped to a minus 55.5-cent average.

“This is the first time since early April that the highest spot cash mark for Waha was a negative value; the all-time record low for a high-water mark was set on April 3 when Waha maxed out at negative $1.50,” Genscape analyst Joseph Bernardi said.

The steep losses occurred as Northern Natural Gas Pipeline production receipts remained more than 200 MMcf/d below the previous 30-day average in Tuesday’s early cycles, attributable to the second day of a planned two-day maintenance. Overall, Permian production had dropped to under 9.40 Bcf/d Tuesday, about 0.25 Bcf/d below the monthly rolling average and a drop of over 0.35 Bcf/d day/day, according to Genscape.

With the maintenance ending, spot prices on Wednesday moved back above zero, with El Paso Permian averaging 24 cents and Waha averaging a penny.

Nevertheless, the damage in the forward markets was done as the prompt month shed close to 40 cents at both Permian pricing hubs. El Paso Permian June dropped to just 15.4 cents as of Wednesday, while July fell 24 cents to 62.3 cents and the balance of summer (June-October) slipped 22 cents to 97 cents, according to Forward Look. The winter strip (November 2019-March 2020) was down 11 cents to $2.21.

Waha June averaged just 2.6 cents after tumbling 38 cents between May 16 and 22. July fell 24 cents to 41.5 cents, the balance of summer dropped 22 cents to 84 and the winter slipped a dime to $2.12.

Most other pricing hubs across the country followed the general lead of the Nymex, although Northwest Sumas posted much larger declines as cash prices are among the cheapest in the Rockies. June tumbled 24 cents to $1.763, July dropped 14 cents to $2.468, the balance of summer shed 18 cents to $2.29 and the winter fell 19 cents to $3.35, Forward Look data show.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 | ISSN © 1532-1266 |