NGI Mexico GPI | E&P | NGI All News Access

Perdido Deepwater Discoveries Yielding More Oil, Natural Gas Reserves

A significant oil and natural gas prospect about 250 miles south of Houston in the deep waters of the U.S. Gulf of Mexico (GOM) could portend more opportunities to add reserves in Mexico’s offshore.

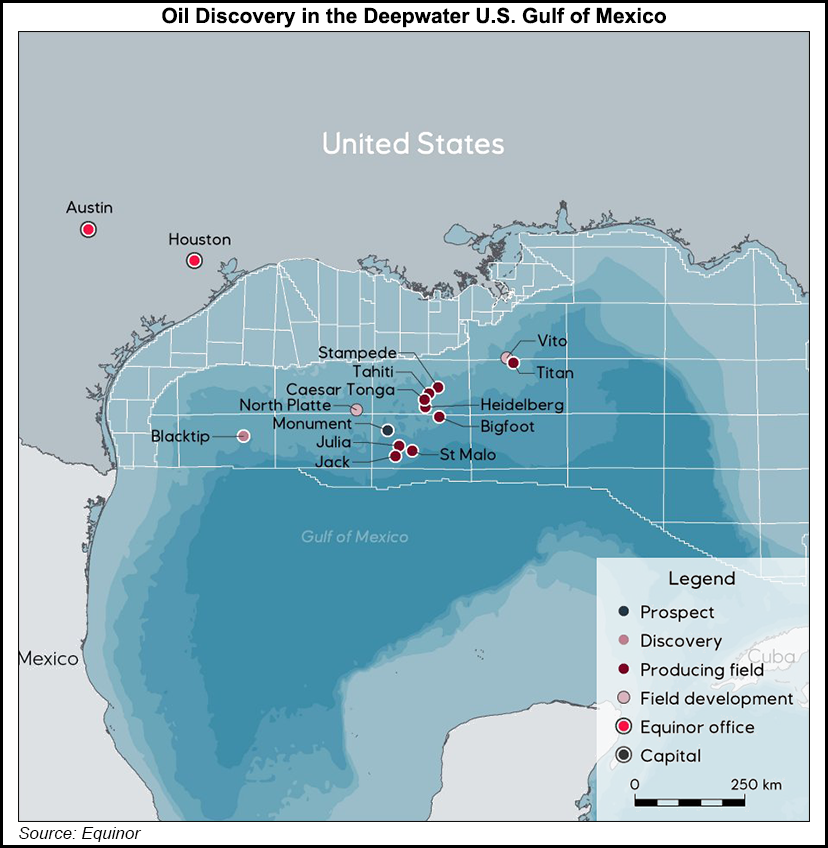

Shell Offshore Inc. recently reported a strike in the deepwater Alaminos Canyon at its Blacktip exploration well, a Wilcox discovery in the rich Perdido thrust belt.

The discovery, unearthed in Block 380 in 6,200 feet of water, is about 30 miles from the Shell-operated Perdido platform in the U.S. portion of the GOM. Blacktip is also near Shell’s recent Whale discovery, also in Alaminos Canyon.

“Blacktip is Shell’s second material discovery in the Perdido Corridor and is part of a continuing exploration strategy to add competitive deepwater options to extend our heartlands,” said upstream director Andy Brown.

The Royal Dutch Shell plc subsidiary’s Great White, Silvertip and Tobago fields are already producing in U.S. deepwater.

Drilling at the initial Blacktip well is still underway and “has to date encountered more than 400 feet net oil pay with good reservoir and fluid characteristics. The well is currently being deepened to further assess the structure’s potential.”

The latest find could augment existing production in the Perdido trust belt, which extends beyond the U.S. Maritime Boundary into Mexico waters. Shell’s Perdido platform had its first commercial production in 2010 from what was then a geological frontier in the U.S. GOM, the Lower Tertiary/Paleogene.

Today the Perdido has become a prospecting area for U.S. and Mexico GOM explorers.

In the Mexico Perdido deepwater, BHP earlier this year agreed to spend $256 million to drill an additional appraisal well (3DEL) and perform further studies in the Trion field to further delineate the scale and characterization of the resource.

BHP captured ownership of the field in 2016 as the first deepwater partner ever for Mexico’s state-owned Petróleos Mexicanos, aka Pemex. In the bidding round, BHP, with a 60% stake, won the right to explore jointly with Pemex two blocks in the prolific Perdido formation.

Trion has gross recoverable resources estimated at 485 million boe. The Trion 1 discovery well in 2012 at the time was considered one of the top 10 discoveries in the entire GOM.

The primary objectives of the 3DEL appraisal well and studies are to confirm the volume and composition of hydrocarbons near the crest of the Trion structure and to study the viability of development of the Trion field. The appraisal well is expected to be drilled in the second half of the year.

Blacktip is operated by Shell (52.375%) and co-owned by Chevron U.S.A. Inc. (20%), Equinor Gulf of Mexico LLC (19.125%) and Repsol E&P USA Inc. (8.5%).

The Perdido discovery “confirms the potential in the deepwater Gulf of Mexico and underpins Equinor’s strategy to exploit prolific basins and deepen in core areas,” said Equinor Senior Vice President Bjørn Inge Braathen, who oversees North American exploration. “We await further results from the well and look forward to continue the collaboration with the operator and co-venturers to assess the full potential of the discovery and evaluate options for development.”

The discovery in a “Shell heartland” adds to its Paleogene exploration success in the Perdido area, Shell executives noted. In the U.S. deepwater, Shell has Appomattox, Kaikias and Coulomb Phase 2 underway, as well as investment options for additional subsea tiebacks and a potential new hub, Vito.

Through exploration, Shell has added more than 1 billion boe in the last decade with the GOM. The supermajor’s global deepwater production is on track to exceed 900,000 boe/d by 2020, from already discovered, established areas.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |