NGI The Weekly Gas Market Report | Infrastructure | NGI All News Access

Decision to Go it Alone on $8B Refinery Said Harmful to Mexico NatGas Aims

The decision to cancel the engineering, procurement and construction tender for the midsize Dos Bocas refinery in Mexico’s Tabasco state and instead have state oil company Petróleos Mexicanos (Pemex) undertake the project alone will prove detrimental to the nation’s production of natural gas, according to experts.

On Thursday morning at his daily press conference, Mexican President Andrés Manuel López Obrador declared the refinery tender void. He said offers provided by the Bechtel Corp.-Techint and WorleyParsons Limited-Jacobs Engineering Group Inc. consortiums, along with individual bids from TechnipFMC and KBR Inc., failed to fall within the $8 billion budget stipulated by his government. They also exceeded the three-year timeline for the refinery’s completion.

The president said that Pemex would build the refinery using state resources under the leadership of Energy Minister RocÃo Nahle. The project will be completed by May 2022.

“The voided contract means the terms weren’t reasonable,” Dwight Dyer, an independent energy consultant and former Energy Ministry official, told NGI’s Mexico GPI. “This will strain the federal government’s budget and Pemex’s budget, and as we know from what Deputy Finance Minister Arturo Herrera has said, funds should be focused on E&P [exploration and production].”

Analysts have long said the refinery doesn’t make commercial sense. In April, Instituto Mexicano para la Competitividad said the project had a 2% chance of success and should be scrapped.

“This is hardly a surprise,” the Wilson Center’s Duncan Wood told NGI’s Mexico GPI. “There was no way a firm that wanted to make a profit could build a refinery like that for $8 billion.” He added that the decision to have Pemex build it is “an unnecessary distraction for the firm and the consumption of already scarce resources and bandwidth at a time when the company is struggling to meet its targets on what should be its prime directive, namely producing more oil.”

Pemex’s production of crude and condensates dropped 11.8% year/year to 1.66 million b/d in the first quarter while natural gas production fell 6.9% to average 3.665 Bcf/d.

Pemex CEO Octavio Romero Oropeza targets production of 2.4 million b/d of crude and 5.64 Bcf/d of natural gas by 2024.

Though López Obrador said construction on the refinery would start in just a few weeks, there is still a chance that the tender’s cancellation could “open a window to explore other options,” GMEC energy consultancy’s Gonzalo Monroy told NGI’s Mexico GPI. “The ideal scenario is where the refinery is cancelled and a good chunk of that investment goes to natural gas production and the upgrade of several gas processing centers. But that would not be as politically profitable as a refinery in López Obrador’s hometown.”

Building and upgrading refineries to slow imports in the name of energy sovereignty was a central part of López Obrador’s populist campaign promise. But the refinery decision will almost certainly lead to more natural gas import needs. “I think today’s decision aggravates the bias and focus towards oil in detriment of natural gas,” Monroy said.

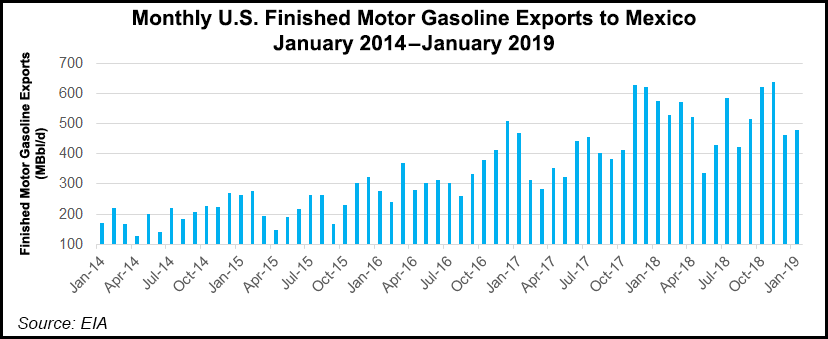

Pemex’s production of natural gas has fallen 42% since 2009. Excluding gas demand from Pemex for its operations, imports supplied 89% of Mexico’s natural gas demand in January, according to the Comisión Nacional de Hidrocarburos. An additional refinery could also lead to extra national gas demand.

It’s “a perfect storm for the natural gas market,” Dyer said. “Lower investment in E&P, no clear plans for recovering gas from ongoing production projects, no clear signs on getting the delayed pipelines finished any time soon. In a nutshell, Mexico will keep on needing greater imports.”

The refinery project was agreed to by public referendum last November, just weeks after López Obrador held a referendum on the $13 billion international airport already under construction outside Mexico City.

After the vote, the airport project was halted. At the time, Abel Hibert, an economic adviser to López Obrador, said the airport cancellation would cost the country 0.7% of GDP. Spending scarce state resources on a refinery project in a country where the refining segment consistently generates annual losses and utilization rates are under 50% could similarly hinder growth, which in the end could prove politically disastrous.

“Of course this will impact economic growth,” Dyer said. Mexico’s GDP fell by 0.2% in the first quarter compared to the previous quarter, according to preliminary figures. GDP rose 1.3% in a yearly comparison, far short of the 4% the president has pledged for his sole six-year term.

“The administration is shooting itself in the foot, because Dos Bocas will be an albatross,” Dyer said. “There is a pretty good chance that López Obrador and his party will lose support in the north and we will revert back to some balance in the lower house in the midterm elections. He’s banking on support from southern parts of the country, but this could backfire.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |