NGI The Weekly Gas Market Report | E&P | Infrastructure | NGI All News Access

Noble Holds Capex Steady as Leviathan Nears Completion, U.S. Onshore Plays Expand

Higher commodity prices will not dissuade Noble Energy Inc. from its pledge to hold capital spending down this year, even as it prepares for starting up the massive natural gas project offshore Israel and for more U.S. onshore opportunities.

CEO Dave Stover held court Friday during an hour-long conference call to discuss first quarter results and plans for the Houston super independent through the rest of the year as it nears completion of the Leviathan gas facility in the Eastern Mediterranean and increases production from its Lower 48 plays.

While some operators have raised capital expenditures (capex) as West Texas Intermediate (WTI) has strengthened this year, Noble is holding firm to its original guidance while squeezing out more production at a lower cost with efficiencies.

“Our total capital came in below expectations with first quarter capital below the low end of the range, due to lower well and facility costs and lower Leviathan spend,” Stover said. “Despite the reduction in capital, we delivered sales volumes above the upper…range of guidance. Operating costs also came in below expectations and these per-barrel efficiencies will drive further improvements in profitability.”

Going into 2019, the goal was to “drive sustainable cash flow growth by challenging the organization to reduce the capital intensity of our business and deliver more for the same or less capital,” he told analysts. “As we continue to progress through the year, we expect to build upon these capital efficiency gains…

“Despite the acceleration in oil prices through the first quarter, we remain disciplined.” Capex for 2019 was set at $50/bbl WTI, and that’s not going to budge, Stover promised.

“We are committed to operate within our budget of $2.4-2.6 billion, and…as commodity prices move higher, we expect to have the ability to further strengthen the balance sheet and return additional cash flow to investors.”

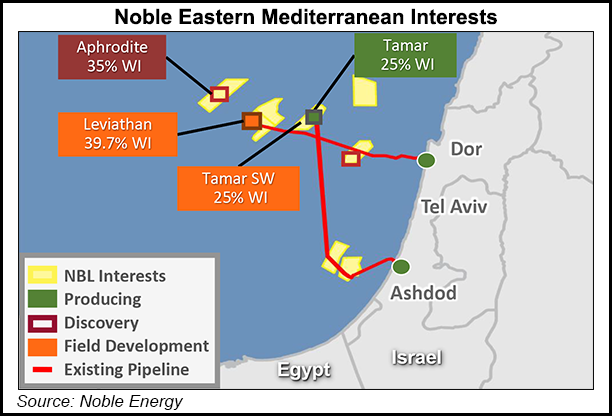

Sales volumes from Leviathan, now 81% complete, totaled 235 MMcfe/d, with gross production exceeding 1 Bcfe/d. Volumes were sharply above expectations on higher-than-anticipated Israeli gas demand.

“With Leviathan…Noble Energy has a unique opportunity to access global natural gas markets and drive further high margin, cash flow growth internationally,” Stover said.

During the first quarter the jacket and piles were installed along with the production manifold. Pipeline installation also was completed The next major milestone is loading and shipping the platform topsides, which is expected by the end of June. The project remains on budget and on schedule for first production by the end of the year.

The “key near-term focus” from a marketing standpoint is the Eastern Mediterranian Gas (EMG) pipeline, which would move natural gas sales into Egypt, COO Brent Smolik said.

“We are diligently progressing this project, and we plan to flow test with gas and complete inspection this month. Following the flow test, we expect to close on the pipeline purchase by mid-year,” he told analysts.

Noble expects to sell an average 800 MMcf/d from Leviathan in 2020.

“We anticipate significant regional demand growth, and we’re excited that the Noble gas can satisfy a portion of that growing demand,” Smolik said.

Noble also recently sanctioned the Alen gas project In Equatorial Guinea (EG) in West Africa. Initial sales of liquefied natural gas (LNG) and incremental liquids are expected to begin in the first half of 2021.

“The economics benefit from global LNG pricing and the project is a significant step toward monetization of over 3 Tcf of discovered gas in the area,” Smolik said. “It’s also important to note that the governments of EG and Cameroon and recently completed a pre-unitization agreement, which will further support development of discovered resources.”

The Lower 48 still provides the bulk of Noble’s output and is taking the majority of the capex.

“In the DJ Basin our business continues to outperform our expectations,” Stover said, despite Colorado’s new legislation that gives local authorities more oversight on oil and gas drilling operations.

“Through the strategic repositioning of our acreage and state approval of our comprehensive drilling plan, we are well positioned to work with both state and local authorities,” Stover said. “We have line of sight to years of activity and are set to execute on our multi-year plan and to build upon our industry leading returns in the basin.”

Total sales volumes were 337,000 boe/d in 1Q2019, with the U.S. onshore averaging 253,000 boe/d. Lower 48 liquids volumes totaled 173,000 b/d. U.S. onshore natural gas volumes were flat year/year at 483 MMcf/d from 482 MMcf/d.

Noble drove its capital efficiencies across the U.S. onshore, with improvements to “sustainably reduce well costs and improve cycle times” using its with row development process,” Smolik told analysts. Among other things, pumping hours/day improved 5-10% sequentially, contributing to lower than budgeted well costs and accelerating first production for new wells.

DJ volumes reflected another quarterly production record, averaging 144,000 boe/d, which was up 5% sequentially and 21% year/year. Increased volumes primarily were driven by completion activity in the Mustang area, where 21 wells were brought online and production averaged 39,000 boe/d, while Wells Ranch output grew to 66,000 boe/d, benefiting from additional natural gas offload.

In the Permian Delaware, volumes jumped about 30% from a year ago to average 59,000 boe/d. The gains came despite divesting 13,000 net acres in the basin, which had about 1,000 boe/d of production. Nine Delaware wells also were turned to sales, with initial production over 30 days averaging 1,560 boe/d.

Eagle Ford volumes totaled 50,000 boe/d, and seven wells began producing from the North Gates Ranch area.

The company during 1Q2019 operated two DJ rigs and drilled 26 wells, and it ran four Delaware rigs and drilled 16 wells. Production ramped on 37 wells, including 21 DJ, nine Delaware and seven Eagle Ford; Noble also completed 56 wells.

U.S. onshore assets produced 75% of sales volumes, EG in West Africa represented 13% and Israel comprised 12%. Unit production expenses for the first quarter 2019 were $10.02/boe including lease operating expenses, production taxes, gathering and transportation expenses, and other royalty costs.

First quarter organic capex included $487 million for the U.S. onshore and $37 million for the domestic midstream, lower than anticipated. The company also invested $132 million in the Eastern Mediterranean, primarily for Leviathan.

In addition, Noble disclosed it spent $39 million to capture more U.S. exploration acreage. Over the past two years, it has amassed more than 140,000 acres in two Wyoming plays at an average cost of less than $430/acre.

Colombia exploration also is on the radar as Noble finalized a 40% working interest agreement to farm into two deepwater blocks offshore that total 2.2 million acres. Drilling is planned for 2020.

Late in April Noble also disclosed that a strategic review is underway of Noble Midstream Partners LP (NBLX), assets that help its Lower 48 production. The contributions from NBLX are considered “very valuable,” Stover said, but the market has not recognized their contribution. Management is considering several potential scenarios, including spinning off the business.

NBLX earnings, consolidated into Noble financial statements, included $29 million in organic capex and $271 million in equity investments relating to acquiring stakes in the Epic Y-grade and crude pipelines to transport Permian Delaware liquids.

Full-year spending and volume expectations for 2019 remain unchanged. Volumes for the second quarter are expected to be slightly higher than the first quarter at 332,000-347,000 boe/d, reflecting increased U.S. onshore production and relatively flat international volumes.

As planned, second-half U.S. onshore output is forecast to be 15% higher than in the first six months.

Net losses in the first quarter totaled $313 million (minus 65 cents) versus year-ago profits of $554 million ($1.14). Operating cash flow reversed to a loss of $289 million from 1Q2018 cash flow of $574 million.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |