NGI Data | Markets | NGI All News Access

EIA Reports 92 Bcf Storage Build as May Natural Gas Futures Sit Near $2.50

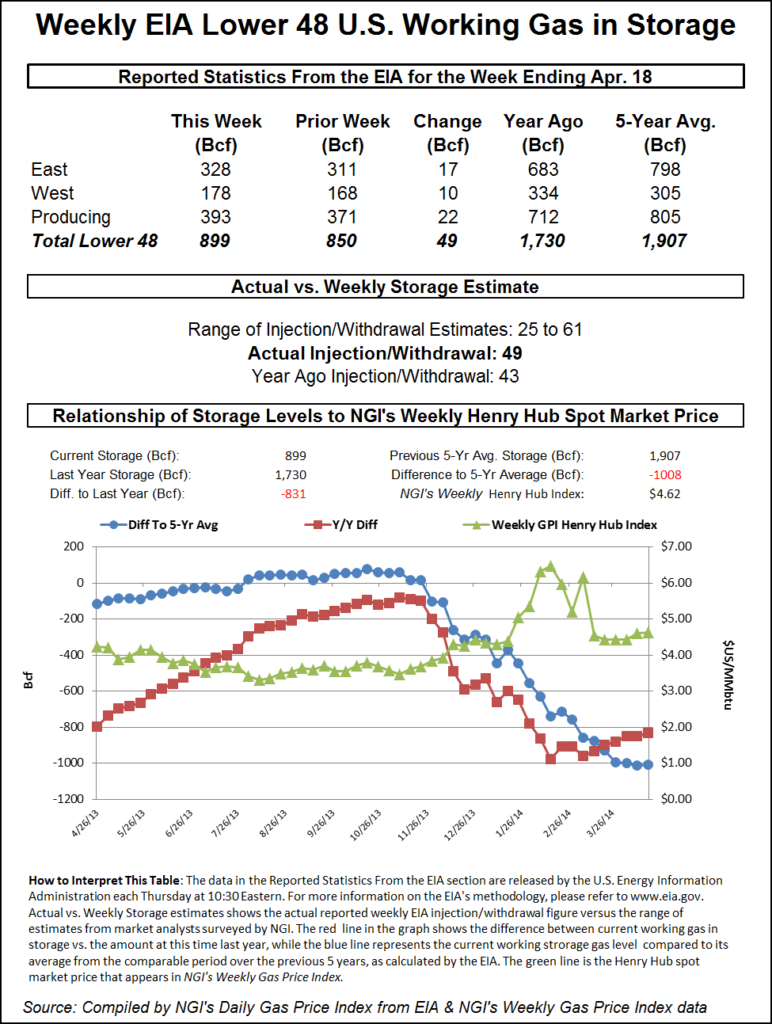

The Energy Information Administration (EIA) reported a 92 Bcf injection into storage inventories for the week ending April 12, a build that was on the higher end of market expectations and a few Bcf above consensus.

May natural gas prices, which had already sunk just below the critical key support level of $2.50 ahead of the EIA’s report, bounced a bit after the print hit the screen, trading at $2.502. By 11 a.m. ET, the May Nymex gas futures contract had moved back to $2.517, flat to Tuesday’s settle.

Bespoke Weather Services, which had called for an 88 Bcf injection, said much of this week’s selloff may have been driven by the fear that the market could see its first triple-digit injection of the season already.

“This does still reflect loose balances, though not quite as loose as the last couple of weeks, and we suspect that next week’s number will be somewhat tighter also, as we find it very difficult to imagine that balances will not show meaningful tightening ultimately, given price levels sitting at multi-year lows,” Bespoke chief meteorologist Brian Lovern said. “As such, our view remains that we are near a bottom, if not have already set one, but confidence not increased until we see early next week’s data.”

Blue Gold Research’s Adrian Bakker, research chief, agreed that any additional downward spiral is rather limited at this point. Speaking on Enelyst, an energy chat room hosted by The Desk, Bakker said part of the reason for the recent price plunge is because “too many intermediaries were caught with too many long positions. So once they started to liquidate, the floor disappeared, so to speak.”

Bulls have capitulated completely and the market price has therefore departed from fundamental factors, he said. “The price is now below ”fair value’, and it doesn’t even matter how you calculate the ”fair value.’”

At $2.50, Blue Gold expects to see 8 Bcf/d of potential coal-to-gas switching, which will exert a bullish pressure on the end-of-season storage index.

“Over the course of this injection season, we currently project 29 builds of 80 Bcf (on average). The year/year storage surplus should be around 400 Bcf by October, but in terms of the five-year average, the storage will still be in deficit in our opinion,” Bakker said.

As for this week’s EIA report, there were a few surprises despite the overall injection coming in fairly in line with expectations. Analysts had projected a considerably larger build in the Midwest while the South Central’s build was larger than most had projected.

Broken down by region, the EIA reported a 19 Bcf injection in the East, a 14 Bcf build in the Midwest and a whopping 48 Bcf in the South Central, only 1 Bcf shy of the all-time record in that region. Salt facilities in the South Central added 21 Bcf to gas stocks, while nonsalts added 27 Bcf, according to EIA.

Total working gas in storage as of April 12 stood at 1,247 Bcf, 57 Bcf below last year and 414 Bcf below the five-year average.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |