NGI The Weekly Gas Market Report | Infrastructure | LNG | NGI All News Access

Cheniere’s Planned Corpus LNG Expansion to Move Forward ‘With or Without China’

After bringing online two liquefaction trains earlier this spring, management for Cheniere Energy Inc. said the ongoing trade spat between the United States and China, which revved up a notch early Friday, has had no impact on its liquefied natural gas (LNG) business and is not going to slow the commercialization of the proposed expansion of its Corpus Christi export terminal in South Texas.

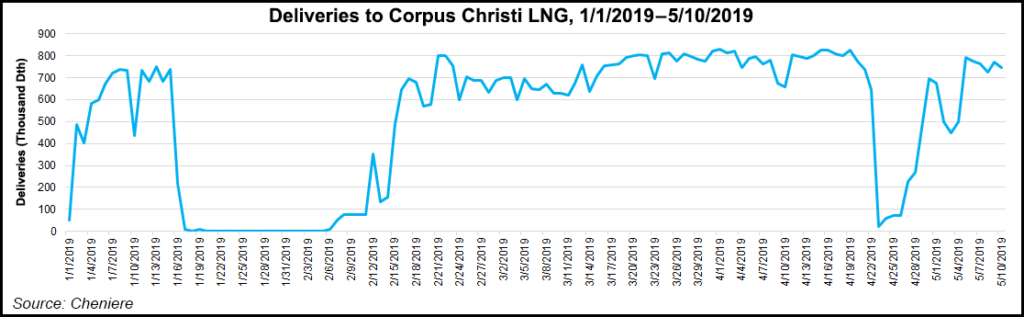

Cheniere has already pulled the trigger on the first three trains at Corpus Christi, with the first train achieving substantial completion in February. The second is in the commissioning phase and expected to introduce feed gas “in the coming weeks,” according to CEO Jack Fusco. Substantial completion for Train 2 is estimated in the second half of the year, while construction on Train 3 continues and was about 52% complete at the end of March.

The proposed Stage 3 expansion would add another 9.5 million metric tons/year (mmty) to the Corpus facility.

While the trade tensions and tariffs are “unproductive” and create some added cost to Cheniere’s Chinese consumers, “as a company, we’re relatively insulated” from proposed tariff hikes, and “we don’t expect any material impacts,” Fusco said Thursday on a call to discuss quarterly earnings.

Out of Cheniere’s 18 foundation customers, PetroChina International Co. Ltd. represents 1.2 mmty. “So it’s relatively small in the portfolio, and we continue to deliver to that customer, and they continue to pay us,” the company chief said.

The trade tensions, which began last fall when the Trump administration enacted a 10% tariff on $200 billion worth of Chinese products, escalated as Beijing retaliated with tariffs of 5-10% on more than 5,000 products imported from the United States, including LNG at 10%.

On Friday, the White House increased tariffs to 25% after trade talks between the two countries on Thursday failed. Talks were to resume Friday, with analysts divided over whether the tit-for-tat tariffs will impact the “second wave” of U.S. LNG projects.

For Cheniere, the ongoing dispute is not seen impacting its final investment decision (FID) for a sixth train at its Sabine Pass terminal, which is expected by the end of June. Executives have spent “a significant amount of time in China already this year, further solidifying our relationships with key commercial decision makers of current and prospective counterparties,” Chief Commercial Officer Anatol Feygin said.

The Houston-based LNG developer recognizes the opportunities that China represents on the demand side. Even as the country’s thirst for gas continues to grow significantly year/year, “they haven’t even begun to pierce the power generation side of natural gas. Their demand is going to grow. It’s going to get filled by somebody. Preferably, it’s coming from the U.S.,” Fusco said.

That said, Feygin added that while the company was “not shying away from the opportunity” in China, management continues to have a robust level of engagement and “is comfortable that Stage 3 is a 2020 event with or without China.”

With two additional liquefaction trains in service during the spring, Cheniere saw 284 TBtu loaded on 87 cargoes during the first quarter; 25 TBtu represented commissioning cargoes. Of the cargoes delivered, 39 went to Europe, 30 to Asia and 17 to Latin America.

With nearly 11 mmty of LNG supply hitting the global market during the quarter, and a reduced appetite for spot LNG in Asia because of a mild winter and higher storage levels, record flows reached European regasification terminals, according to Feygin.

First quarter imports into Europe more than doubled from 1Q2018, resulting in higher storage levels. While the increased storage stocks have led to lower spot gas prices, they have also underpinned an increase in gas-fired power generation, Feygin said.

“Increases in carbon prices have also played a role in incentivizing tiered gas-fired power generation, especially in countries such as Germany where ample capacity exists to displace coal in the generation stack.”

Management has already begun to see Asian and European prices rebound. However, even during the period of price weakness, Cheniere continued to deliver all of its spot cargoes as scheduled and does not expect to see any future cancellations based on its “long-term forecast for natural gas here in America”, which is range-bound in the mid- to high $2 range, Fusco said.

In fact, it appears that prospective customers in Asia are finally warming up to the idea of Henry Hub-linked contracts. “They appreciate now what the Henry Hub-linked contract can deliver to them,” Fusco said. “How gas prices in America, and Henry Hub in particular, are very flat and stable and could be hedged out for over 10 years in a very liquid market, and they’re feeling the shock, the oil shock and the oil-linked shock of LNG.”

Feygin added, “You need to come up with a way to source based on the same index that you are then selling on. So that’s the challenge.”

Looking ahead, there are positive signals for markets like Japan and South Korea, where 2.3 GW of older coal-fired power plants are set to shut down in the first half of 2019.

Furthermore, “nuclear maintenance and a change in coal and LNG taxes that incentivize coal-to-gas switching during the back half of the year could spur new LNG demand,” Feygin said. The country decreased taxes on LNG and raised them on coal beginning in April as part of its efforts to curb air pollution.

Meanwhile, five nuclear reactors in Japan totaling 5.6 GW were expected to undergo scheduled maintenance between April and the third quarter, and another four reactors are set for maintenance next winter, Feygin said.

Looking further out, Japan’s Nuclear Regulation Authority indicated last month that it would start ordering shutdowns on any reactors for which power companies have not met deadlines for installing anti-terrorism safety features. Ten reactors could be affected, six of which are currently online, he noted. “This increases the uncertainty around nuclear generation output during the early 2020s and could spur an increase in LNG demand.”

In other emerging Asian markets, Pakistan and Thailand each recorded double-digit import growth to support their growing economies and declining indigenous gas supply, while other countries such as Bangladesh, India, Taiwan and others continue to add LNG regasification infrastructure.

Cheniere reported first quarter net income of $141 million (55 cents/share), a drop from the $357 million ($1.52) reported in 1Q2018, largely because of increased operating costs and expenses from the additional liquefaction trains and increased service and maintenance costs at Sabine Pass. Distributable cash flow for the quarter was more than $200 million, in line with a projected full-year target of $600-800 million.

Another Houston-based LNG developer, Tellurian Inc., continues to progress its Driftwood LNG export project ahead of an FID expected later this year. Earlier this month, the Department of Energy (DOE) approved worldwide exports from the Lake Charles, LA, facility.

Driftwood, which is proposing to export up to 27. 6 mmty, would be allowed to export up to 3.88 Bcf/d to any country. Last month, federal regulators granted authorization for Driftwood, and Tellurian continues to gauge shipper interest in two pipelines to move supply in Louisiana, including from the Haynesville Shale, to the Gulf Coast. Separate, binding open seasons are running through June 21.

Tellurian on Wednesday reported a net loss of $34.1 million (16 cents/share) in 1Q2019, and ended the quarter with $88.3 million in cash/cash equivalents and about $57.3 million in debt. The balance sheet consists of around $384 million in assets.

“Our primary focus for the next quarter is finalizing the Driftwood partnership financing,” CEO Meg Gentle said. French supermajor Total SA, which holds substantial stakes in Tellurian, was Driftwood’s first partner, “and we expect to execute final agreements with them by mid-June.

“We remain on schedule to produce LNG in 2023 and generate $8.00 of cash flow/share after ramp-up.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |