Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Carrizo Increases Eagle Ford, Permian Delaware Output as Costs Decline

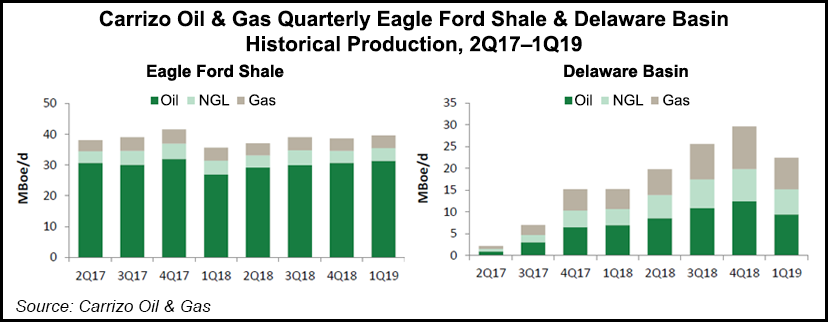

Houston independent Carrizo Oil & Gas Inc., which plies its trade in the Eagle Ford Shale and the Permian Basin’s Delaware, saw production climb 21% year/year in the first quarter, with better-than-expected efficiencies yielding well cost reductions across the portfolio.

Total output reached 61,960 boe/d, with natural gas at 67,977 Mcf/d, oil hitting 40,727 b/d and natural gas liquids output of 9,903 b/d.

“Our recent operational focus has been on the development of several highly efficient multipad projects, which we completed on time and within budget,” CEO S.P. “Chip” Johnson IV said. “While these larger-scale projects are expected to result in greater efficiencies, and thus, improved project-level economics, they also result in a more uneven production profile. We saw this impact in the first quarter, as the limited number of wells that we turned to sales late in the fourth quarter and early in the first quarter, combined with a higher level of planned downtime for offsetting completion activity, led to a sequential decline in our production.

“However, we are now reaping the rewards of this activity as we began bringing on wells from our two large-scale multipad projects in the Eagle Ford Shale during the first quarter and our initial multipad project in the Delaware Basin during the second quarter. As a result, we expect to see a significant increase in our production during the current quarter.”

A primary objective, Johnson said, “has been increasing our capital efficiency through the optimization of all phases of our drilling and completion programs. We set aggressive targets for cost reductions and efficiency gains, and we are currently exceeding these targets in both of our plays.

“As a result, we have been able to reduce our well costs in the Eagle Ford Shale and Delaware Basin by an additional 5-10%. A key driver of these additional efficiency gains has been reduced cycle times in our operations, especially in the Delaware Basin, where we have been drilling wells faster than planned.

“Given this, we may not need to add a third rig in the Delaware Basin as early as previously forecast in order to execute on our planned drilling activity for 2019.”

COO Bradley Fisher during the quarterly conference call said from an efficiency standpoint, most of the savings came from hydraulic fracturing and completions. “In the Permian, we’ve gone from a 165-foot stage spacing to 200-foot stage spacing, so that’s driving efficiency, or costs really.”

The company also has switched to hybrid completions and changed its proppant concentrations, which has improved efficiencies. Proppant once was around 2,000 pounds/foot across the board, but it was reduced in some locations to 1,600 pounds/foot.

In addition, drilling times for Permian wells have declined by around 19%. “We think that our 27-day well that we have now is probably going to go to 23-24 days by the end of the year,” reducing more costs.

All of the reductions are tied to management’s commitment to capital discipline and generating free cash flow (FCF), Johnson said.

“As a result, we have no plans to adjust our planned 2019 budget in response to the recent increase in crude oil prices,” Johnson said. Carrizo is on track to hit a FCF-positive “inflection point by the third quarter…and currently plan to use incremental cash flow from higher-than-budgeted commodity prices to accelerate debt reduction.”

Drilling, completion and infrastructure (DC&I) capital expenditures (capex) in the first quarter came in at nearly $215 million, with 63% directed to the Eagle Ford. Land and seismic capex of $9 million primarily focused in the Delaware.

Through 2019, Carrizo is maintaining its DC&I capex of $525-575 million and plans to run on average up to four rigs. Based on this level of activity, around 65-75 net operated wells should be drilled, with 85-95 completed.

Production guidance for 2019 was reiterated at 66,800-67,800 boe/d, with crude accounting for nearly two-thirds of output, an overall midpoint guidance range that equates to 11% year/year growth.

First quarter net income was $146.2 million ($1.59/share), compared to year-ago profits of $14.7 million (18 cents).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |