Production Data Seen Fueling Natural Gas Futures Rally; Cash Mixed on Stormy Pattern

The timing of the season’s first significant summer cooling demand remained an open question Wednesday, but that didn’t stop natural gas futures from rallying sharply, helped by a reported drop in production. In the spot market, a stormy spring pattern didn’t stir much interest for buyers, and the NGI Spot Gas National Avg. added 0.5 cents to $2.210/MMBtu.

The June Nymex futures contract rallied 7.3 cents to settle at $2.610, effectively erasing losses recorded in recent sessions going back to last week. Further along the strip, July and August also each added 7.3 cents, settling at $2.646 and $2.666, respectively.

A second straight day of data showing a drop in production appeared to fuel Wednesday’s rally, according to Bespoke Weather Services. The firm also described the latest forecast guidance as less bearish compared to previous runs.

“Other data was mixed at best, however, with burns actually less impressive” Wednesday, Bespoke said. “With the production dip related to maintenance in Colorado, and some of it likely back online” Thursday, “based on afternoon data, the timing and magnitude of the rally came as a bit of a surprise.”

However, “this price level, in our view, makes sense given how early we are in the season, with so many factors that can change along the way. From here, we feel that we will need to confirm that late month has material warm risks to continue advancing higher, as that could tighten up balances when we see legitimate heat show up.”

Radiant Solutions highlighted a small warmer change in the southern United States in its latest 11-15 day forecast Wednesday.

“The forecast features a mix of changes in this period, leaning cooler in the Midwest and warmer in the South,” Radiant said. “These changes are associated with model trends in building a Southeast ridge during the second half. The forecast returns aboves to this region for then. Otherwise, the forecast continues to have temperatures on the warm side of normal in the period composite across the Eastern Half.”

Potentially influencing the market’s outlook on the supply picture, management for Chesapeake Energy Corp. said during a 1Q2019 earnings call Wednesday that it would lay down natural gas rigs as it continues its push to develop oilier assets. CEO Robert Lawler said the company has “rapidly integrated” Upper Eagle Ford assets in East Texas acquired in February from the purchase of WildHorse Resource Development Corp.

“When we took over the assets on Feb. 1, the majority of the rigs were working in the gas window of the Austin Chalk, we have now altered course, transferring all four rigs to the oil window in the Eagle Ford, which we expect will result in our oil volumes picking up speed in or around the third quarter,” said exploration and production chief Frank Patterson.

The company also plans to shift capital from the Marcellus Shale and the Midcontinent to the Powder River Basin, where it’s been increasingly focused. Chesapeake will drop from three to two rigs in the Marcellus, from two to one in the Haynesville Shale, and it has already dropped its only rig in the Midcontinent.

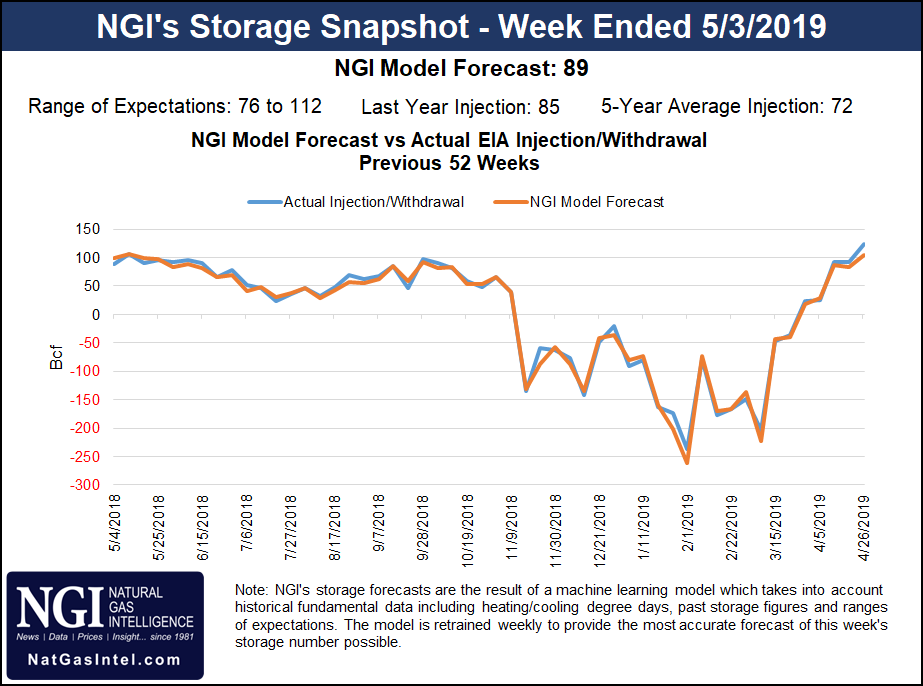

As for Thursday’s Energy Information Administration (EIA) storage report, estimates point to a larger-than-average double-digit build for the week ended May 3. A Bloomberg survey as of Wednesday showed expectations ranging from a build of 79 Bcf up to 108 Bcf, with a median 87 Bcf injection. Last year, EIA recorded an 85 Bcf build for the period, and the five-year average is an injection of 72 Bcf.

Intercontinental Exchange EIA Financial Weekly Index futures settled Tuesday at a build of 86 Bcf. NGI’s model predicted an 89 Bcf injection.

A stormy spring pattern expected to deliver cooler-than-normal temperatures for the central and northern parts of the country failed to inspire significantly higher prices in the spot market Wednesday. Some of the strongest gains were found along the Gulf Coast as forecasters with the National Weather Service (NWS) highlighted risks for excessive rainfall and severe weather for the Arkansas/Louisiana/Texas area.

Henry Hub picked up 4.5 cents to $2.585, while Houston Ship Channel added 9.5 cents to $2.580.

The NWS was calling for a mix of below normal and above normal temperatures associated with a “potent front” that had been lingering over the Central Plains and Mississippi Valley earlier in the week.

“The main front across the country will delineate much above and much below average temperatures,” the NWS said. “On the cold side of the front, the Rockies, Northern/Central Plains and Midwest to upper Great Lakes can expect below average temperatures, pushing into the Southern Plains on Thursday as well.

“High temperatures are forecast to be 20-35 degrees below average in the Central High Plains. South of the warm front, high temperatures of 10-15 degrees above average are forecast in the Ohio and Tennessee Valleys. The Northeast is expected to remain cool due to a backdoor cold front. Meanwhile, record-setting heat is forecast in the Pacific Northwest as upper-level ridging builds.”

As of Wednesday, the NWS was also looking for late-season snow for some parts of the country, including northeastern Minnesota, far northern Wisconsin and Michigan’s Upper Peninsula. All told, the pattern over the next few days was expected to result in a “minor increase” in national demand, according to NatGasWeather.

“With lows of 30s to 40s the next few nights and into the weekend, a little extra national heating demand is required, aided by slightly hot conditions across the far southern U.S. where upper 80s to locally 90s continues,” the forecaster said. “However, the pattern for next week continues to favor very light national demand as the southern U.S. cools into the very comfortable 70s to lower 80s. The northern U.S. will remain a touch cool with lows of 40s, but not enough to overcome light demand elsewhere.”

Most Midwest points saw modest gains. Joliet added 1.5 cents to $2.345.

With maintenance in the region impacting flows on the Natural Gas Pipeline Co. of America (NGPL) system, prices at NGPL Midcontinent came under pressure Wednesday, falling 18.5 cents to $1.890.

A force majeure in Kansas was limiting 90 MMcf/d of flows into the Midwest via NGPL, according to Genscape Inc. analyst Matt McDowell. The event, effective for Wednesday’s timely nominations, impacted Compressor Station 104 on NGPL’s Amarillo Mainline in Barton County, KS.

“Citing electrical issues at the station, the notice stated that the capacity reduction is expected to last through Monday (May 13),” McDowell said. “Historical data has shown the capacity reduction being buffered by an increase in receipts at the ”NBORDER/NGPL HARPER KEOKUK’ interconnect with Northern Border during similar events, but there has been no uptick in scheduled capacity with timely cycle nominations” as of Wednesday.

Heating degree days in the Midwest “are forecast to be above the 30-year norm for the duration of the event and could increase receipts at the Northern Border and Trailblazer interconnects.”

After gaining earlier in the week, most Rockies locations sold off Wednesday. Cheyenne Hub dropped 7.5 cents to $2.065, while CIG slid 11.0 cents to $2.010.

Plant shut-ins in the Rockies had cut nearly 1 Bcf/d of production from the Denver-Julesburg Basin for Wednesday’s gas day, according to Genscape’s McDowell, who pointed to a series of recent underperformance notices posted by the Colorado Interstate Gas (CIG) Pipeline.

As of early Wednesday, the Platte Valley and Lancaster plants both had a scheduled capacity of 0 MMcf/d, according to McDowell.

Over the course of Tuesday’s gas day, “nominations at the Platte Valley gas processing plant fell by 380 MMcf/d while nominations at the Lancaster meter station dropped 580 MMcf/d day/day,” the analyst said. “A similar event at the two gas processing plants back in June 2018 partially shut in the Lancaster plant, while Platte Valley was able to absorb about 50% of the displaced volumes, which is consistent with prior events given that both plants operate in tandem.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |