Shale Daily | E&P | NGI All News Access

Challenge of Building Delayed MVP Makes Pipe ‘Even More Valuable,’ Says NextEra Exec

After an unfavorable federal court decision earlier this year, the Appalachia-to-Southeast Mountain Valley Pipeline (MVP) probably won’t meet its target in-service date in late 2019, but the regulatory setbacks and rising costs could serve to further demonstrate the project’s value.

That’s according to NextEra Energy Inc. CFO Rebecca Kujawa, who acknowledged during a conference call to discuss 1Q2019 results that legal setbacks make it “unlikely” that MVP will enter service by 4Q2019 as previously planned.

Kujawa specifically pointed to a February decision by the U.S. Court of Appeals for the Fourth Circuit to deny an en banc rehearing of an earlier ruling overturning the Atlantic Coast Pipeline’s (ACP) permit to cross the Appalachian National Scenic Trail. Backers for the 300-mile, 2 million Dth/d MVP had been watching the case closely, as their project also aims to cross the trail and could be jeopardized by the court’s ruling.

“While we continue to advance MVP toward ultimate completion and we expect to ramp up construction activities in the coming months, the Fourth Circuit’s decision not to pursue an en banc review on the Atlantic Coast Pipeline Appalachian Trail crossing authorization presents a challenge to both timing and cost,” she said. “Since the original court decision, we have been working with our project partners on several alternatives to address the issue, and we continue to vigorously pursue these paths.

“At this point our previously announced fourth quarter 2019 target in-service date appears unlikely. We are continuing to work through options with our partners, and we’ll provide a further update in the near future.”

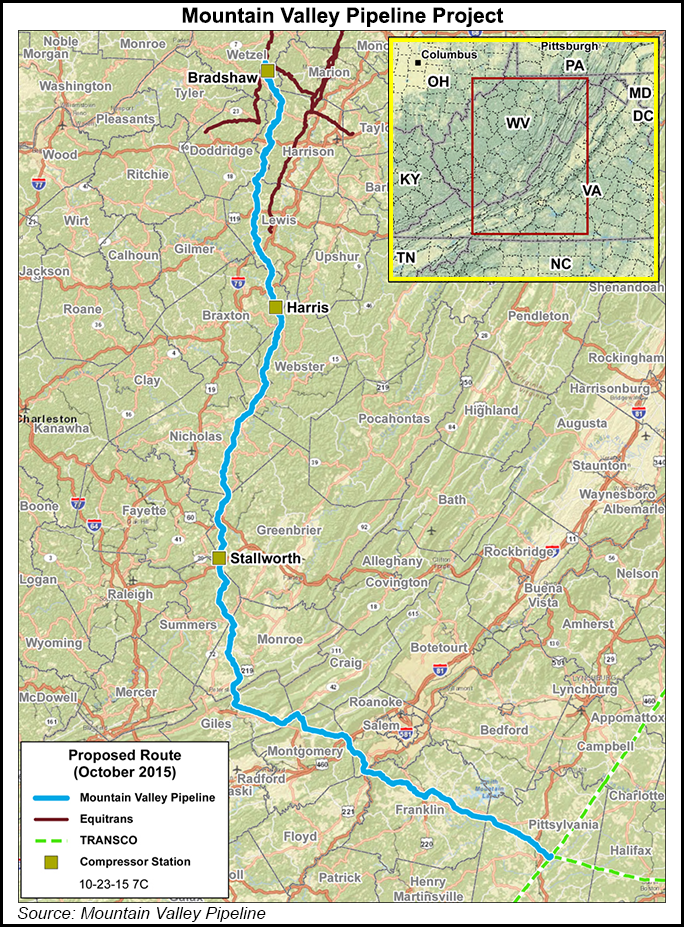

MVP is a joint venture of EQT Midstream Partners LP, NextEra US Gas Assets LLC, Con Edison Transmission Inc., WGL Midstream and RGC Midstream LLC. The greenfield project aims to cross from West Virginia into Virginia to deliver Marcellus and Utica shale gas to an interconnect with Transco (aka, the Transcontinental Gas Pipe Line) in Pittsylvania County.

MVP, like the similarly routed ACP, has faced significant legal and regulatory setbacks and rising costs. As a large pipeline attempting to traverse sensitive terrain along the Virginia/West Virginia border, the project has been a prime target for environmental groups in the proxy war over fossil fuels that has figured prominently in FERC proceedings and in the courts.

MVP’s sponsors have shown no signs of giving up on the project, which could prove even more valuable than previously thought given the extent of the challenges the developers will have overcome getting the pipe in the ground, according to Kujawa.

“As soon as the initial adverse decision was made, we started working closely with our partners on a variety of different options, whether it’s legislative, administrative, etc, to resolve the issues so that we can continue to build and ultimately bring MVP online,” the CFO said.

“We remain confident that one of those many options will ultimately come together so that we can put MVP into service, which at this point we think will be even more valuable than what we originally thought just because of the challenge that building pipelines in this area has proven to be.”

Management wouldn’t share details on the specific options MVP is pursuing to address the Fourth Circuit decision. The developers anticipate resuming construction this spring.

After deciding to temporarily “tone down construction” during the winter because of “overall conditions,” Kujawa said MVP will “resume construction where we can. And then as we firm up plans and it’s clear which of these options will come to fruition,” management will disclose “more specifications in terms of timing and ultimate cost.”

NextEra reported 1Q2019 net income of $680 million ($1.41/share), versus $4.431 billion ($9.32) in the year-ago quarter.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |