Natural Gas Futures Hit Reverse on Expectations for Plump Storage Build

After consecutive daily gains going back to last week, natural gas futures reversed sharply Wednesday as estimates pointed to a larger-than-average build in upcoming weekly storage data. In the spot market, with more intense cooling demand not expected until next week, discounts were widespread across the Lower 48; the NGI Spot Gas National Avg. skidded 9.5 cents to $2.210/MMBtu.

The June Nymex futures contract sold off 5.8 cents to settle at $2.601 after going as low as $2.595. The July contract dropped 5.5 cents to settle at $2.634, while August settled at $2.651, down 5.4 cents.

The prospect of a hefty triple-digit storage injection from the Energy Information Administration (EIA) may have provided the impetus for those responsible for recent buying in the market to make an exit Wednesday, according to INTL FCStone Financial Senior Vice President Tom Saal.

“The profiles look like there has been some steady buying, and it might be people hedging storage,” Saal told NGI. “You’re buying the front of a contract and then selling the back end. So that storage hedge may be part of the buying. Could be some short-term speculative buying, but I’ve got my doubts about that.”

However, Wednesday’s “action I think is just a retracement from the move off the lows” recorded in late April. “From the profile here, it looks like it’s long liquidation. So whoever was buying it may have just gotten out” on Wednesday “because they’re concerned about the storage report” set for Thursday.

Saal said a higher storage figure could lead to further retracement. Based on Wednesday’s declines, the market could drop further to test the $2.579 area. That represents the 50% break down target from the weekly initial balance between $2.607 and $2.664 laid out in Saal’s latest Market Profile.

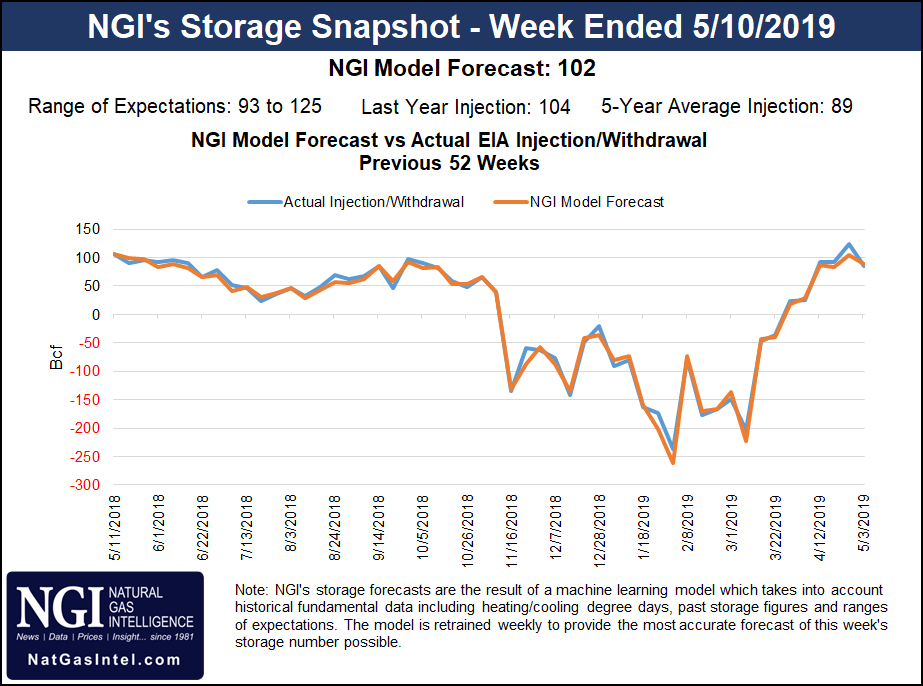

Estimates Wednesday called for EIA to report a low-triple-digit build for the week ended May 10. A Bloomberg survey as of Wednesday afternoon produced a median estimate of 104 Bcf, based on 12 responses ranging from 93 Bcf to 125 Bcf. A Reuters survey also showed consensus landing on a 104 Bcf build, based on 16 responses ranging from 93 Bcf to 125 Bcf.

Intercontinental Exchange EIA Financial Weekly Index futures settled Tuesday at 105 Bcf, while NGI’s model predicted a 102 Bcf injection. Last year, EIA recorded 104 Bcf for the period, and the five-year average is a build of 89 Bcf.

The sell-off Wednesday came even as the latest production data continued to show maintenance-related declines. Genscape Inc.’s Lower 48 production estimate remained “notably lower” for a second straight day Wednesday. Although Tuesday’s production estimate was revised more than 1 Bcf/d higher to 87 Bcf/d, it was still nearly 1.1 Bcf/d below the average from the previous three days, according to the firm.

While also subject to an upward revision, Wednesday’s estimate came in “even lower” at 85.95 Bcf/d, driven by continued short-term declines in the Northeast and Rockies regions (each down about 375 MMcf/d day/day), along with drops of 100 MMcf/d or more in Texas and the Gulf Coast, Genscape senior natural gas analyst Rick Margolin said.

In addition to the numerous pipeline maintenance events that contributed to Tuesday’s production dip, new maintenance events were expected to start Wednesday on the Columbia Gulf, Dominion, El Paso Natural Gas, Texas Eastern Transmission and Wyoming Interstate Co. systems, according to Margolin. High Point Gas Transmission in the Gulf of Mexico and KPC in the Midcontinent were also experiencing unplanned disruptions, he said.

“On top of the Lower 48 declines, production out of Western Canada is in decline with spring breakup getting underway and maintenance across British Columbia and Alberta,” Margolin said. “Total Western Canada fell below the 15 Bcf/d mark early last week and, since then, has dropped to as low as 13.8 Bcf/d this past Saturday. This represented a drop of more than 2.4 Bcf/d below the 30-day high.”

In Alberta, production hitting Nova Gas Transmission Ltd. (NGTL) had dropped to 10.22 Bcf/d Wednesday, the lowest level observed since September 2017.

“The declines there are a product of the spring breakup kicking in a bit later than usual with prolonged cold blanketing the province, along with widespread maintenance events taking place across the NGTL network,” Margolin said. “In British Columbia, production hitting the Westcoast Energy system has dropped to a 182-day low of 1.52 Bcf/d due to the breakup in Horn River combined with numerous maintenance events all along the Westcoast mainline and interconnects to NGTL.”

Looking at the weather, Radiant Solutions highlighted hotter trends for the southern United States in its latest six- to 10-day forecast Wednesday, with warmer conditions continuing for the East in the 11-15 day period.

The six- to 10-day “features a more amplified regime compared to previous expectations, with cool changes from the Southwest to the Upper Midwest and warm changes in the South and Mid-Atlantic,” the forecaster said. “Strong ridging will build over the Eastern Half, resulting in above to much above normal coverage. At the peaks, temperatures are forecast in the upper 80s to near 90 degrees from St. Louis to Washington, DC, with additionally hotter readings in the South at the end of the period.”

In the 11-15 day outlook, Radiant’s forecast showed cooler changes in the West and warmer changes in the Southeast.

“These changes come as a result of a slower moderating of the pattern,” Radiant said. “Strong ridging remains favored to settle over the Southeast, keeping most areas in the Eastern Half on the warm side of normal. This includes much aboves in the Mid-Atlantic and Southeast through mid-period.”

While hot in some parts of the country, forecasts showing comfortable temperatures spreading across key markets mostly sent spot prices lower Wednesday. Benchmark Henry Hub slipped 1.5 cents to $2.610.

With forecasts showing “the first semblance of above-normal temperatures for this summer” arriving next week to drive an increase in cooling degree days (CDD), Lower 48 power burns are set to increase, according to Genscape’s Margolin.

“Genscape meteorologists forecast net CDDs starting to creep above seasonal norms starting next Thursday (May 23). From there through May 28, the forecast for CDDs increases into the plus 50 CDDs range, about 63% above normal. The vast majority of the gains are weighted toward the Southeast/Mid-Atlantic and Midcontinent regions. Midwest and Northeast markets may see a few days of above normal temperatures, but not radically so.”

As cooling demand cranks higher, so will power burns, with Genscape estimates showing power demand rising from 26.1 Bcf/d as of Wednesday to as high as 31.7 Bcf/d by the end of next week.

“All five EIA regions are expected to show higher burns, with the EIA East region expected to post the largest gains of 2.7 Bcf/d above” Wednesday’s totals.

Meanwhile, hotter temperatures stretching from Texas to the Mid-Atlantic through the end of the current week produced only modest adjustments for day-ahead prices Wednesday. In the Southeast, Transco Zone 4 shed 1.5 cents to $2.530. In East and South Texas, most locations posted discounts. Katy slumped 7.5 cents to $2.605.

In West Texas, meanwhile, basis differentials strengthened nearly across the board, with constrained Permian Basin producers possibly seeing some pricing benefits from hotter temperatures in the Lone Star State. After gaining 30.5 cents in trading Tuesday, Waha picked up another 9.5 cents Wednesday to average 86.0 cents.

“A warmer southern and eastern U.S. pattern will set up during the second half of the week, then holding through the weekend,” NatGasWeather said Wednesday. “It will be a touch hot over Texas and the Southeast, with mid-80s to lower 90s, although very comfortable from Chicago to New York City with 70s to 80s.

“The West into the Plains will be cooler and stormy.” Taken together, the pattern will result in “slightly lighter national demand than early in the week, just rotating which regions will drive it.”

In the Midwest, Chicago Citygate fell 7.5 cents to $2.330. Northeast points continued to grind lower as a chilly pattern to start the week was expected to give way to milder temperatures. Algonquin Citygate gave up 7.5 cents to $2.315.

Coming off widespread gains a day earlier, prices fell at many Rockies and California locations as forecasts showed heavy precipitation in store for parts of those regions.

The National Weather Service was calling for a “strong upper level system” arriving in the western United States by Thursday morning to “bring several days of unsettled weather to much of the Northwest into the Rockies. Locally heavy to excessive rainfall is possible, especially along the favored terrain of Central/Northern California” Wednesday night and the northern Rockies Thursday.

“This system will usher in much below normal temperatures (10-20 degrees or more below average), which will support moderate to heavy snowfall in some of the highest elevations,” according to the forecaster.

Malin tumbled 38.5 cents to $1.920, while Kern River gave up 34.0 cents to $1.945.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |