NGI All News Access | Infrastructure | Markets

Natural Gas Storage Stocks Move Above Year-Ago Levels After EIA Reports 92 Bcf Build

The Energy Information Administration (EIA) reported a 92 Bcf injection into U.S. natural gas storage for the week ending April 19, pushing inventories to a 55 Bcf surplus over year-ago levels.

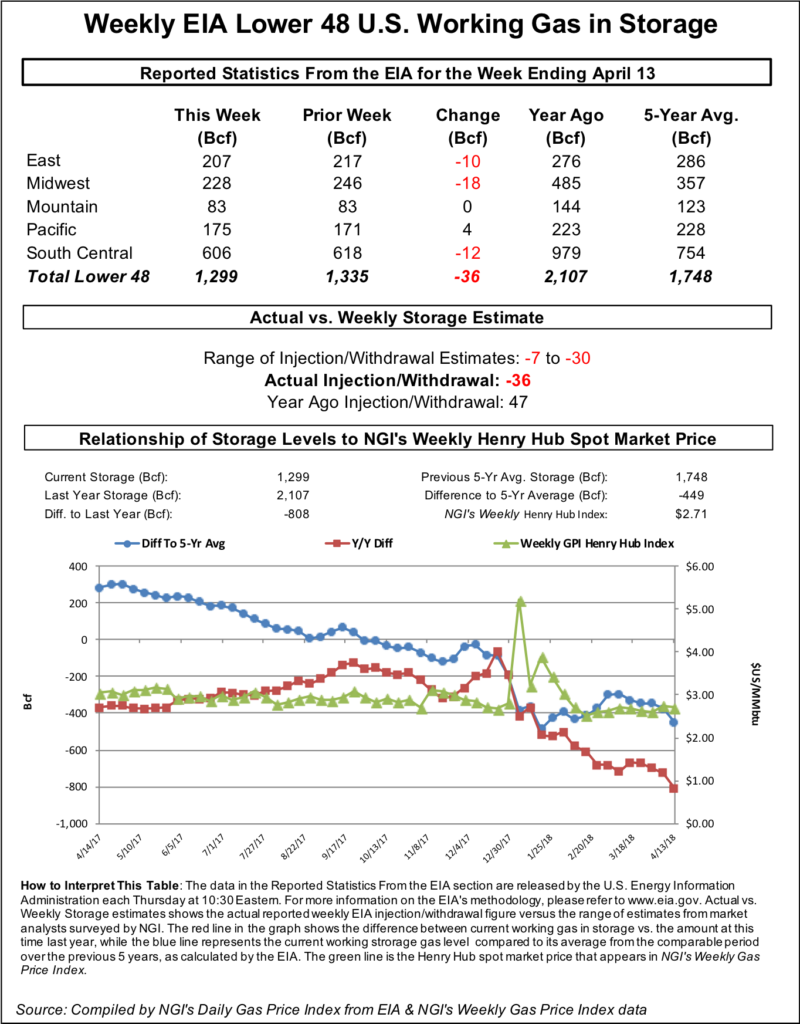

The reported build was in line with market expectations and compares to last year’s 20 Bcf withdrawal and the five-year average injection of 47 Bcf.

Natural gas futures prices had a muted initial response to the reported injection, shifting about a penny higher after the print hit the screen, although pushing the prompt month into positive territory. By 11 a.m. ET, the May Nymex gas futures contract had tacked on additional small gains as it traded at $2.481, up 1.9 cents on the day.

Ahead of the report, a Bloomberg survey of 17 analysts showed a build ranging from 69 Bcf to 98 Bcf, with a median of 92 Bcf. A Wall Street Journal poll of 13 market participants had estimates ranging from an increase of 82 Bcf to 94 Bcf, with an average build of 89 Bcf. A Reuters survey of 19 analysts ranged from a 69 Bcf to 95 Bcf build, with a median of 91 Bcf.

Intercontinental Exchange EIA Financial Weekly Index futures settled Wednesday at a build of 90 Bcf. NGI’s model predicted an 82 Bcf build, slightly below consensus.

The South Central continued to surprise to the upside this week, with the EIA reporting a 45 Bcf build in that region. IAF Advisors’ Kyle Cooper questioned whether part of that storage build could be attributed to local distribution companies in the Midwest and Northeast indexing gas now for the upcoming winter and passing on the cost to ratepayers.

“Obviously, things have changed a lot over the years,” Cooper said on Enelyst, a chat room hosted by The Desk. “From a long-term plan, buy April/May South Central, then buy the Northeast local gas in the summer, maybe when Texas gets hot … just a theory.”

Broken down by region, the EIA reported a 23 Bcf injection in the East, a 10 Bcf build in the Midwest and a 45 Bcf injection in the South Central region. Salt facilities added 17 Bcf, while nonsalts added 29 Bcf to inventories, according to EIA.

Total working gas in storage as of April 19 was 1,339 Bcf, 55 Bcf above last year and 369 Bcf below the five-year average.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |