Emboldened Bears Claw Through Key Support as May Natural Gas Slides

Natural gas bears were emboldened after taking out a long-held key support level on Wednesday with weather models trending increasingly warmer. The Nymex May gas futures contract settled 5.5 cents lower at $2.517/MMBtu, and June settled 5.8 cents lower at $2.559.

Spot gas prices remained mixed, with markets out West continuing to strengthen and Permian Basin markets benefitting from the trickle-down effects of those gains. The NGI Spot Gas National Avg. fell 4 cents to $2.095.

With warmer changes to already bearish weather outlooks, natural gas bears amped up the pressure on prices Wednesday, taking out a key level of technical support that had been in place for nearly three years. The continuation chart prompt-month contract had been hugging the bottom of its 20-Day Bollinger Band since March 22, and Wednesday’s decline pushed prices below major support from its previous reaction low of about $2.55 that was reached in early February, according to NGI’s Patrick Rau, director of strategy and research.

However, the gradual slide in the futures market has left the May contract extremely oversold. The prompt month had a slow stochastics reading early Wednesday. In the last four times the contract approached that level, it rebounded by more than 20 cents, Rau said. “I’m not suggesting that happens again this time, considering the country remains awash in production and is entering the shoulder season, but the May contract does appear to be setting up for a little technical rally driven relief.”

The $2.55 previous support level had been tested numerous times since August 2016, but until Wednesday, had always held. From a pure technical standpoint, given May’s slide just below $2.52, “then there is nothing to stop the continuation chart from falling toward $2.00,” Rau said.

“But I would have to think producers would start to rein in unhedged production activity if that were to happen, particularly publicly traded ones, as they have vowed to take down activity in such a situation in order to keep their spending within free cash flow.”

Indeed, since recovering from shale-era lows in 1H2016, the prompt-month contract has seen at least seven instances where $2.50 support has been tested, according to Mobius Risk Group. All seven instances showed downside pressure fail to push prices below that level.

“Sequential production lethargy and pending liquefied natural gas (LNG) export additions will fundamentally support a continuance of this trend,” Mobius analyst Zane Curry told NGI.

Both Sempra Energy’s Cameron and Freeport’s LNG facilities received important federal approvals earlier this week, and based on publicly available pipeline data, Cameron could begin substantially increasing feed gas deliveries throughout April, according to Mobius. “By midsummer, there could be an additional three trains in various stages of start-up, and demand could begin to ratchet up by another 1.5 Bcf/d-plus.”

Considering it is unlikely that production will increase by that amount sequentially, there is a low probability that the market will loosen on a weather-adjusted basis before peak summer, according to Mobius. “However, in the meantime, extremely mild shoulder-season weather is emboldening market bears, and keeping astute market bulls patiently in waiting,” Curry said

Beyond $2.50, if that support level is breached, the market will become highly reliant on a fundamental response to lower prices. “Price-elastic demand increases will be desperately needed, as technical support beyond $2.50 is not material again until $2.00 is approached,” Curry said.

In the meantime, another likely bearish factor weighing on prices is the likelihood of substantial storage injections during the prolonged mild spell. Several analysts have noted the potential for multiple triple-digit injections over the next month, with some builds possibly reaching close to or above 130 Bcf.

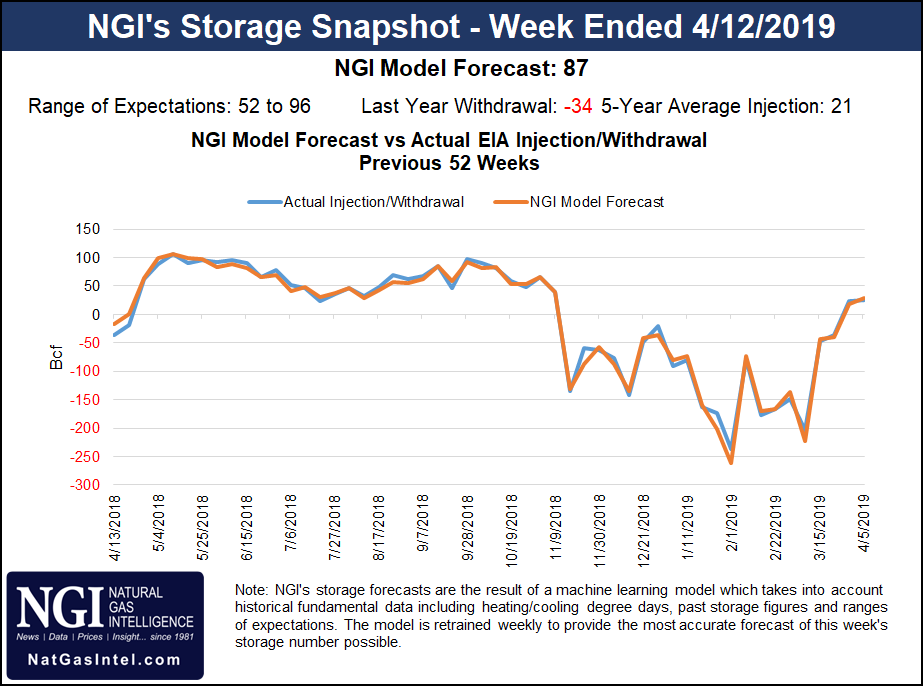

Estimates for Thursday’s Energy Information Administration (EIA) storage report point to a build in the upper 80 Bcf range. A Bloomberg survey of 11 analysts had an injection range from 52 Bcf to 96 Bcf, with a median of 86 Bcf. NGI projected an 87 Bcf build.

Last year, the EIA reported a 34 Bcf withdrawal, and the five-year average injection is 21 Bcf. Inventories as of April 5 stood at 1,155 Bcf, which is 183 Bcf below year-ago levels and 485 Bcf below the five-year average, according to EIA.

Spot gas prices remained mixed Wednesday as unsettled weather patterns continued in the West, bringing slightly chilly temperatures and stronger prices to the part of the region. Much milder weather in store for most of the rest of the United States sent prices in most other areas lower despite ongoing pipeline maintenance ahead of the summer.

SoCal Citygate next-day gas rose 5.5 cents to $2.90, while PG&E Citygate dropped 5.5 cents to $3.24.

In the Rockies, CIG jumped 27.5 cents to $1.53, although several other pricing locations in the region posted gains of less than a dime.

Rockies production is holding fairly steady by finding alternative routes out of the region to cope with notable constraints on Rockies Express Pipeline (REX) and Kern River Gas Transmission, according to Genscape. REX began its planned pipeline work on Tuesday, limiting eastbound flows out of the Rockies and forcing regional production to reroute to other systems.

“Capacity through REX SEG 200 from the Cheyenne Hub to Colorado/Wyoming State Line has been cut to zero through gas day Thursday (4/18). The restriction cuts approximately 1.5 Bcf/d from flowing eastbound on REX,” Genscape analysts Anthony Ferrara and Matthew McDowell said.

Further constraining the region, Kern River posted a force majeure for Monday’s timely cycle limiting southbound flows through its Fillmore compressor station in central Utah. The compressor station has been isolated from the mainline because of an unexpected pipe repair, according to Genscape.

“This is reducing capacity from 3 Bcf/d to 1.99 Bcf/d. April flows have averaged 1.91 Bcf/d for the last three years, and the current month-to-date flows have averaged 2.0 Bcf/d. Compared to the month-to-date high of 2.1 Bcf/d, this could leave 100 MMcf/d backed up and also limit the additional amount of gas in the region that could be rerouted onto Kern given the ongoing REX maintenance,” Ferrara and McDowell said. There is currently no estimated return to service date.

Rockies production (excluding North Dakota and Montana) for the past two days was down only 132 MMcf/d versus the prior seven-day average, indicating gas constrained by REX and Kern is now flowing in other directions out of the region or being injected into storage, according to Genscape. Most notably, the firm is seeing evidence of reroutes as increased volumes are moving southwest on Kern, west on the Ruby and Overthrust pipelines, northwest on Northwest Pipeline (NWPL) and southeast on Cheyenne Plains Pipelines.

“For storage, we are seeing an uptick in injections in a few facilities including Jackson Prairie Storage on NWPL and Clay Basin on Questar Pipeline,” the analysts said.

Meanwhile, Permian Basin pricing piggybacked on the increases out West as prices across the region tacked on less than a dime.

However, a force majeure on Natural Gas Pipeline Company of America (NGPL) is constraining 65 MMcf/d of Permian gas bound for Midwestern markets. NGPL issued a notice citing horsepower issues at compressor station 167 in Lea County, NM. The force majeure became effective for intraday 2 nominations Tuesday and cut operational capacity through compressor station 167 by 92 MMcf/d.

“Flow for the past month has averaged 338 MMcf/d. Pending any revisions, nominations do not appear to have been picked up at any interstate interconnects in the area, however, nominations at gas plants with connections to multiple pipelines could mitigate production volume upsets,” McDowell said. Like the Kern River outage, the force majeure on NGPL is ongoing with no effective end date.

Elsewhere in Texas, prices slipped a nickel or less at most market hubs, similar to the declines seen in Louisiana and the greater Southeast.

Appalachia prices fell slightly more, with Tennessee Zn 4 313 Pool tumbling more than a dime to $2.255. Not to be outdone, Algonquin Citygate in the Northeast plunged 44.5 cents to $2.40 despite ongoing maintenance on the Algonquin Gas Transmission system.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |