Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Devon Boosts ’19 Oil Output Forecast on Strong Permian Delaware Results

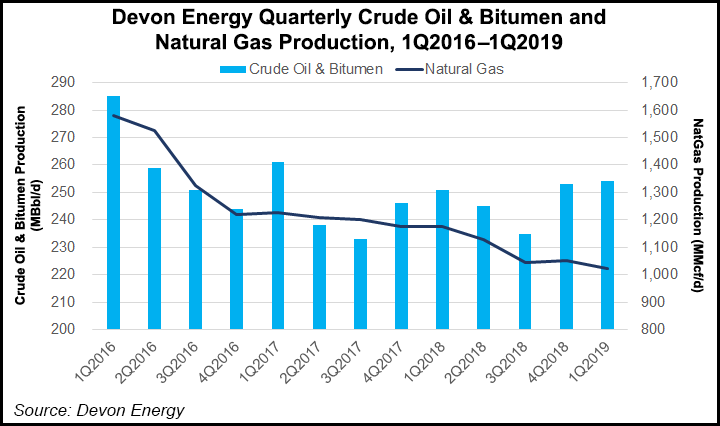

Devon Energy Corp. has increased its projections for Lower 48 oil production growth to 17% from 2018, up 200 basis points from previous guidance, on improving well productivity and capital efficiencies, particularly in the Permian Basin.

The Oklahoma City-based independent, which had earlier pegged oil output to increase 15% year/year, also made progress in reducing corporate expenses, with general and administrative (G&A) costs down 23% from a year ago.

CEO Dave Hager during the quarterly conference call Wednesday said the incremental production growth this year will come “without any increase in capital spending, and our margins will benefit from operating and G&A cost-saving initiatives that are tracking ahead of plan…”

Devon earlier this year announced it would sell its gassy Barnett Shale assets and Canadian portfolio to transform into an oil-weighted producer. The Barnett and Canada assets may be sold or could be spun off, Hager said.

The Lower 48-only focus now is on the Permian Delaware, Eagle Ford Shale, Powder River Basin and Oklahoma’s STACK, aka Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties.

“A key area of emphasis is the aggressive reshaping of our organization with the singular focus on supporting our U.S. oil portfolio in the most cost-efficient manner possible,” Hager said. “We expect our U.S. oil business to achieve at least $780 million in sustainable annual cost savings by 2021 versus our 2018 baseline.

“Our cost reduction plan includes a range of actions to achieve more efficient field-level operations, lower drilling and completion costs and better alignment of personnel with the go-forward business.”

With the strong cost performance to date, Devon is on track to achieve more than 70% of the targeted $780 million in annual cost savings by year’s end, the CEO predicted.

Upstream capital spending totaled $457 million in the first quarter, which was $43 million, or 9% below midpoint guidance. The largest field-level cost, lease operating expenses, improved to $4.63/boe in the quarter, down 10% sequentially and at the low end of guidance. Capital spend for 2019 remains at $1.8-2.0 billion.

Overall, net production for the retained U.S. assets alone increased to an average 308,000 boe/d, exceeding midpoint guidance by 27,000 boe/d.

Natural gas production from the retained assets increased to 581 MMcf/d from 493 MMcf/d. Oil production improved to 138,000 b/d from 111,000 b/d, while liquids output climbed to 73,000 b/d from 56,000 b/d.

The big gun production-wise was the Permian, with oil production averaging 138,000 b/d in the first three months, 24% higher than a year ago and 8,000 b/d above guidance.

Delaware net output alone jumped 76% to 107,000 boe/d, with operating results highlighted by five prolific Cat Scratch Fever wells that targeted a second Bone Spring interval in southwest Lea County, NM. Each well averaged initial 24-hour production rates of more than 10,000 boe/d.

Devon fetched an average gas price of $3.15/Mcf in 1Q2019, versus $3.01 a year ago. The realized oil price was $54.88/bbl West Texas Intermediate, down from $62.93 in 1Q2018.

Net losses totaled $317 million (minus 74/share) in 1Q2019, versus a year-ago net loss of $211 million (minus 41 cents). Devon attributed the 1Q2019 loss to one-time hedging losses of $670 million. Operating cash flow totaled $377 million, off from $610 million a year earlier. Upstream revenue in 1Q2019, excluding commodity derivatives, totaled $1.4 billion, a 24% sequential increase, primarily on higher oil price realizations.

Devon has repurchased 114 million shares, or more than 20% outstanding, at a total cost of $4 billion of its total planned $5 billion program. The company also has increased the quarterly dividend by 13% to 9 cents/share effective in 2Q2019.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |