Utica Shale | E&P | Marcellus | NGI All News Access

Appalachian Pure-Play Montage Focused on Cost Cutting as NatGas Outlook Weakens

As the natural gas outlook weakens in Appalachia, pure-play Montage Resources Corp. doubled down on operational efficiencies during the first quarter, allowing the company to cut costs further and increase its full-year production guidance.

Following the merger between Eclipse Resources Corp. and privately held Blue Ridge Mountain Resources that created the company, Montage said it would increase 2019 guidance by 3% at the midpoint to 520-540 MMcfe/d. The company’s focus on cost and operational improvements delivered first quarter cycle time improvements of about two weeks, putting it on track to drive down wells costs this year.

“From an operations perspective, the team has been able to steadily achieve a completion cadence of approximately 9 stages per day on the last three pads, allowing us to place wells to sales more quickly than originally budgeted,” CEO John Reinhart said. “With the spud to turn-to-sales timeline compressed and the continued outperformance of our wells, we have raised our production guidance for the full year.”

Meanwhile, the capital expenditures budget of $375-400 million remains unchanged. “The natural gas macro environment we are currently experiencing reinforces the importance of our belief in being a low cost producer with high quality assets,” Reinhart said of Montage’s footprint, which is in eastern Ohio and north-central Pennsylvania.

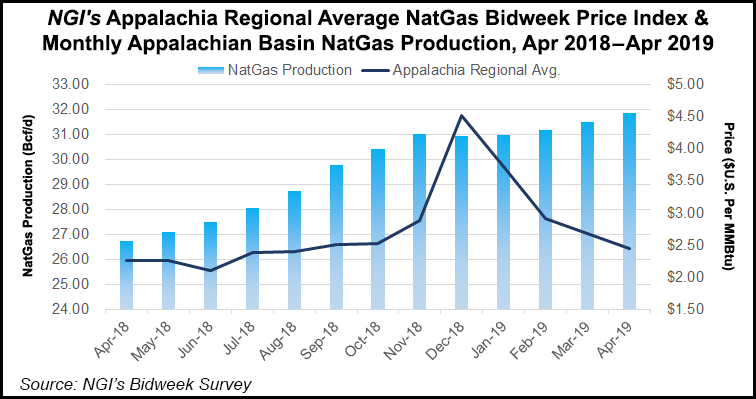

Indeed, the tenacious gas production growth that has characterized the Appalachian Basin over the last decade is poised to slow as an epic pipeline buildout ends and supply again outweighs demand. Prudent investors are also searching for better returns, prompting the upstream sector to hit the brakes on some spending.

In the near-term, Appalachian operators this earnings season have mostly acknowledged that prices are likely to weaken after first quarter gains as the shoulder season gets underway and broader market factors come into play. Credit ratings agency Moody’s Investors Service recently revisited the trends, highlighting Appalachian spending cuts as prices depress investment returns.

“Exploration and production companies in Appalachia have come under sustained shareholder pressure to improve their capital discipline amid lower natural gas prices that cap margins and returns,” said Moody’s senior credit officer President Elena Nadtotchi. “In response, most natural gas producers in the region are cutting growth investment to manage their businesses within operating cash flow.”

Shortly after the merger closed, Montage fell in line, saying it would spend its first year focused on cutting costs, generating free cash flow and modestly growing production. The company is also now guiding for per unit cash production costs of $1.35-1.45/Mcfe, or 12.5% lower at the midpoint of its previous forecast.

Like many of its peers, Montage’s year/year realized gas prices, before hedges, improved by about 5% in the first quarter to $3.01/Mcf, or a 14-cent discount to the average monthly New York Mercantile Exchange (Nymex) settlement price. While an improvement from its previous range, the company is still guiding for a 15-25 cent differential to Nymex through the remainder of the year.

Montage produced 407.5 MMcfe/d during the first quarter, which included only one month of consolidated results after the merger, which closed Feb. 28. Volumes came in above guidance. Prior to the merger closing, Eclipse produced 315.2 MMcfe/d in the year-ago period and 404.5 MMcfe/d in 4Q2018. Given the outlook for gas, management said during a recent call to discuss first quarter results it would continue to focus on wetter acreage in Ohio.

The company reported a first quarter net loss of $14.1 million (minus 55 cents/share), compared with a net loss of $2.6 million (minus 13 cents) in the year-ago period. First quarter revenue was $141.5 million, compared with $110.2 million in 1Q2018.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |