Shale Daily | E&P | Markets | NGI All News Access | NGI The Weekly Gas Market Report

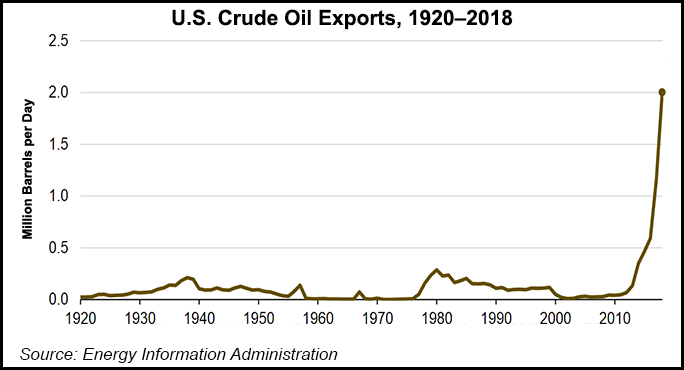

Domestic Crude Exports Nearly Doubled in 2018, Says EIA

U.S. crude oil exports nearly doubled in 2018, rising to 2.0 million b/d versus 1.2 million b/d in 2017 as domestic volumes reached 42 destinations across the globe, according to the Energy Information Administration (EIA).

Along with the sharp growth in exports — driven by higher domestic crude production and infrastructure changes — the agency also noted significant shifts in export volumes by destination in 2018, including a drop in exports to China and growth in exports to South Korea, Taiwan and Canada.

U.S. crude oil production rose 17% to 10.9 million b/d in 2018, including 7.1 million b/d produced in the Gulf Coast, the departure point for 90% of U.S. crude oil exports, EIA said, noting that the “mismatch” between domestically produced light, sweet crude oil and U.S. refineries geared for heavy, sour crude has contributed to higher exports.

The Louisiana Offshore Oil Port (LOOP) in the Gulf of Mexico was modified in early 2018 to allow loading of vessels for crude oil exports, EIA said. As the agency has previously noted, the facility is currently the only one in the United States capable of handling fully loaded Very Large Crude Carriers (aka, VLCC). A VLCC is capable of carrying around 2 million bbl of crude.

Following the modifications at LOOP, the increase in cargo enabled U.S. crude exports to surpass 2 million b/d for 25 weeks in 2018, versus just one week in 2017.

“In addition to LOOP, other U.S. Gulf Coast export facilities in and around Houston and Corpus Christi, TX, have been investing in increasing the scale of U.S. crude oil export cargos,” EIA said.

Late last month, Lone Star Ports LLC, a joint venture between the Carlyle Group and the Berry Group, received approval from the Port of Corpus Christi Commission for a lease agreement for 200 acres on Harbor Island to develop a state-of-the-art petroleum export terminal.

Lone Star’s facility if it is sanctioned would be the deepest-draft safe harbor crude export facility in the nation when it is commissioned. The project is one of two now proposed for the Corpus area, and among eight deepwater ports planned along the Gulf Coast.

Also in South Texas, a facility backed by global commodity trader Trafigura Group Pte Ltd. is also on the drawing board to move more crude volumes out of the region.

Meanwhile, Enbridge Inc. disclosed late last year that it is working on a joint project with Kinder Morgan Inc. and Oiltanking GmbH to build a VLCC loading facility offshore Texas. The $800 million project under development, called Texas Colt, could be ready by late 2021.

The competition to build crude export projects along the Texas coast has only heated up in 2019, with Sentinel Midstream entering the fray in February when it launched a proposal to build Texas GulfLink, an offshore oil export terminal near Freeport capable of exporting up to 85,000 b/d with nominal capacity of 1.2 million bbl a year. That terminal would also be able to accommodate VLCCs.

Looking at U.S. crude exports by destination, Asia was the largest regional destination in 2018, followed by Europe. Similar to previous years, Canada remained the largest single destination for U.S. crude exports, receiving 378,000 b/d, or 19% of total U.S. output for the year. South Korea moved up to become the second-largest single destination for U.S. crude, receiving 236,000 b/d to surpass China’s 228,000 b/d.

“However, the distribution of U.S. crude oil exports by destination varied significantly from the first half of 2018 to the second half,” EIA said. “In the first half of 2018, the United States exported 376,000 b/d of crude oil to China, which made China the largest single destination for U.S. crude oil exports for that period.

“However, in August, September and October of 2018, the United States exported no crude oil to China. U.S. crude oil exports to China resumed in the final two months of the year but at much lower volumes. On average, the United States exported 83,000 b/d of crude oil to China in the second half of 2018.”

EIA noted that the shifts in exports to China occurred as Washington, DC, and Beijing were engaged in negotiations stemming from the trade war between the two countries, a dispute that has impacted the oil and gas industry.

“In the summer of 2018, as part of ongoing trade negotiations between the United States and China, China temporarily included U.S. crude oil on a list of goods potentially subject to an increase in import tariffs,” EIA said.

Around the same time, the spread between domestic West Texas Intermediate crude prices and global benchmark Brent narrowed, according to the agency.

“The rapidly narrowing price discount of U.S. crude oils versus international crude oils and the potential for higher import tariffs caused China’s imports of U.S. crude oil to slow,” EIA said. “As U.S. crude oil exports to China fell, exports to South Korea, Taiwan, Canada and India increased. Ultimately, the rate of crude oil exports to all destinations in the second half of the year (2.2 million b/d) was higher than in the first half (1.8 million b/d).”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |