NGI Data | Markets | NGI All News Access

Another Three-Digit EIA Injection; NatGas Balances in Need of ‘Material Improvement’

The Energy Information Administration (EIA) on Thursday reported a 100 Bcf weekly injection into U.S. natural gas stocks, a figure on the low side of estimates that elicited a fairly muted reaction from the futures market.

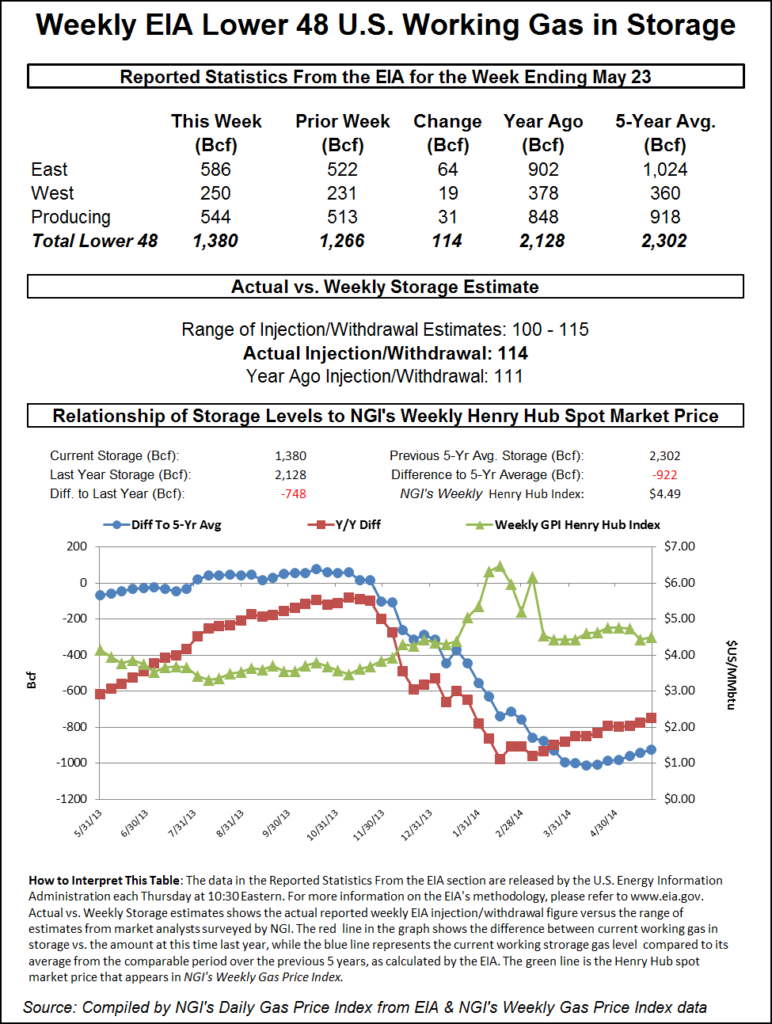

The 100 Bcf injection, recorded for the week ended May 17, compares with a 93 Bcf injection in the year-ago period and a five-year average 88 Bcf build. The number continues a run of above-average builds stretching back to March. Injections have topped the comparable five-year average every week since the season’s first net injection, recorded for the period ended March 29, EIA data show.

Coming off a steep sell-off over the past two sessions, natural gas futures were trading around $2.554 to $2.564 in the minutes leading up to the report. As the final number crossed trading screens at 10:30 a.m. ET, the prompt month ventured as high as $2.571. By 11 a.m. ET, June was trading around $2.562, up about 1.9 cents from Wednesday’s settle and roughly in line with the pre-report trade.

Estimates prior to the report had pointed to yet another above-average shoulder season storage injection a few Bcf higher than the actual figure. Surveys as of Wednesday had shown a consensus prediction in the low triple digits, with estimates ranging from 99 Bcf to 112 Bcf. NGI’s model predicted a 105 Bcf build.

According to Bespoke Weather Services, “Balance-wise, this is similar to last week’s 106 Bcf build, with the two-week average versus the five-year average balance implying just under 3.9 Tcf at the end of the season, though weather adjusting can be more difficult in these lower demand times of the year. That still suggests that we need to see material improvement in balances to avoid a large storage total heading into winter.”

The report marks the third build to top the 100 Bcf mark so far this injection season, but it might not be the last. According to various projections and estimates shared during a weekly storage discussion on energy chat platform Enelyst, two or more 100 Bcf-plus builds could be coming from EIA over the next few weeks.

Total Lower 48 working gas in underground storage stood at 1,753 Bcf as of May 17, 137 Bcf (8.5%) above last year’s stocks but 274 Bcf (minus 13.5%) lower than the five-year average, according to EIA.

By region, the South Central posted the largest build for the week at 31 Bcf. That included a 9 Bcf injection into salt stocks, along with a 22 Bcf build into nonsalt. The Midwest refilled 28 Bcf for the period, while the East refilled 23 Bcf. Further west, the Mountain region saw a net 7 Bcf build, while the Pacific injected 12 Bcf, according to EIA.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |