NGI The Weekly Gas Market Report | LNG | Markets | NGI All News Access

LNG Developers Said Better Armed to Shrug Off ‘Difficult Delivery Reputation’

Nearly 90 million metric tons/year (mmty) of liquefied natural gas (LNG) capacity is likely to be sanctioned in the near term worldwide as the second wave of export projects begins, with developers hoping to avoid cost overruns that plagued the initial building boom.

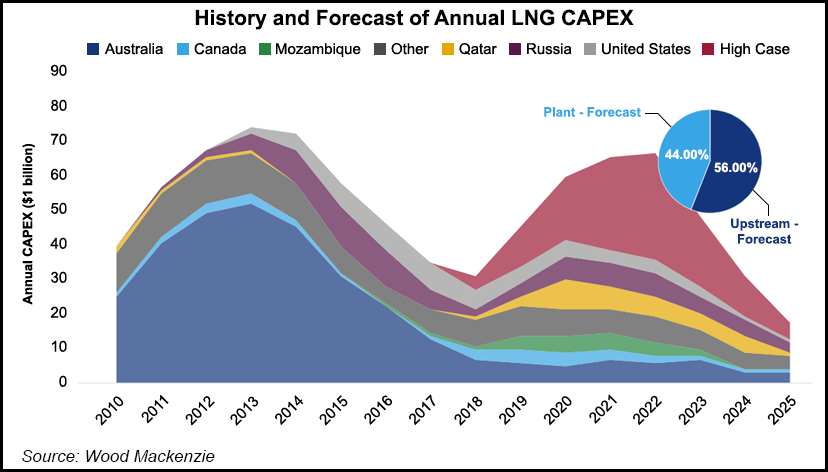

Capital expenditures (capex) for plant and upstream infrastructure are forecast at $200 billion-plus between 2019 and 2025, resulting in a “major boon” for engineering, procurement and construction (EPC) contractors and other providers along the supply chain, according to Wood Mackenzie.

However, the LNG industry has been “notorious for cost overruns and project delays,” with only 10% of all projects under budget; 60% have experienced delays following final investment decisions (FID).

“The many projects jostling for FID right now have low headline costs, but in light of the historical reality of LNG construction, some project delays are likely,” senior global LNG research analyst Liam Kelleher said.

“While there is a risk that current low LNG prices may see some proposed projects cancelled, Wood Mackenzie believes the risk to new LNG supply development is low, and we see considerable upside supply potential.”

Many operators and analysts have heralded the second wave of project sanctions. Rystad Energy in February forecast FIDs were surging worldwide for both oil and natural gas projects and were on pace to nearly triple from 2018. More than one-third are predicted to be LNG export projects.

In Wood Mac’s high case for LNG export projects, about 70 mmty of capacity could be sanctioned in the next three years. “Should even some of this materialize, construction would be stretched beyond the height of the 2010-14 boom,” Kelleher said.

However, the growth does not mean the upcoming cycle is destined to be a replay of the last, as a “number of key differences” exist this time, he said.

“Firstly, the global spread of projects will mean that the local inflation pressure, particularly in terms of manpower, which hit Australia and the U.S. in previous cycles, is lessened. Secondly, developers are also being more cautious about LNG development solutions, opting for modularization and capex phasing.

“This, coupled with renewed caution with investment programs across the upstream sector, should help limit global upstream inflation.” In addition, lower raw materials costs should help keep a cap on spend, as global steel prices are set to ease from their 2018 peak.

New players entering the EPC market mean that competition for construction contracts should be strong.

“While LNG operators have enjoyed a return to profits in recent years, many LNG EPC contractors remain firmly in the red,” Kelleher said. “Tough times bring tough contract conditions, and EPC contractors have taken financial hits from project cost overruns” at, among other projects, Ichthys LNG project in Australia and U.S. export facilities Cameron and Freeport.

“With an increase in workload, there is the potential for a recovery in project revenues for EPC contractors.” Other parts of the value chain also may see an increase in the workload and with it, higher costs.

“A lean time for upstream subcontractors has resulted in a 25% drop of workload capacity across the sector,” Kelleher said. “An uptick in activity is expected to bring higher rig rates and subsea costs, a risk for major integrated projects in Mozambique and Qatar.”

State-owned Qatar Petroleum (QP), the undisputed LNG export king, is aiming to remain on the throne after awarding contracts earlier this month to enhance production capacity by 2024 to 110 mmty from 77 mmty. QP in September said its long-range plans were to increase gas production and boost liquefaction capacity by 43%.

Two LNG export projects also are in the planning stages in Mozambique. The Coral South LNG export project sponsored by Eni SpA and ExxonMobil Corp. was sanctioned last year. One led by Anadarko Petroleum Corp. is set for sanctioning by mid-year.

“Cost overruns in the previous boom averaged 33%, with Australian projects overrunning by 40%,” Kelleher said. “While Wood Mackenzie does not expect similar increases this time, the potential for operators and contractors to drop the ball on project delivery remains.

“This risk will only be heightened if more projects go ahead than our base case forecast. Only time will tell whether LNG will start to shrug off its difficult delivery reputation.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |