NGI Mexico GPI | Markets | NGI All News Access

Natural Gas Traders Eye Year/Year Surplus in EIA Data as Prices Stall; Cash Bounces

Weather models continued to add back some demand for the next couple of weeks, driving natural gas futures marginally higher Wednesday as the market begins to move beyond a month-long period of massive year/year weather differences that were seen pushing storage inventories to a surplus over last year’s levels. The May Nymex gas futures contract settled seven-tenths of a cent higher at $2.462/MMBtu, while June rose 0.1 cents to $2.50.

Spot gas prices were mostly higher Wednesday as some cooler weather moved over the far northern part of the United States, driving up demand in that region ahead of what is expected to be a several-day span of cooler temperatures. The NGI Spot Gas National Avg. rose 8 cents to $2.095.

Despite the typical demand lull seen during the spring season, the moderate amount of demand in the market is often complicated by the fact that although milder weather moves into the northern part of the country, southern areas are starting to transition to hotter weather. That has been the reason for the recent additions to weather-driven demand, as overnight weather models added both cooling degree days (CDD) and heating degree days (HDD) back into six- to 10-day outlooks, according to Bespoke Weather Services.

“We have quietly moved the forecast closer to normal demand levels since last Thursday,” Bespoke chief meteorologist Brian Lovern said. “Recall back then, the 15-day forecast was around 35 gas-weighted degree days below the long-term normal, while today’s is less than 15 below normal, with some risk that we further close that gap from here.”

Bespoke also said it sees net demand for the next 15 days now higher when compared with the same dates last year, having finally rid itself of the massive year/year weather differences driven by exceptional cold in April 2018, “which could be important when it comes to perception of balances.”

The firm continues to watch the Madden-Julian Oscillation signal as well, in case it provides a boost to southern CDDs toward the middle of May.

Warming remained on track to follow across the Great Lakes and Northeast May 2-8 with near-perfect temperatures returning from Chicago to New York City, making for light demand, according to NatGasWeather. However, this is expected to mark the transition from where cooling demand begins to take a greater percentage compared to heating demand, “flipping the onus to hot/heat building instead of cold arriving,” the firm said.

In the meantime, the recent spate of mild weather and generally bearish outlook for the next few weeks is expected to dramatically improve storage deficits, with early estimates pointing to a string of 100-plus Bcf injections. The Energy Information Administration (EIA) is set to release its next weekly storage report at 10:30 a.m. ET on Thursday.

Estimates for this week’s report are pointing to an injection in the upper 80 to lower 90 Bcf range, which will all but certainly shift year/year inventories to a surplus. A Bloomberg survey of 17 analysts showed a build ranging from 69 Bcf to 98 Bcf, with a median of 92 Bcf. A Wall Street Journal poll of 13 market participants had estimates ranging from an increase of 82 Bcf to 94 Bcf, with an average build of 89 Bcf. A Reuters survey of 19 analysts ranged from a 69 Bcf to 95 Bcf build, with a median of 91 Bcf. NGI projected an 82 Bcf build.

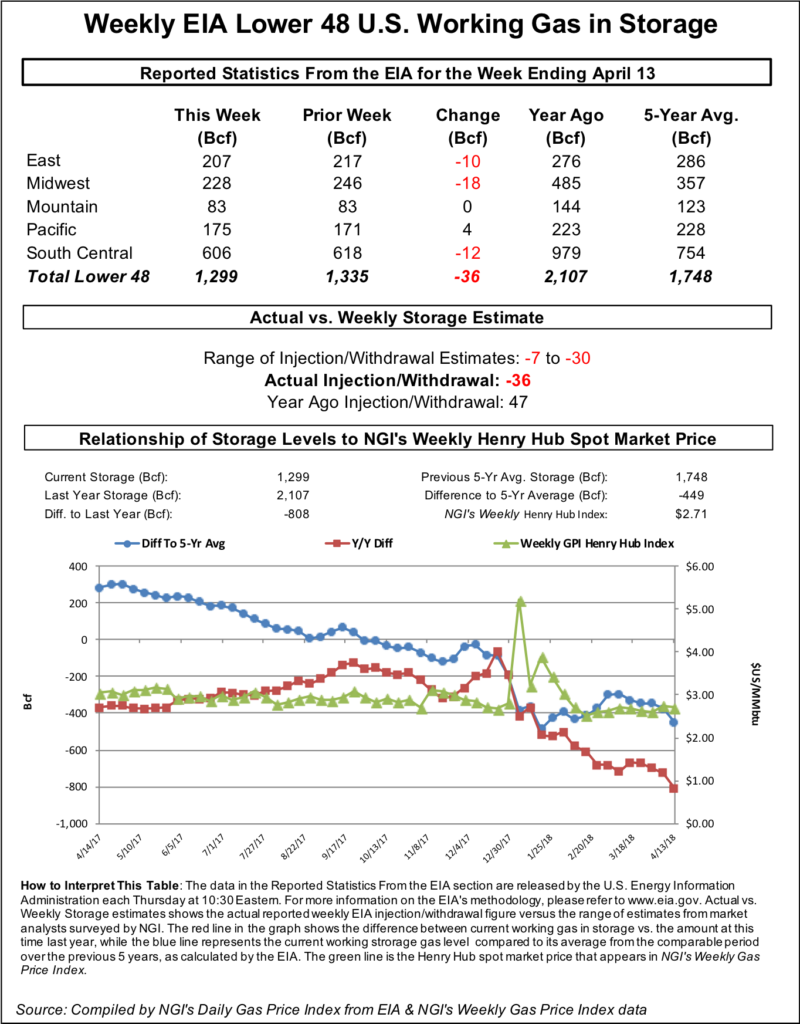

Last year, the EIA reported a 20 Bcf withdrawal, while the five-year average injection stands at 47 Bcf. Inventories as of April 12 sat at 1,247 Bcf, just 57 Bcf below the year-ago level and 414 Bcf below the five-year average.

Despite Wednesday’s modest price bump, which was seen by some analysts as temporary before additional downside resumes, gas is now priced cheaper than Powder River Basin (PRB) coal, according to BofA Merrill Lynch Global Research. The recent selloff in the futures strip has left summer prices at $2.60 and Midwest gas at $2.40, both levels which are cheaper than PRB coal for the summer.

“Historically, these low price levels have led to higher gas burns from the power sector. The lack of preparation last summer caused total stocks to enter winter at the lowest levels since 2005, while salt inventories were at the lowest levels since 2005,” said BofA Merrill Lynch’s Clifton White, commodity strategist.

Given that total stocks are at a slight deficit year/year and salt’s on par with the low levels from a year ago, the research group’s analysts believe the recent sell-off is premature and expect to see stronger Midwest basis over the next couple of months.

Researchers expect stocks to end the summer at 3.68 Tcf, which although near the five-year average, is still 370 Bcf below the 4.05 Tcf realized in 2016. Even if weak global gas markets price U.S. liquefied natural gas (LNG) exports to shut in this fall, and Kinder Morgan Inc.’s Gulf Coast Express pipeline enters service early, “there will likely be storage capacity available to help digest these volumes,” according to BofA Merrill Lynch.

“The market was complacent last summer by betting on production growth to bail out low gas inventories,” White said. “We believe the market will not maintain the current low summer prices in anticipation of potential late-summer LNG curtailments. Pricing additional PRB displacement in the power sector given projected inventory levels seems untenable this early in the injection season.”

As such, BofA Merrill Lynch researchers maintain their $2.70 summer price forecast, which is now 15 cents above the current Nymex strip.

Spot gas prices rebounded Wednesday as some cooling was seen returning to the far northern United States during the next few days, where daytime temperatures were forecast to reach the 50s and 60s, according to NatGasWeather. Meanwhile, a weather system was expected to bring heavy showers to the south-central part of the country, Texas and Mississippi Valley during that time, although with weather remaining warm with highs of 60s and 70s.

Stronger cooling is expected across the northern United States this weekend through early next week for an increase in national demand as highs drop into the 50s to lower 60s, locally 40s.

“It’s this weekend when a cool front pushes across the Canadian border and into the northern tier, dipping lows into the 30s and 40s, resulting in a modest surge in heating demand and where cooler trends have been most notable,” NatGasWeather said.

Still, it would be more impressive if it wasn’t for most of the weather data continuing to favor a comfortable northern U.S. pattern setting up May 2-8, the firm said.

West Texas prices were among the biggest movers across the country, where Waha jumped nearly 40 cents to average 85.5 cents.

Though still below $1, spot gas prices in the Permian Basin are vastly improved from the sub-zero levels seen starting in late March and continuing through the first half of April. Earlier this week, Apache Corp. blamed the “extremely low prices at Waha hub” for its initiation in late March of natural gas production volume deferrals from its Alpine High play in the basin, with current deferrals representing 250 MMcf/d of gross output.

Apache plans to address the impact of deferrals in its second quarter Alpine High production guidance when first quarter results are issued next week (May 1).

In California, spot gas jumped more than 20 cents at most pricing hubs, with Malin averaging $1.94. Rockies prices were mostly stronger as well, although some pipeline maintenance that began Tuesday at Gas Transmission Northwest (GTN) began impacting Kingsgate prices as the pipeline tacked on some additional work that further restricted flows.

GTN began planned work at its Station 8 near Walla Walla in southeast Washington that was scheduled to last through May 10. This work was intended to reduce operational capacity for flows past Kingsgate to 2,340 MMcf/d, which would restrict new incremental firm nominations for the remainder of the gas day and lower operational capacity to a margin still above the three-year average for flow in April and May.

“However, in a critical notice posted Tuesday morning, the pipeline noted that there would be concurrent unplanned maintenance taking place on other compressor stations during the same period that would impact flow through Kingsgate,” Genscape Inc. natural gas analyst Matthew McDowell said.

The critical notice, citing a revised maintenance calendar, increased the probability for cuts to primary firm nominations from an eight-day window of “medium” risk to an 18-day window of “high” risk. The stated operational capacity for “Flow through Kingsgate” was adjusted downward by 214 MMcf/d to 2,126 MMcf/d for the duration of the maintenance.

The new operating capacity restrictions, when compared to “Flow through Kingsgate” for the last 30 days, would have constrained 133 MMcf/d of Malin-bound gas, according to Genscape. Simultaneous maintenance on Westcoast Transmission also began Tuesday and is planned to last through Friday.

Timely data for Wednesday morning showed a realized maintenance restriction of 115 MMcf/d compared to the prior 30 days, Genscape said. The 2,157 MMcf/d of scheduled nominations will likely be revised down to meet the posted operational capacity of 2,144 MMcf/d.

“The combination of the GTN and Westcoast events are reducing overall supply into the Pacific Northwest, but weak demand should also materialize as Genscape meteorologists are forecasting mild weather,” McDowell said.

Although prices had yet to respond to the maintenance that was originally announced, the additional work sent Kingsgate prices plunging nearly 90 cents to average only 61.5 cents.

Over in the Midcontinent, next-day gas strengthened by more than a dime at a majority of pricing points, while Midwest gains were limited to a couple of pennies at best.

The Northeast also saw small increases across much of the region, while points along the Transcontinental Gas Pipe Line posted modest losses of a couple of pennies.

Appalachia spot gas moved significantly higher at a handful of pricing hubs, including Tennessee Zone 4 Marcellus, which jumped 28 cents to $1.92.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |