NGI All News Access | Markets | NGI The Weekly Gas Market Report

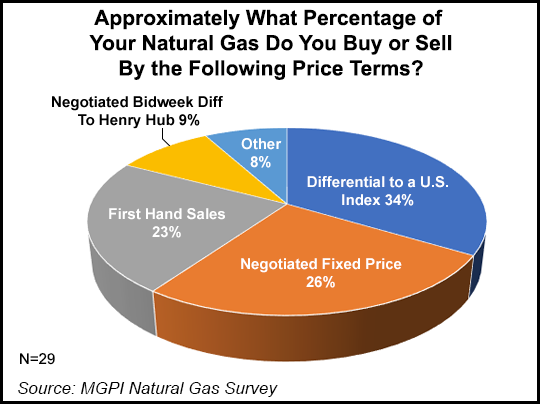

U.S. Pricing Dominates Physical Natural Gas Market Transactions in Mexico, MGPI Survey Says

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |