NGI Mexico GPI | Infrastructure | NGI All News Access

Argentina, Bolivia Seeking New LNG Export Markets as Supply Outpaces Demand

Argentina and Bolivia are seeking new markets for their domestically produced natural gas via the export market amid a potential supply glut.

In a joint press conference with Argentine President Mauricio Macri on Monday, Bolivian President Evo Morales confirmed that his country plans to invest with Argentina in a liquefied natural gas (LNG) export terminal in Argentine territory.

YPF SA CEO Daniel Gonzalez, who runs Argentina’s 51% state-owned oil company, said during the fourth quarter 2018 earnings call that a small-scale LNG barge with capacity to export 2.5 million cubic meters/day had arrived to the BahÃa Blanca port and would commence operations in 3Q2019.

“However, the game-changer here is a large-scale LNG terminal [for] which we are in the process of finalizing conceptual design and [will] eventually move to front-end engineering this year as part of a consortium that yet needs to be put in place,” Gonzalez.

The LNG announcement follows an agreement reached in March for Argentina to continue exporting gas via pipeline to its neighbor across the Andes Mountains, Chile.

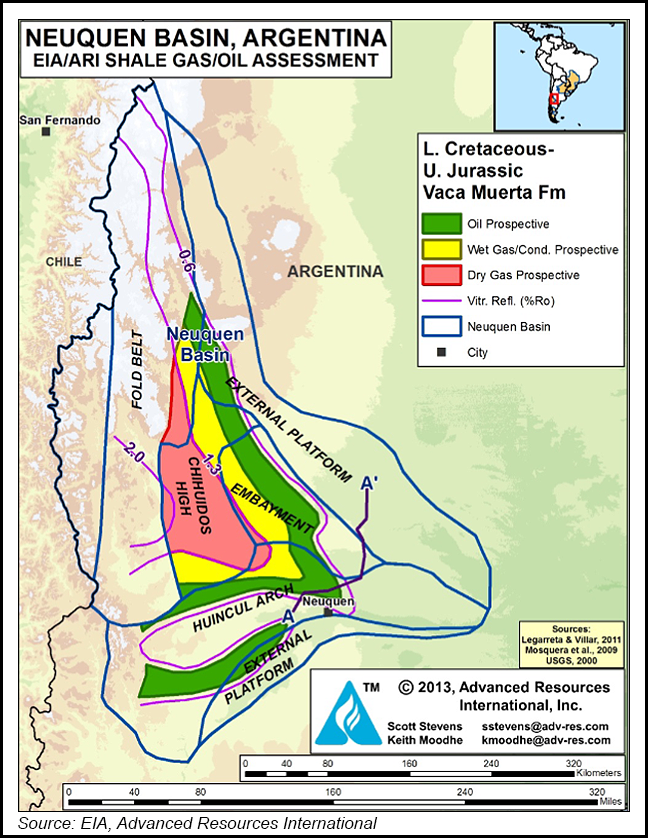

Argentina, whose economy is expected to shrink for a second straight year in 2019, is home to the Vaca Muerta shale formation in the Neuquén Basin.

Incentivized wellhead pricing under the government’s Resolution 46-E/2017 for new unconventional gas developments has helped turn Vaca Muerta into the most prominent shale success story outside of North America. The subsidy program caused production of both shale and tight gas to soar in 2018, dampening the need for imports of piped gas from neighboring Bolivia, a land-locked country that depends on long-term export agreements of natural gas with Argentina and Brazil.

“Unfortunately, starting in May, the [Argentine] peso lost half its value and the local economy started to cool down and then rapidly fell into a deep recession,” Gonzalez said.

He said, “local supply of natural gas significantly increased during the year as a result of the incentive price program put in place but at a time when the local economy was not demanding more gas … this had a negative impact in our production figures of the last quarter and resulted in us rethinking our investments in natural gas development over the near future.”

YPF curtailed its 2018 gas production as a result of the oversupply, a scenario that would have been all but unthinkable only a couple of years ago.

“I would say that if we didn’t have restrictions on demand for natural gas production…it would be approximately 10% higher in 2019 than what we are now projecting,” Gonzalez said.

Early this year the government announced it would limit the scope of the subsidy program to projects and production levels that had already been approved.

“Needless to say, early this year when the government announced the interpretation of Resolution 46 we scaled down a little bit further all natural gas projects,” Gonzalez said.

Argentina’s unconventional gas production during the 12-month period ending in February rose by 42.8% and accounted for 37.1% of total gas output, according to a report issued earlier this month by the IAE General Mosconi energy consultancy.

Natural gas and oil production drove economic growth of 3.8% in Neuquén province last year, state news outlet Neuquén Informa reported on Tuesday. That figure led all of recession-stricken Argentina’s 23 provinces, the newspaper said, citing figures published this week by local consultancy EconomÃa y Regiones.

Indeed, only five provinces posted growth during the period, with Neuquén and Chubut leading the way at 3.8% and 1.4%, respectively.

Neuquén is Argentina’s leading producer of natural gas, while Chubut is the largest oil producer, according to February figures published by Minem.

Argentina’s total natural gas production rose in February by 7.9% year/year to 133.1 Bcf in February, and by 5.6% to 1.677 Tcf during the 12-month period ending in February, according to the Mosconi report.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |