NGI Mexico GPI | Markets | NGI All News Access

Natural Gas Futures Extend Slump on Large Storage Build

Coming off a 6.0-cent sell-off on Tuesday, the June Nymex futures contract plunged another 7.0 cents on Wednesday to settle at $2.543. Losses were steeper further along the summer strip. July shed 8.2 cents to $2.559, while August dropped 8.2 cents to $2.574.

A less than impressive forecast for early June and expectations for another triple-digit storage injection created an opening for bears to extend a recent sell-off in the natural gas futures market. In the spot market, sweltering conditions in the Southeast couldn’t stave off widespread discounts; the NGI Spot Gas National Avg. fell 1.0 cent to $2.080/MMBtu.

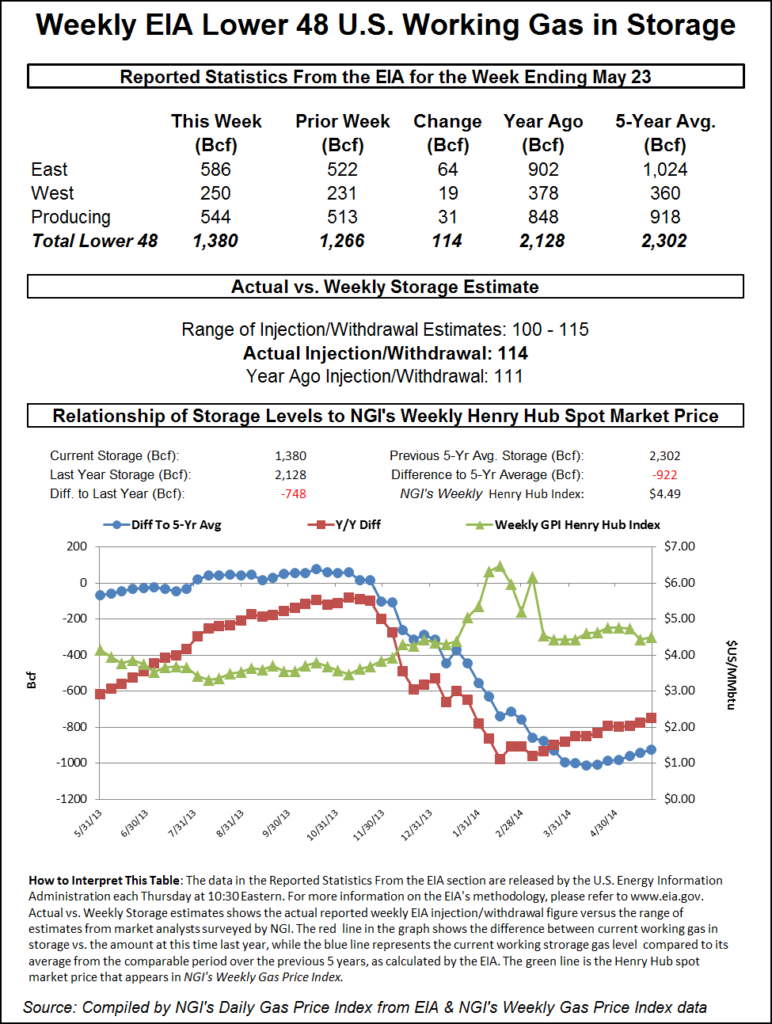

The Energy Information Administration (EIA) on Thursday reported a 100 Bcf weekly injection into U.S. natural gas stocks for the week ended May 17, a figure on the low side of estimates.

The 100 Bcf injection compares with a 93 Bcf injection in the year-ago period and a five-year average 88 Bcf build. The number continues a run of above-average builds stretching back to March. Injections have topped the comparable five-year average every week since the season’s first net injection, recorded for the period ended March 29, EIA data show.

During the last five weeks, storage injections into the U.S. SoCentral region have totaled 173 Bcf, a full 35% higher than the average over the previous five years for the same time period. Part of that is the result of cooler temperatures in the region, as the number of cooling degree days in Texas over the last five weeks is down about 4% from normal. But lower Waha prices are likely helping, too, noted Patrick Rau, NGI‘s Director of Strategy & Research.

“The last five years, Waha prices averaged more like $2.60-$2.70, but those have been well below $1 these past few weeks, and on some days, they’ve been negative,” Rau said. “These lower Waha prices should begin to rise here in the coming weeks, as air conditioning load kicks up and Texas, and perhaps as more gas finds its way to Mexico along the emerging Wahalajara system. So if you have the storage space, you may as well take advantage of this temporary window by injecting as much cheap Waha gas as you can right now, especially if you are getting paid to do it via negative pricing.”

Despite calls for some exceptionally hot temperatures in the southeastern United States this week and next, spot prices mostly posted discounts from Texas to the Mid-Atlantic Wednesday. In East Texas, Katy slid 1.5 cents to $2.535, while further east, Transco Zone 4 gave up 4.5 cents to $2.565.

NatGasWeather called for national demand to remain “relatively strong” Wednesday “due to unseasonably strong high pressure strengthening across the South and Southeast, with coverage of 90s gaining, hottest and most uncomfortable over Georgia and South Carolina.

“Demand is also being aided by cool conditions across the West and into the Plains as weather systems with rain and snow track through with chilly lows of 30s and 40s,” the forecaster said. “Demand for cooling will remain strong across the southeastern U.S. through the middle of next week.”

Still, demand totals would likely be more impressive if not for “mostly comfortable temperatures” expected across a corridor stretching from Chicago to New York City, including highs in the 60s to 80s in the coming days, NatGasWeather said.

Midwest locations sold off Wednesday, including at Joliet, which dropped 11.0 cents to $2.270. The Northeast saw generally minor day/day adjustments. Transco Zone 6 NY notched 1.5 cents to $2.265.

Elsewhere, with Northern Natural Gas (NNG) expected to finish maintenance work that had been impacting Permian Basin volumes this week, prices in West Texas rebounded Wednesday, albeit with a few trades still logged in the negatives. Waha’s day-ahead average nosed back above zero, gaining 56.5 cents to finish at 1.0 cent.

As of Wednesday’s early cycles, NNG’s production receipts remained more than 200 MMcf/d below the prior 30-day average, reflecting a second day of impacts from an ongoing two-day planned maintenance event, Genscape analyst Joe Bernardi said. The maintenance, expected to conclude Wednesday, impacted capacity through the pipeline’s Brownfield North and Mitchell to Gaines allocation groups.

“Overall Permian production was down just under 9.40 Bcf/d Tuesday, about 0.25 Bcf/d below the monthly rolling average and a drop of over 0.35 Bcf/d day/day,” the analyst said.

Further downstream in California and the Desert Southwest, prices were mixed. PG&E Citygate slipped 7.0 cents to $3.230, while Transwestern San Juan picked up 2.0 cents to $1.320.

A force majeure declared Tuesday on the Transwestern Pipeline was expected to have only a minor impact on flows into California from the Desert Southwest, according to Genscape’s Bernardi.

“Transwestern’s Topock Lateral capacity is cut by 165 MMcf/d by the force majeure, reducing it from 437 MMcf/d to 272 MMcf/d,” Bernardi said. “However, the previous month’s average flow was only 268 MMcf/d.”

Transwestern notified shippers that it expects the capacity to be restored by Thursday’s gas day. “Transwestern’s deliveries onto PG&E’s Redwood Path at Topock, AZ, have accounted for essentially all of this lateral’s volumes recently,” according to Bernardi.

The 2.6 Bcf/d Sur de Texas-Tuxpan marine pipeline considered key as a release valve for Permian natural gas will come online at the end of June, CFEnergía’s director Miguel Reyes said on Wednesday.

The offshore project “has experienced force majeure events that have delayed in-service,” developer TC Energy Corp. said in its 1Q2019 report to shareholders.

However the adjoining 886 MMcf/d Tuxpan-Tula and 886 MMcf/d Tula-Villa de Reyes pipelines, which were tendered by anchor customer Comisión Federal de Electricidad (CFE) and will transport U.S. gas to power stations and industry in central Mexico, aren’t expected to enter operation until next year.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |