NGI The Weekly Gas Market Report | E&P | Markets | NGI All News Access

Capital Discipline, Mergers, Permian Natural Gas at Center Stage for 1Q Calls

Consolidation, capital discipline and natural gas prices in the Permian Basin are likely to be high on the list of investor queries during the first quarter conference calls, as the earnings season begins in earnest.

Kinder Morgan Inc. officially kicked off the quarter for the U.S. energy industry with a conference call last Wednesday, followed by Schlumberger Ltd. on Thursday. The coming weeks are jam packed, with lots of questions hanging in the air.

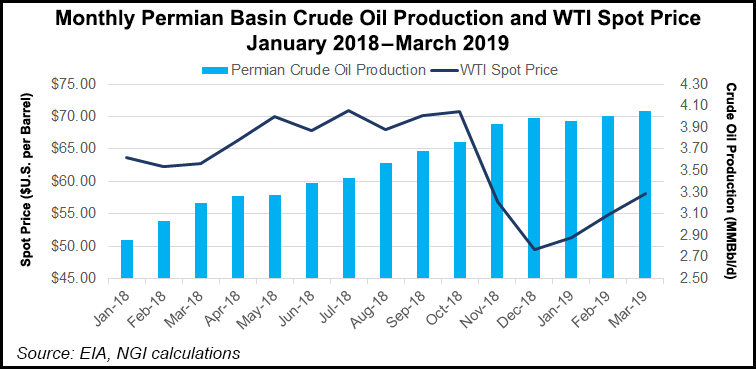

How much did the downturn in oil prices in late 2018 impact the first quarter? Exploration and production (E&P) companies were in the midst of budgeting when the bottom dropped out of crude.

Many operators had set their 2019 capital expenditures (capex) and operating plans lower for this year. During the first quarter, Permian Basin natural gas producers faced even tougher questions, as gas prices fell below zero, with few outlets and even fewer takers.

With oil prices strengthening, a big question remains around the notoriously overspending E&Ps and whether prospects actually will improve for the oilfield services (OFS) sector in 2019.

Some energy analysts expect less enthusiasm and more realism about near-term prospects for North America’s onshore.

Optimism abounds about the expanding domestic liquefied natural gas (LNG) export market, and better times are predicted for offshore prospects and overseas growth. Early on, though, it may not be pretty, according to Raymond James & Associates Inc.’s John Freeman and Pavel Molchanov.

“While the decrease in capital spending from 2018 was what investors were clamoring for from the space, the Street seems to be missing the front-end heavy nature of budgets this year as activity is being dropped through the year,” the analysts said. “Rather than operating at an even cadence throughout the year, many operators planned to slow drilling and completions activity/spend over the course of the year.

“This makes intuitive sense as rigs and fracture crew contracts are on an ad-hoc rather than annual basis, so dropping rigs/crews isn’t solely a year-end event.”

However, capex is front-loaded within E&P budgets, which may create an “optical issue of consistent capex ”misses’ when the elevated first quarter numbers are compared to the average quarterly run rate implied by full-year capital budgets.”

Typically, E&Ps have outspent cash flow on average by 25% over the last decade. Last year 88% of the E&Ps covered by Raymond James had capex above the high end of original guidance. Producers’ history of outspending cash flows “has placed the impetus on the industry to prove that the nascent commitment to capital discipline is genuine and not just boilerplate messaging,” said the Raymond James duo.

“Our concern is that a cacophony of capex ”misses’ during earnings will scare off skittish generalists and imperil the industry’s efforts to convince the market of their commitment to capital discipline.”

Analyst Gabriele Sorbara and the team at Williams Capital Group LP (WCG) is forecasting most of the E&Ps it covers will miss consensus estimates on total oil production and capex, but “the consensus is largely stale.”

Current share prices and market sentiment already may be reflect lower expectations, as “the group, on average, has not kept pace with the improved oil prices.” WTI recently was up 40.2% year-to-date versus the universe covered by WCG, which is up 18% on average.

“Thus, we expect a buy-the-news type reaction across many names as the majority of companies are setting up for a position of strength in the second half of 2019, on the front-end weighted spending/activity which provides a tailwind to the production profile,” Sorbara said.

Raymond James analyst J. Marshall Adkins and Praveen Narra said there may be a “tug-of-warn in investors’ minds” during the earnings season, with “mostly sub-par” results expected for the first quarter but positive guidance for the quarters ahead.

As activity strengthens, the “beat-up names” in the energy sector may benefit the most longer term, but those same names likely will disappoint in the first quarter, Adkins and Narra said.

Evercore’s analyst team said forecasting every quarter for every company “is a bit of a fool’s errand.” However, James West and Doug Terreson in February laid out a strategy for the OFS sector noting that the status quo was not working, as commercialization of shale/tight output has upended the entire energy value chain.

Rather than seek to preserve value, Evercore said the OFS sector had chased market share and bundled services to protect utilization, allowed pricing concessions, generated technological advances but cannibalized opportunities for additional spending and built for peak demand levels even though unconventional development has driven shorter cycles.

Analysts encouraged operators to adopt a pledge to disciplined spending even if oil prices rise, with surplus capital distributed to shareholders. The Evercore team also has recommended the sector use performance measures at the business/corporate levels tied to intrinsic value in the equity market, i.e. rate on capital employed, and to tie the value-based metrics to CEO pay.

Analysts are tuning in to see if anybody in the OFS sector is listening. “The pledge is our crusade,” West said. If operators are adjusting to the new market, visibility in North America for the OFS sector during 1Q2019 should be “minimal at best,” and while international results could be seasonally low, the outlook through the rest of the year likely is for relatively solid growth.

Schlumberger reported a slowdown in North America during 1Q2019 with lower activity expected through the rest of the year. Halliburton Co. was scheduled to deliver its results on Monday (April 22), with an avalanche of other E&Ps and OFS operators waiting in the queue.

Schlumberger, whose management said it was focused on free cash flow over spending, offered encouraging results for remaining disciplined, West said. The “pledge tenets are coming through,” as the company said it would not return addition fracture spreads unless returns improve. It also is prepared for slower spend in North America.

Along with reduced spending, the Evercore team is listening in for more about an expected shortage of high spec offshore rigs, both jackups and floaters, as the offshore markets grow worldwide.

In addition, the liquefied natural gas buildout cycle should be “firing on all cylinders.”

High on the list of questions to be answered: are there more mega-deals in the making for E&P or the OFS sectors?

Permian consolidation has been underway for the past couple of years, and other onshore areas are seeing some small merger and acquisition (M&A) activity. However, Chevron Corp.’s agreement earlier this month to pay $33 billion to buy Anadarko Petroleum Corp. caught the market by surprise.

Following the Chevron-Anadarko deal and the merger between offshore operators Ensco and Rowan, we expect M&A will be a widely discussed topic during first quarter earnings calls,” said the Evercore analyst team.

“We expected consolidation would be led by the E&Ps, which would then push the OFS group to do the same. Much of the consolidation we have seen in the services space has taken place with the offshore drillers so far.

“But as the majors increasingly account for more of the wallet onshore, the need for scale, technology, and safety will become even more important. Consolidation is also a recipe for higher returns in product lines which have fragmented.”

Determining the state of the M&A market is problematic, but over the next several years, increasing consolidation among the big and small E&Ps is likely, said Raymond James’ Freeman and Molchanov.

“As the industry has matured, the benefits of scale become increasingly important,” with the biggest operators with the deepest pockets best positioned to capitalize.

Tudor, Pickering, Holt & Co. Inc.’s team noted that there has been a “titanic shift in energy business models” over the past decade or so with the advent of unconventional drilling and the next two years or so should result in even more consolidation.

“That said, with the major basins now defined, short-cycle capital opportunities favored by integrated and independents alike, and line of sight to core inventory depletion in a number of plays over the next six-to-eight years, M&A should be the next big move for the energy sector,” analysts said.

“We continue to believe the upstream and service subsectors should see the heaviest activity over the next 12-24 months as operators look to cut cost and gain scale, but also see logical and strategic mergers in both midstream and refining. “

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |