Shale Daily | Bakken Shale | E&P | NGI All News Access

Northern Oil to Acquire Williston Assets for $311M

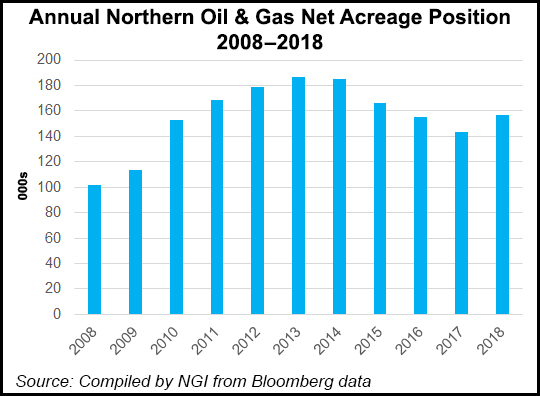

Northern Oil and Gas Inc. is acquiring about 18,000 net acres in the heart of the Williston Basin, including producing wells, from Ven Bakken LLC in a cash-and-stock deal valued at more than $311 million.

The Minnetonka, MN-based independent, which is focused on the Bakken/Three Forks formation in North Dakota and Montana, said the assets include about 87 net producing wells, 2.7 net wells in process and 47.5 net undeveloped locations. The assets are expected to produce about 6,600 boe/d (80% oil) on a two-stream basis and bring in $29.3 million in free cash flow (FCF) during the second half of 2019.

“This transaction furthers our stated goals of allocating capital to generate free cash flow in low commodity prices, keep debt metrics low, and grow our debt adjusted cash flow per share,” said Northern CEO Brandon Elliott. “Durable cash flows, core drilling inventory, hedges and low leverage should help to generate long term value for shareholders.”

Under the agreement, the subsidiary of Flywheel Bakken LLC, formerly Valorem Energy LLC, would receive $165 million in cash, $130 million in 6% three-year senior unsecured notes due in 2022, and about 5.6 million shares of Northern stock. The deal is expected to close in July. Flywheel is a portfolio company of Kayne Private Energy Income Funds.

Northern is projecting the acquired assets will produce 9,475 boe/d (79% oil) and bring in $54.6 million in FCF in 2023. The company had completed several bolt-on purchases in the Williston throughout 2018, but last month said it would slash capital expenditures for 2019 by more than two-thirds.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |