NGI Mexico GPI | Markets | NGI All News Access

Potential Large EIA Build Doesn’t Phase Natural Gas Bulls as Futures Rally

Undeterred by the prospect of a hefty injection from this week’s government storage report, natural gas futures traders bid up prices Wednesday with support from seasonal and technical factors. In the spot market, cooler temperatures to the north and warmer conditions to the south helped drive modest but widespread gains; the NGI Spot Gas National Avg. rose 6.5 cents to $2.210/MMBtu.

The June Nymex futures contract added 4.5 cents to settle at $2.620, near the top of the daily range from $2.561 up to $2.626. Further along the strip, July added 4.1 cents to $2.658, while August settled at $2.676, up 3.5 cents.

Powerhouse LLC President Elaine Levin attributed Wednesday’s rally to a combination of seasonal buying in anticipation of summer cooling demand and technical momentum following last week’s lows. The market broke below a key support level in late April, with the May and June contracts dropping into the $2.40s, but momentum indicators suggested the move was running out of steam, Levin told NGI.

“So even though we took out an important technical number, you just didn’t have a lot of push behind it. And when that occurs, oftentimes you have a push in the other direction,” she said.

This technical bounce has coincided with what tends to be a bullish time of year for natural gas, Levin noted.

“Typically you’re buying sometime in May, you’re holding it into June,” she said.

Larger-than-normal storage builds the next few weeks could “derail” the usual seasonal momentum, but Wednesday’s rally offers an encouraging sign for bulls.

“With everybody and their brother girding their loins for a triple-digit injection, we are rallying in the face of that, and I think that needs to be respected,” Levin said.

Meanwhile, the latest six- to 10-day forecast from Radiant Solutions Wednesday showed a pattern expected to retain above-normal temperatures in the Southeast.

“Ridging over this region will also support a stormy period in the Plains and Midwest, along its western periphery,” Radiant said. “Unsettledness and cool conditions also accompany an upper level low into the Southwest, with this feature being responsible for lowering confidence during the second half. Models disagree in its potential interaction with a northern trough at that time. Belows are forecast along the northern tier.”

Radiant said the overall themes remained the same for its updated 11-15 day outlook, although the forecaster noted a cool change over the East Coast early in the period.

“Slightly above normal temperatures are in the Southeast and Northwest, while cool support from high latitude blocking…has below normal temperatures in the Upper Midwest,” Radiant said. “Due to model disagreements stemming from earlier upper air interactions, the forecast holds onto an element of pattern persistence. Confidence, however, is lowered, with risks mostly leaning to the cooler side of the forecast.”

Recent forecasts haven’t significantly altered the overall outlook for natural gas demand in the coming weeks, EBW Analytics Group CEO Andy Weissman noted.

“But bearish forces are looming,” he said. “Between Week 1 and Week 3, power sector demand is expected to drop by more than 6 Bcf/d.”

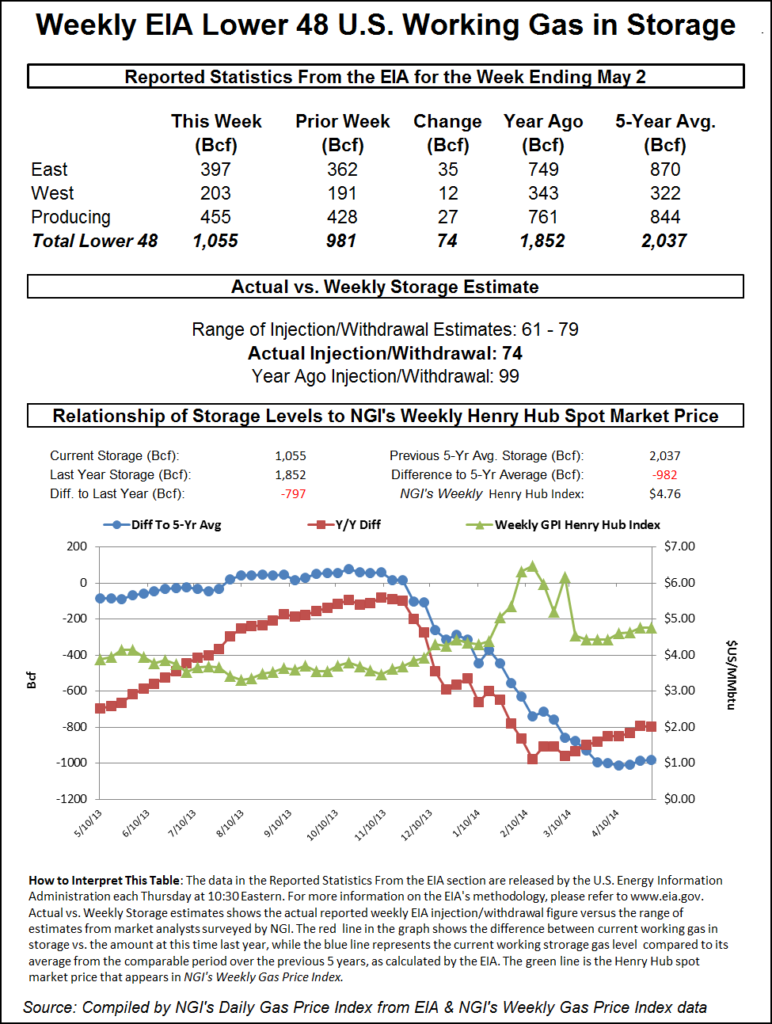

This comes as Thursday’s Energy Information Administration (EIA) storage report could show the first in a string of triple-digit injections, with builds potentially averaging close to 5 Bcf/d more than the five-year average even with near-normal weather, according to Weissman.

“While support is unlikely to crumble quickly, natural gas could struggle to post any significant gains in the face of this onslaught,” he said. “Instead, while gas prices often rise as summer grows nearer, at least some additional losses are likely.”

Weissman isn’t alone in predicting a triple-digit build from Thursday’s EIA report, which covers the week ended April 26. A Bloomberg survey as of Wednesday afternoon showed a median 116 Bcf build, with responses ranging from a build of 95 Bcf up to 126 Bcf. A Reuters survey had a median build of 114 Bcf, with the same range of predictions from 95 Bcf to 126 Bcf.

IAF Advisors analyst Kyle Cooper called for a 119 Bcf build, while Intercontinental Exchange EIA Financial Weekly Index futures settled Tuesday at an injection of 120 Bcf. NGI’s model predicted a build of 105 Bcf.

A triple-digit injection would dwarf recent norms for this time of year. Last year, EIA recorded a 50 Bcf injection, and the five-year average is a build of 70 Bcf.

Comfortable temperatures and a multitude of pipeline maintenance events continued to characterize natural gas day-ahead trading Wednesday as prices generally strengthened on a mix of heating and cooling degree day accumulations.

The National Weather Service (NWS) was calling for temperatures to remain below average over the northern tier of the Lower 48 through mid-week before undergoing a “slow moderating trend” into the end of the week.

“Warmer than normal readings are expected from Texas to the Southeast and Mid-Atlantic region, which will remain south of the frontal boundaries,” the NWS said. “Widespread highs in the 80s to low 90s are possible during the time, making it feel more like late June for many areas.”

The warmer temperatures in the South, Southeast and Mid-Atlantic accompanied higher spot prices at locations like Transco Zone 4, which crept 3.5 cents higher to average $2.580. Forecasts showing highs in the 80s in cities like Dallas and Houston supported gains throughout Texas. Katy picked up 8.0 cents to $2.550.

Conversely, calls for chillier temperatures across the northern tier of the Lower 48 corresponded with gains for Midwest locations. As Radiant Solutions was forecasting Chicago temperatures in the 40s and 50s through the end of the week, around 5 degrees cooler than normal, prices at Chicago Citygate gained 8.5 cents Wednesday to $2.495.

Perhaps drawing support from the Texas heat, constrained Permian Basin price points strengthened Wednesday, overcoming the impact of maintenance-related restrictions on pipeline takeaway capacity. That said, prices there remained depressed compared to surrounding regions. Waha managed to add 15.5 cents during Wednesday’s session, averaging 31.5 cents.

Permian outflows could be further impacted this week as El Paso Natural Gas (EPNG) is expected to tighten restrictions from an ongoing force majeure event at its Caprock compressor, potentially impacting 50 MMcf/d compared to the highest volumes recorded in April, Genscape analyst Joe Bernardi said.

“EPNG’s Caprock force majeure has been in effect since late December, when a compression unit at the Caprock station failed,” Bernardi said. “This occurred only a few weeks after EPNG’s Permian North expansion went into service in early December, initially leading to a notable increase through the ”LINCOLN N’ meter in central New Mexico. Since then, an additional five compression units have gone down at various times,” including the other unit at Caprock and units at the Belen and Roswell stations.

These various compression outages, all impacting flows at the “LINCOLN N” meter, have all been grouped under the same force majeure, according to Bernardi.

“In this latest update, EPNG announced the failure of equipment associated with Roswell’s Unit #2 and Belen’s Unit #2,” the analyst said. “This decreases throughput capacity by an additional 56 MMcf/d with the end date still to be determined both for this reduction and for the force majeure as a whole. The current operating capacity limit is 411 MMcf/d, which is 18 MMcf/d below April’s average flow and 54 MMcf/d below April’s maximum flow.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |