Regulatory | Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

Oklahoma Governor Signs New Law to Advance Natural Gas Vehicles

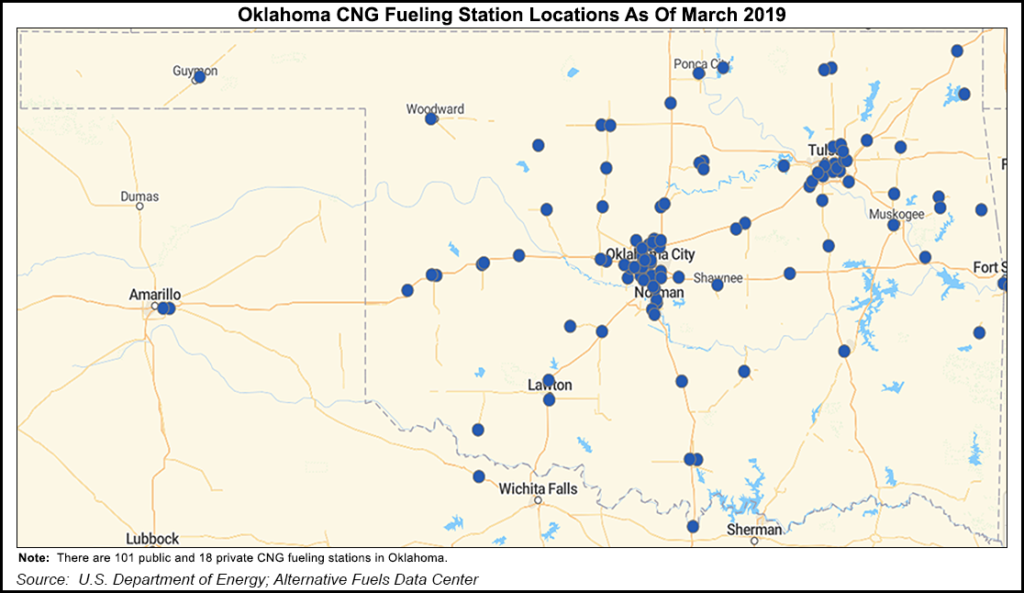

Oklahoma Gov. Kevin Stitt earlier this month signed a bill to spur more development of natural gas vehicle (NGV) fueling stations and related infrastructure.

House Bill 2095 extends a tax credit for either converting diesel or gasoline-powered vehicles to run on compressed natural gas (CNG), liquefied natural gas (LNG) or liquefied petroleum gas (LPG). It also offers a tax credit for buying vehicles equipped to operate on those alternative fuels.

The measure extends the state tax credits from Jan. 1, 2020, to Dec. 31, 2027, capping the collective annual amount of credits at $20 million.

NGVAmerica President Dan Gage said Oklahoma’s 2019 Clean Transportation Reform and Modernization Act will “ensure that Oklahoma will consistently lead the country in supporting NGVs as the best path to build demand for the state’s produced product.

“The measure received widespread support from public, private and nonprofit sectors that understand the need for this crucial infrastructure and the use of NGVs.”

Gage said NGVAmerica will promote Oklahoma’s latest action as a “model” for other states to follow in promoting alternative fuel vehicles.

Separately, one of the leading companies in the NGV fueling sector, Clean Energy Fuels Corp., recently reached agreements with several trucking fleet operators to collectively lease or purchase more than 250 new heavy-duty trucks fueled by Clean Energy’s Redeem brand of renewable natural gas (RNG).

The Newport Beach, CA-based NGV fueling company is offering low-cost NGV truck leasing tied to the use of Redeem to produce near-zero emissions trucking operations. “Clean Energy’s ‘Zero Now’ program makes the cost of leasing or purchasing a new NGV heavy duty truck equal to the price or even lower than that of the same truck equipped with a diesel engine,” said Clean Energy spokesperson Raleigh Gerber.

Through the Zero Now program, fleet operators also can obtain Redeem fuel at a discounted price to diesel.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |