Natural Gas Futures Hit Reverse as Triple-Digit EIA Build Tops Consensus

The Energy Information Administration (EIA) on Thursday reported an above-consensus and much larger than average 123 Bcf weekly injection into U.S. natural gas stocks, keeping the pressure on sliding front month futures prices.

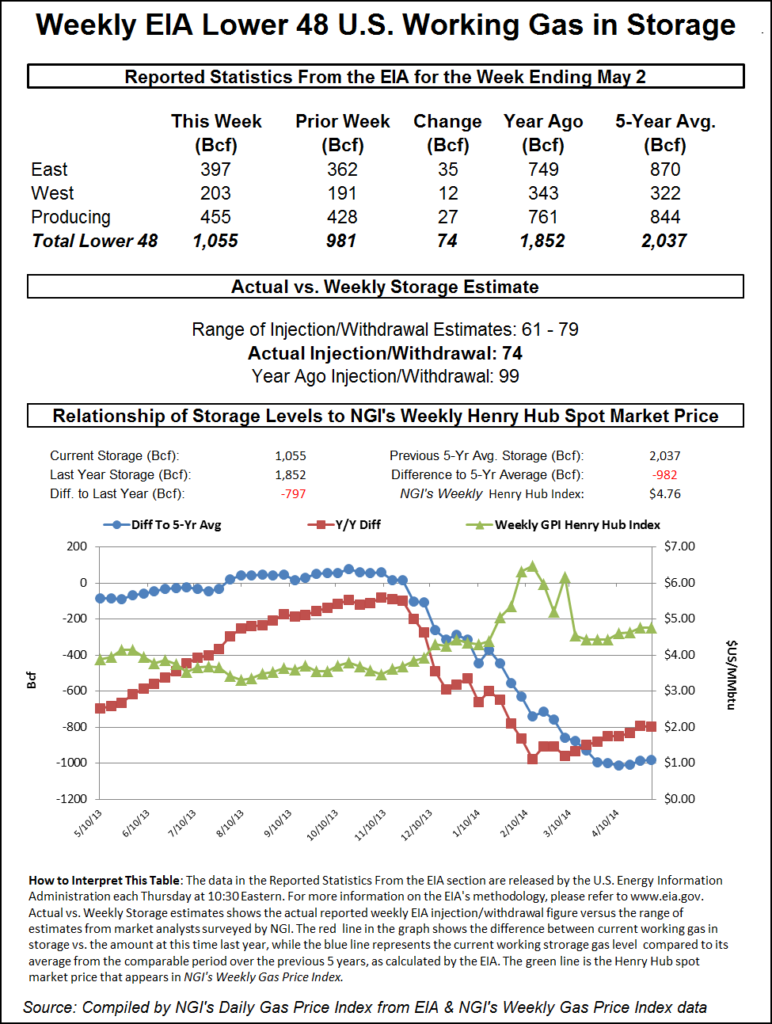

The 123 Bcf build for the week ended April 26 compares to just a 50 Bcf build recorded in the year-ago period and a five-year average 70 Bcf injection.

In the lead-up to the report, the June Nymex futures contract was already trading about 3-4 cents lower. As the 123 Bcf figure crossed trading screens, the front month went as low as $2.571 and as high as $2.596 before prices fell back in line with the pre-report trade around $2.580-$2.590. Shortly after 11 a.m. ET, prices had slipped down to $2.571, off 4.9 cents from Wednesday’s settle.

Estimates prior to Thursday’s report undershot the actual figure, even as the consensus pointed to a hefty triple-digit build — the first in what analysts expect could be a series of triple-digit shoulder season injections in the weeks ahead. Major surveys had pointed to a build in the neighborhood of 114-116 Bcf for this week’s report, with predictions ranging from 95 Bcf up to 126 Bcf.

Intercontinental Exchange EIA Financial Weekly Index futures had settled Wednesday at an injection of 118 Bcf, while NGI’s model missed to the low side, predicting a build of 105 Bcf.

The selling early Thursday effectively erased a 4.5-cent rally in Wednesday’s session that came on a combination of seasonal and technical momentum. But confirmation of the large storage build from EIA seemed to arrest any momentum from the day before.

From a technical standpoint, prices saw a “bullish divergence” after bears broke below long-term support last month but failed to follow through to the downside, according to Powerhouse LLC President Elaine Levin. Seasonal trends also favor higher prices this time of year, she said.

“You have this strong seasonal where May into June tends to be a bullish time of year,” Levin told NGI. But a string of larger-than-normal injections from EIA this month could be “the one thing that could derail all of this.”

Total Lower 48 working gas in underground storage stood at 1,462 Bcf as of April 26, 128 Bcf (9.6%) above year-ago stocks but 316 Bcf (minus 17.8%) below the five-year average, according to EIA.

By region, the largest build came in the South Central, where IAF Advisors analyst Kyle Cooper told Enelyst chat participants demand has been “at a minimum.” The region injected 50 Bcf on the week, including 29 Bcf into nonsalt and 20 Bcf into salt stocks.

The East injected 28 Bcf for the week, while the Midwest recorded a 26 Bcf build. In the West, the Pacific and Mountain regions — where stocks sit well below five-year average levels — injected 14 Bcf and 5 Bcf, respectively.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |