EIA Build Seen as Neutral; Muted Response for Natural Gas Futures

The Energy Information Administration (EIA) on Thursday reported an above-average 85 Bcf weekly injection into U.S. natural gas stocks that confirmed the market’s expectations, resulting in a fairly muted response from futures prices.

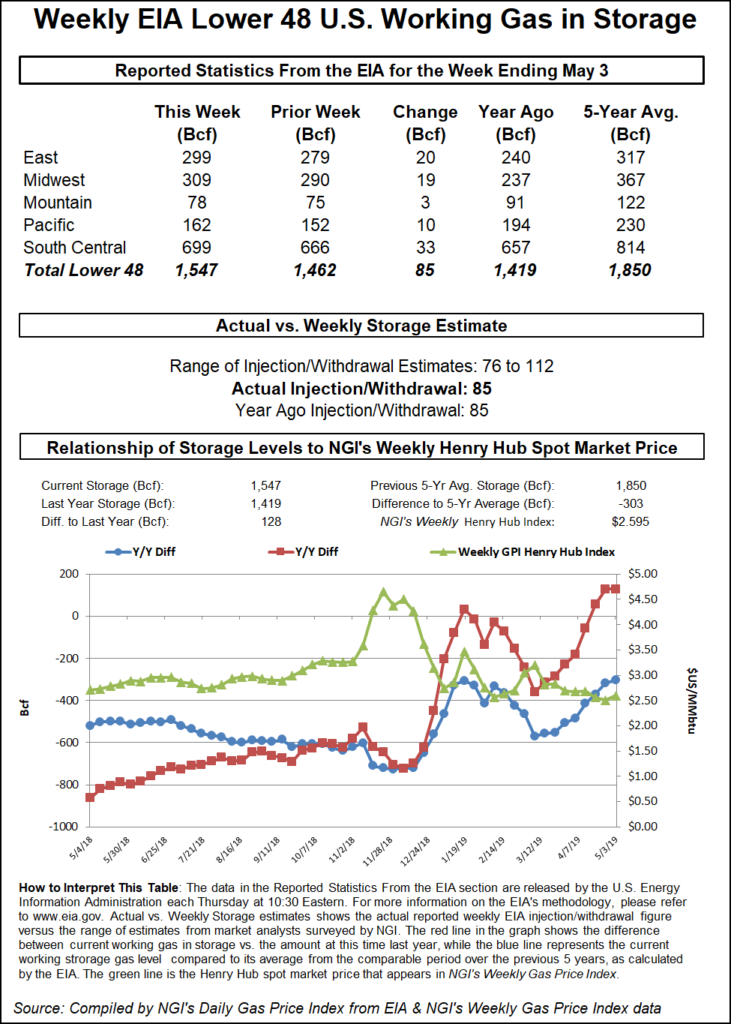

The 85 Bcf injection EIA reported for the week ended May 3 matches the 85 Bcf build recorded for the year-ago period but is larger than the 72 Bcf five-year average.

Natural gas futures had been trading a few pennies lower early Thursday as traders prepared to digest the latest weekly government storage data. As the EIA data crossed trading screens at 10:30 a.m. ET, the June contract went as low as $2.577 and as high as $2.592, venturing only slightly outside of the $2.582-2.587 area prices occupied in the minutes leading up to the report.

By 11 a.m. ET, June had slid down to $2.573, off 3.7 cents from Wednesday’s settle.

Prior to the report, market observers had been looking for a build close to the actual number. A Bloomberg survey had shown expectations ranging from a build of 79 Bcf up to 108 Bcf, with a median 87 Bcf injection. Intercontinental Exchange EIA Financial Weekly Index futures settled Wednesday at a build of 86 Bcf. NGI’s model predicted an 89 Bcf injection.

In a weekly Enelyst chat coinciding with the release of the EIA data, market observers described the 85 Bcf figure as neutral given its close proximity to what many had predicted.

Still, Genscape Inc. analyst Eric Fell noted during the chat that “over the last six weeks we have injected 185 Bcf more than the five-year average, while total degree days over the last six weeks have been very close to the five-year average.”

Fell said storage data indicates the market has been about 4.5 Bcf/d loose on a weather-adjusted basis versus the five-year average over the same six-week period.

“Production growth is driving the looser balances” even in the face of demand growth from exports, power generation and industrial sources, he said. “Despite impressive growth across the board, production has still outpaced the collective growth in demand/exports so far.”

Total Lower 48 working gas in underground storage stood at 1,547 Bcf as of May 3, 128 Bcf (9.0%) more than year-ago levels but 303 Bcf (minus 16.4%) below the five-year average.

By region, the South Central saw the largest build for the week at 33 Bcf, including 24 Bcf into nonsalt and 10 Bcf into salt stocks. The East injected 20 Bcf, while the Midwest injected 19 Bcf on the week. Further west, the Mountain region posted a net 3 Bcf weekly injection, while the Pacific injected 10 Bcf, according to EIA.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |