NGI The Weekly Gas Market Report

NGI The Weekly Gas Market Report | Forward Look | Markets | NGI All News Access

Production Cuts Boost Natural Gas Forwards as Signs Point to Slower Growth Ahead

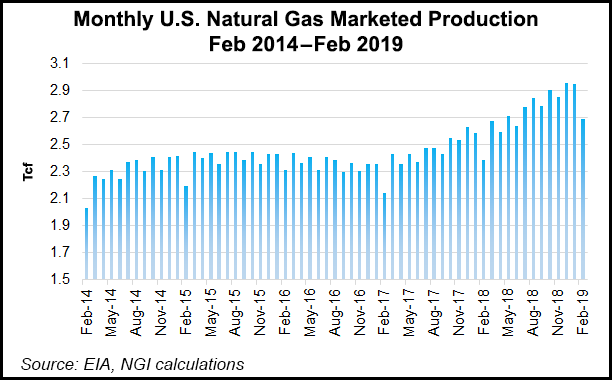

With Lower 48 natural gas production well off recent highs, forward prices continued to strengthen May 2-8 despite the absence of any early-summer heat to drive demand. Gains were small, however, as temporary pipeline maintenance was to blame for a significant chunk of the supply cuts.

Prices rose less than a nickel on average through the rest of the summer strip (June-October), while the winter package (November 2019-March 2020) was up 4 cents on average, according to NGI’s Forward Look.

Nymex futures led the way, trading lower for several days during the May 2-8 period as weather forecasts for the next couple of weeks showed a mix of below- and above-normal temperatures. Models overnight Wednesday reflected slightly higher demand overall, with the risk of warmth returning to the South and East after an extended period of lower demand due to storms moving across the region through next week, according to Bespoke Weather Services.

“With tropical forcing then shifting out of regions that favor cooler weather, above-normal temperatures creep back into the South and East the following week, not to levels seen last year, but still enough to push cooling degree days back on the above side of normal. The central United States likely remains in a stormy pattern in this setup,” Bespoke chief meteorologist Brian Lovern said.

Despite the generally mild pattern on tap for the coming weeks, Nymex futures staged a noteworthy rally Thursday as production, already off recent highs, took another big hit when nearly 1 Bcf/d of Rockies supply fell off the radar. Genscape Inc. reported Wednesday that 920 MMcf/d of regional production was being shut in after a series of underperformance notices posted by Colorado Interstate Gas (CIG) on Tuesday eventually led to a complete shut-in.

The two gas processing plants being shut in, Platte Valley and Lancaster, both had a scheduled capacity of 0 MMcf/d for May 8. Over the course of Tuesday’s gas day, nominations at the Platte Valley gas processing plant fell by 380 MMcf/d, while nomination at the Lancaster meter station dropped 580 MMcf/d day/day.

A similar event at the two gas processing plants in June 2018 partially shut-in the Lancaster plant, while Platte Valley was able to absorb about 50% of the displaced volumes, which is consistent with prior events given that both plants operate in tandem, according to Genscape.

“In June of 2018, it took five days for the plant to nominate volumes comparable to prior scheduled quantities,” Genscape natural gas analyst Matthew McDowell said.

With other various pipeline maintenance events stifling production elsewhere, the Nymex June contract jumped 7.3 cents to settle Wednesday at $2.61.

Such a leap proved to be too much for market bulls to sustain, however, as the prompt month was already a few pennies lower early Thursday as traders eyed an expected large bump in storage inventories. A Bloomberg survey had shown expectations ranging from a build of 79 Bcf up to 108 Bcf, with a median 87 Bcf injection. NGI’s model predicted an 89 Bcf injection.

The Energy Information Administration (EIA) reported an 85 Bcf injection into storage inventories for the week ending May 3. The reported build was in line with market expectations and exactly on target with last year’s injection, though it was well above the 72 Bcf five-year average.

While the fresh storage data was viewed by most market observers as neutral, Genscape analyst Eric Fell said the print indicates the market has been about 4.5 Bcf/d loose on a weather-adjusted basis versus the five-year average over the same six-week period.

“Production growth is driving the looser balances” even in the face of demand growth from exports, power generation and industrial sources, he said. “Despite impressive growth across the board, production has still outpaced the collective growth in demand/exports so far.”

Total Lower 48 working gas in underground storage stood at 1,547 Bcf as of May 3, 128 Bcf (9.0%) more than year-ago levels but 303 Bcf (minus 16.4%) below the five-year average.

By region, the South Central saw the largest build for the week at 33 Bcf, including 24 Bcf into nonsalt and 10 Bcf into salt stocks. The East injected 20 Bcf, while the Midwest injected 19 Bcf on the week. Farther west, the Mountain region posted a net 3 Bcf weekly injection, while the Pacific injected 10 Bcf, according to EIA.

The Nymex June contract went on to settle Thursday at $2.595, down 1.5 cents.

While current data suggests the market remains significantly oversupplied — to the tune of a projected end-of-season storage level of more than 4 Tcf — recent trends in Permian Basin production could give the market some pause. Permian production has remained subdued following the unprecedented negative pricing seen in late March and early April, although prices have mostly stayed out of negative territory since then.

Prior to April 2019, average Permian monthly production had posted month/month increases in 12 out of 15 months since the beginning of 2018, according to Genscape. From January 2018 through March 2019, monthly average production increased from around 7.2 Bcf/d to around 10.2 Bcf/d, equivalent to an increase of about 200 MMcf/d in each successive month.

However, when prices began to venture into negative territory in late March and fell to unheard-of record lows in early April, production plunged roughly 500 MMcf/d lower month/month from March to April.

“This was the second-largest month/month drop for the basin, behind only the 578 MMcf/d drop from November to December 2015. Production has ticked up slightly in the first week of May, coming in about 130 MMcf/d higher than April’s average,” Genscape analyst Joseph Bernardi said.

Apache Corp.’s deferrals at Alpine High have contributed a hefty share of the overall Permian production decline, according to Genscape. April’s monthly average receipts at Alpine High were 78 MMcf/d less than their previous six-month average. The same comparison for total Permian production yields a drop of 246 MMcf/d for April.

“In other words, the drop in El Paso Natural Gas’ receipts from Alpine High is just under one-third (32%) of the total net production decline,” Bernardi said.

Meanwhile, Appalachia producers are also cutting back on capital spending as persistent low prices have depressed investment returns and market valuations, which will likely temper production increases after a period of “phenomenal growth”, according to credit ratings agency Moody’s.

“Exploration and production companies in Appalachia have come under sustained shareholder pressure to improve their capital discipline amid lower natural gas prices that cap margins and returns,” said Moody’s Vice President Elena Nadtotchi, senior credit officer. “In response, most natural gas producers in the region are cutting growth investment to manage their businesses within operating cash flow.”

Improved access to cheap midstream infrastructure will be a key driver for future margin growth, and companies with low gathering and processing costs and solid pipeline arrangements will be better able to access more attractive markets and thereby maximize realized prices, according to Moody’s. Meanwhile, Appalachian producers will seek to maintain and improve drilling efficiencies and may focus on developing their higher-margin, liquids-rich acreage to maximize price realizations, the firm said.

Indeed, as part of its continued transformation into an oil-focused producer, Chesapeake Energy Corp. indicated on Thursday that it plans to run only three rigs on its natural gas assets in the second half of the year. That’s despite a record gross production level of 2.5 Bcf/d in Pennsylvania in January, resulting in average net Marcellus production of 948 MMcf/d during the first quarter.

Southwestern Energy and Range Resources Corp. have also both announced year/year capital expenditure cuts and substantially lowered their production guidance for 2019 as they aim to live within cash flows. This slowdown is reflected in the steady decline in the number of drilled but uncompleted wells, which have fallen nearly 60% since 2015 as production has grown around 70%, according to Barclays Commodities Research. Pennsylvania well permits also dropped by about a third in 1Q19.

“Lower activity feeds our thesis that sequential Appalachian production growth will be limited to less than 1 Bcf/d through 4Q19,” Barclays said.

Continued pipeline maintenance in western Canada that has restricted exports left NOVA/AECO C prompt-month prices in the red for the May 2-8 period, according to Forward Look. June prices fell 2 cents during that time to average 66.6 cents, while July rose 2 cents to 74.1 cents. The balance of summer was up a penny to 85 cents, and the winter strip climbed a more meaningful 6 cents to $1.61.

On Tuesday, Westcoast Transmission announced the latest in a string of pipeline maintenance events that cut receipts by more than 400 MMcf/d as part of a modernization project at Compressor Station 1 in northern British Columbia. The maintenance required the McMahon and Aitken Creek plants to shut in for the duration of the five-day event that was scheduled to end Saturday.

McMahon averaged 411 MMcf/d in receipts onto Westcoast up until the eve of the maintenance, according to Genscape. It then dropped nearly 100 MMcf/d to 315 MMcf/d for Monday’s nominations.

Meanwhile, Northwest S. of Green River responded to the import restrictions with an 8-cent jump for June prices, which averaged $2.074, Forward Look data show. July climbed 6 cents to $2.351, the balance of summer rose a nickel to $2.29 and the winter edged up a few pennies to $2.77.

Malin June climbed 8 cents to $2.142, while July and the balance of summer each rose 5 cents to $2.478 and $2.40, respectively. The winter strip was up 3 cents to $2.81.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 | ISSN © 1532-1266 |