NGI Data | Markets | NGI All News Access

Coming Off Rally, Natural Gas Futures Post Small Loss; Cash Weak on Stormy Pattern

Coming off a sharp rally the day before, one that seemed to surprise analysts, natural gas futures bulls mostly held their ground Thursday amid less than inspiring signals from the latest forecasts and weekly government storage data.

Meanwhile, stormy spring weather and expectations for a small increase in national demand heading into the weekend couldn’t shake the spot market loose from its shoulder season malaise; the NGI Spot Gas National Avg. slid 2.5 cents to $2.185/MMBtu.

The June Nymex futures contract went as low as $2.561 Thursday before finishing strong to settle at $2.595, conceding just 1.5 cents following the prior session’s 7.3-cent rally. July also dropped 1.5 cents Thursday, settling at $2.631. August settled at $2.652, off 1.4 cents.

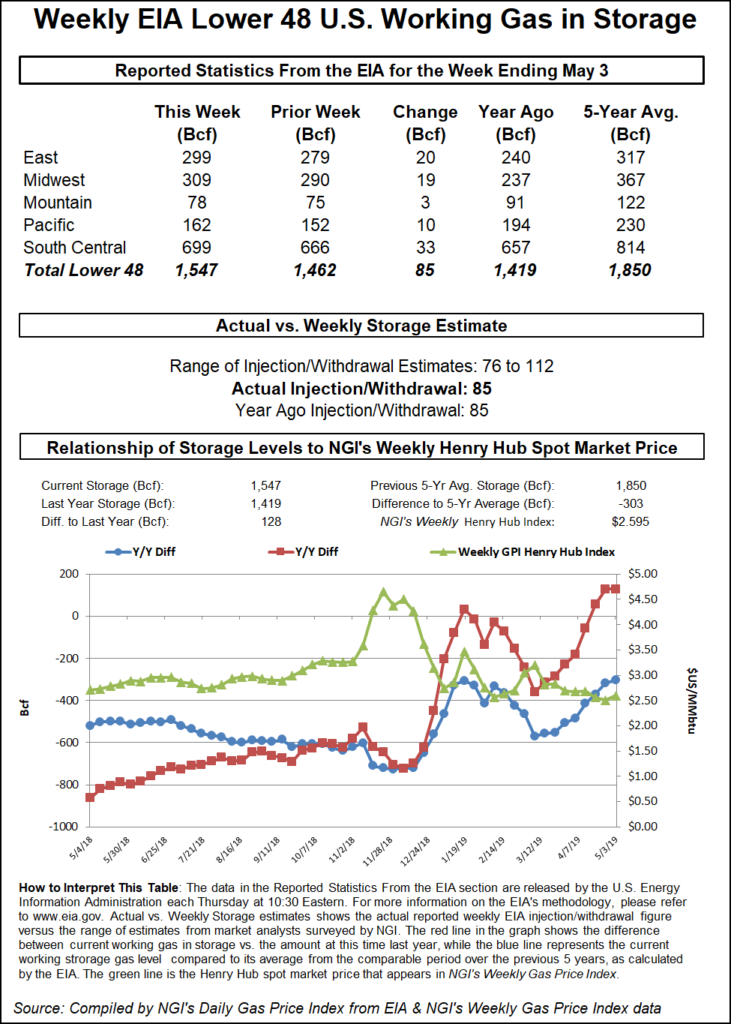

The Energy Information Administration (EIA) on Thursday reported an above-average 85 Bcf weekly injection into U.S. natural gas stocks that confirmed the market’s expectations, resulting in a fairly muted response from futures prices.

The 85 Bcf injection EIA reported for the week ended May 3 matches the 85 Bcf build recorded for the year-ago period but is larger than the 72 Bcf five-year average.

Futures had been trading a few pennies lower early Thursday as traders prepared to digest the latest weekly government storage data. As the EIA data crossed trading screens at 10:30 a.m. ET, the June contract went as low as $2.577 and as high as $2.592, venturing only slightly outside of the $2.582-2.587 area prices occupied in the minutes leading up to the report.

The front month set a low for the day shortly after 11 a.m. ET before gaining steadily into the settle.

Prior to the report, market observers had been looking for a build close to the actual number. A Bloomberg survey had shown expectations ranging from a build of 79 Bcf up to 108 Bcf, with a median 87 Bcf injection. Intercontinental Exchange EIA Financial Weekly Index futures settled Wednesday at a build of 86 Bcf. NGI’s model predicted an 89 Bcf injection.

In a weekly Enelyst chat coinciding with the release of the EIA data, market observers described the 85 Bcf figure as neutral given its close proximity to what many had predicted.

Still, Genscape Inc. analyst Eric Fell noted during the chat that “over the last six weeks we have injected 185 Bcf more than the five-year average, while total degree days over the last six weeks have been very close to the five-year average.”

Fell said storage data indicates the market has been about 4.5 Bcf/d loose on a weather-adjusted basis versus the five-year average over the same six-week period.

“Production growth is driving the looser balances” even in the face of demand growth from exports, power generation and industrial sources, he said. “Despite impressive growth across the board, production has still outpaced the collective growth in demand/exports so far.”

Total Lower 48 working gas in underground storage stood at 1,547 Bcf as of May 3, 128 Bcf (9.0%) more than year-ago levels but 303 Bcf (minus 16.4%) below the five-year average.

By region, the South Central saw the largest build for the week at 33 Bcf, including 24 Bcf into nonsalt and 10 Bcf into salt stocks. The East injected 20 Bcf, while the Midwest injected 19 Bcf on the week. Further west, the Mountain region posted a net 3 Bcf weekly injection, while the Pacific injected 10 Bcf.

As for the latest forecasts Thursday, NatGasweather said the midday Global Forecast System model added a small amount of demand through early next week but was little changed for late next week and the following weekend.

“No meaningful change overall as bearish weather headwinds ease slightly into early next week due to a little stronger heating demand but then strengthen after that as much of the country again becomes very comfortable with highs of 60s to 80s,” the forecaster said. “…Warmer conditions are expected to gradually gain across the southern and eastern U.S. late next week through May 24, thereby increasing cooling demand across the South and Southeast.

“However, this will be effectively countered by light demand across much of the northern U.S. as temperatures warm into near-perfect 70s from Chicago to New York City. Essentially, national demand will continue to remain light, although rotating what regions of the country will be the primary driver of it.”

According to Powerhouse President Elaine Levin, selling the rallies has been a profitable strategy for traders in this market, meaning short-covering could help explain the strength of Wednesday’s 7.3-cent surge.

After the June contract got above $2.600 last week, traders “probably came in to try to sell it again, and when it turned around” this week “it probably pushed some people out,” Levin told NGI.

The backdrop for recent price action is a seasonal pattern that shows prices typically rally at this time of year, she said. Recent readings from momentum indicators also appeared to favor the bulls.

“The daily charts, some of the momentum indicators there are saying we should buy this thing, believe it or not,” Levin said. “…There’s a lot there that says this downside may be taking a break for a little bit.”

Spot prices were mixed across the Lower 48 Thursday, with heat in some areas and cooler temperatures in others together unable to drive any significant price gains.

“Numerous weather systems will impact the U.S. the next several days with heavy showers and thunderstorms, including snow into the coldest air over the Rockies and far north,” NatGasWeather said. “Lows across the central and northern U.S. will drop into the 30s and 40s through the weekend for a little stronger demand. The southern U.S. will also see areas of heavy showers and thunderstorms but still warm with upper 60s to lower 90s, hottest in the Southeast.”

In the West, the forecaster called for a “mix of mild-to-warm” conditions.

“Overall, demand will increase slightly through the weekend, then ease next week as the southern U.S. becomes comfortable with highs of 70s and 80s,” NatGasWeather said.

The hotter temperatures in the Southeast didn’t produce any broad uplift for spot prices in the region. Transco Zone 4 slid 2.0 cents to $2.495, while Florida Gas Zone 3 fell 1.0 cent to $2.530.

Driven by power burns in Florida, demand in the Southeast has been trending higher recently, setting a new high for this time of year after having bottomed out April 21, according to Genscape analyst Josh Garcia.

“Demand in Florida, Georgia and the Carolinas hit a recent max of 9.0 Bcf/d on May 2, far above previous maxes for this time of year,” Garcia said. “Florida power burns have been trending upwards since the end of March, but this had been offset by lower residential/commercial demand in the Carolinas in April. Late May/early April temperatures have been hotter than recent years but not significantly, although it is too early in the natural gas summer to confidently say that demand per degree has increased.

“Still, this higher demand aligns with the narrative of recent gas plant builds coming online in Florida, suggesting higher structural demand in the region for the immediate future, although more solar builds and batteries could eat into natural gas demand long-term.”

In the Northeast, where Radiant Solutions was calling for comfortable temperatures in the 50s and 60s for New York City and Boston heading into the weekend, prices saw discounts Thursday. Transco Zone 6 NY dropped 11.5 cents to $2.235. Further upstream in Appalachia, Texas Eastern M-2, 30 Receipt fell 6.5 cents to $2.130.

Meanwhile, in West Texas, Waha picked up 6.5 cents to 31.5 cents, while Transwestern finished flat at 21.0 cents.

The unprecedented low prices in West Texas recorded this spring — including day-ahead trades that plunged deep into the negatives — have had an impact on Permian Basin production, according to Genscape analyst Joe Bernardi.

“Prior to April 2019, average Permian monthly production had posted month/month increases in 12 out of 15 months since the beginning of 2019,” Bernardi said. “From January 2018 through March 2019, monthly average production increased from around 7.2 Bcf/d to around 10.2 Bcf/d, equivalent to an increase of about 200 MMcf/d in each successive month.

“However, when prices began to venture into negative territory in late March and fell to unheard-of record lows in early April, production dropped significantly, ending up roughly 500 MMcf/d lower month/month from March to April. This was the second largest month/month drop for the basin, behind only the 578 MMcf/d drop from November to December 2015. Production has ticked up slightly in the first week of May, coming in about 130 MMcf/d higher than April’s average.”

Much of this recent decline is due to Apache Corp’s deferrals at Alpine High, the analyst said, noting that a drop in El Paso Natural Gas receipts from Alpine High accounts for just under a third of the total net Permian production decline in April.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |