Regulatory | NGI All News Access | NGI The Weekly Gas Market Report

Another Battlefront Opens for NatGas as Nuclear Subsidies Bill Lands in Ohio

Yet another bill to support struggling nuclear power plants with state subsidies has been introduced, this time in Ohio, where FirstEnergy Corp. subsidiaries have announced plans to close the state’s two reactors without legislation or market reform to help them. The natural gas industry immediately decried the legislation as it continues to fight similar proposals nationwide.

Republican Reps. Jamie Callender and Shane Wilkin introduced House Bill (HB) 6 last Friday, touting it as a “commitment and investment in clean energy.”

“This legislation looks to Ohio’s energy future by investing in clean energy,” Wilkin said. “It addresses the global need of generating power and balancing it with a portfolio of supporting cleaner resources to meet the state’s demand.”

Power customers in the state currently pay monthly charges for renewable and energy efficiency services. The new bill proposes to keep those options available, but replace them on consumer bills with the Ohio Clean Air Program (OCAP).

The legislation would create a fund and program administered by the Ohio Air Quality Development Authority to certify “clean air resources.” It would also develop another program for generators who reduce their emissions. Certified clean air resources, which the co-sponsors said would produce zero-carbon emissions, would report the megawatt hours they generate each month and receive credits based on a formula. The OCAP program, the lawmakers said, is expected to collect $300 million annually.

While the average residential customer pays $4.39/month for clean energy mandates, the lawmakers said their bill would lower that on average by $1.89 under the new program.

But natural gas industry interests disagreed, saying the legislation could potentially cost billions of dollars and come at “the expense of the state’s economic prosperity.”

“HB 6 is nothing short of a taxpayer-funded bailout of failing nuclear power plants,” said API Ohio Executive Director Chris Zeigler. “Ohio lawmakers should be mindful of the long-term consequences of supporting a policy that will subsidize bankrupt corporations and deliberately manipulate the market to the disadvantage of all Ohioans.”

Wholesale electricity prices have declined by nearly 50% since 2008 thanks largely to natural gas-fired power generation, Zeigler added, saying HB 6 “would deliberately distort the market and reverse these benefits.”

The bill follows similar measures in other states to subsidize nuclear power, including those in Connecticut, Illinois, New Jersey and New York. The battle has spilled into the Appalachian Basin, where unconventional drilling in Ohio and Pennsylvania combined to produce more than 8 Tcf of natural gas last year. Over the last two months, legislation has been introduced in Pennsylvania that would make nuclear power a qualifying resource under Pennsylvania’s Alternative Energy Portfolio Standards.

The subsidies continue to gain ground. The U.S. Supreme Court on Monday denied the Electric Power Supply Association’s (EPSA) petition challenging the incentives. The trade group overwhelmingly represents gas-fired power generators. EPSA CEO John Shelk told NGI on Monday that he believes gas-fired generators have a better chance of staving off legislation to support nuclear resources in Ohio and Pennsylvania because unconventional producers have a strong presence in both states.

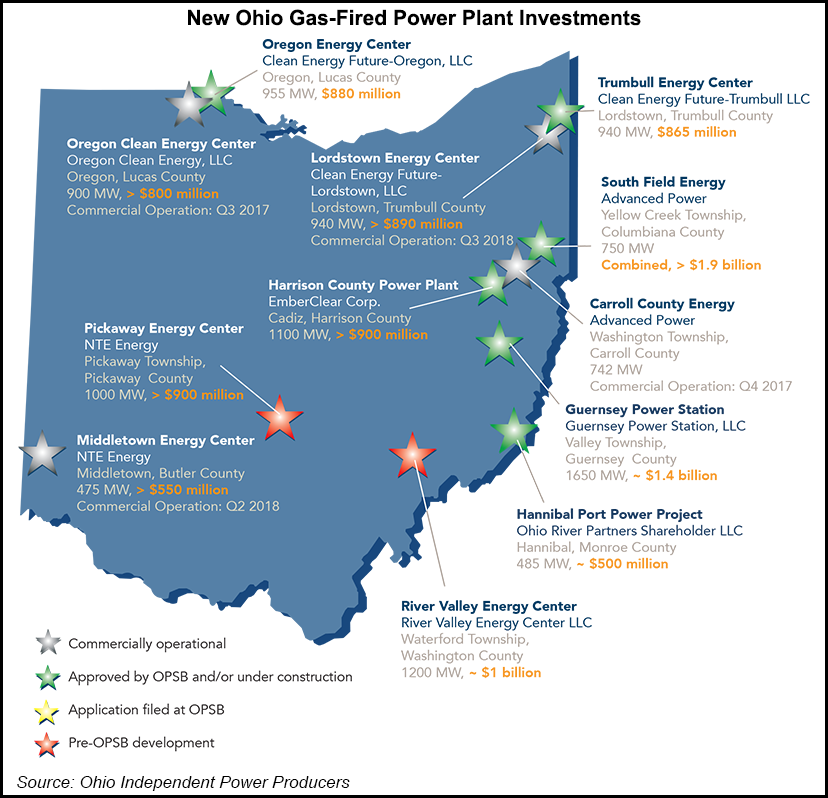

Low cost gas has made it hard for nuclear facilities to compete in wholesale power markets. Dozens of gas-fired facilities have entered service or are under construction across Appalachia. In Ohio alone, gas-fired generators have invested $11 billion to build more than 11,000 MW of capacity, according to the Ohio Independent Power Producers (OIPP). OIPP President Peter Rigney slammed HB 6 as another “government intrusion on the private electricity market.”

There are two nuclear reactors in Ohio that generate about 15% of the state’s electricity and nearly 89% of its emissions-free power, according to the Nuclear Energy Institute (NEI). The Davis-Besse and Perry plants, owned by FirstEnergy Solutions Corp., employ more than 1,400 workers and pay over $20 million in taxes, according to NEI.

FirstEnergy Solutions filed for bankruptcy last year, citing the prolific natural gas supplies in Appalachia that have eroded profits from power sales. The company is currently mired in those proceedings and has already announced plans to close Davis-Besse and Perry.

“Without legislative action, Ohio will lose permanently a reliable, resilient and emissions-free source of energy,” said NEI CEO Maria Korsnick.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |