Shale Daily | E&P | Infrastructure | NGI All News Access

Marcellus Activity Slows as BHGE’s U.S. Rig Count Drops to 1,022

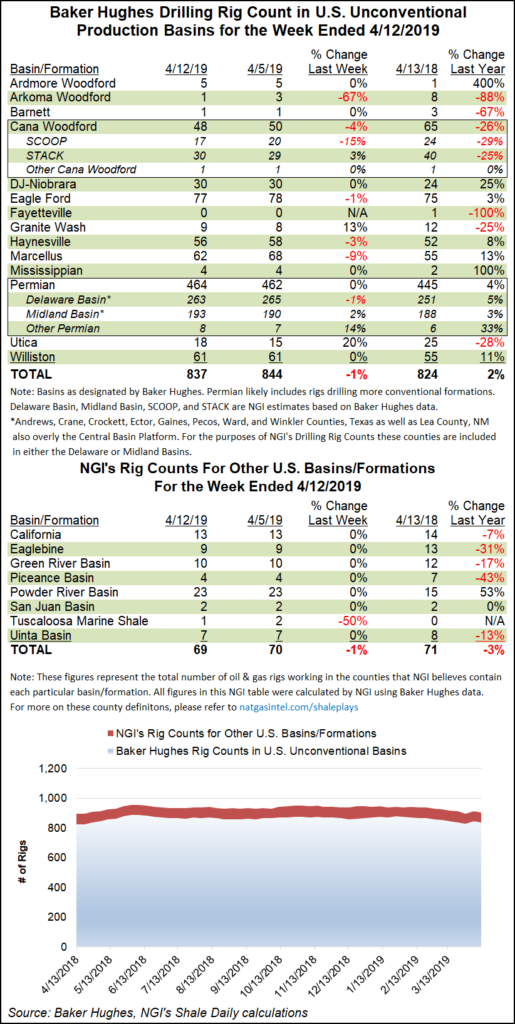

A sharp decline in the Marcellus Shale spurred a retreat in the overall U.S. rig count during the week ended April 12, as the total number of domestic rigs fell to 1,022, according to data from Baker Hughes, a GE Company (BHGE).

The United States saw a net decline of three rigs for the week, as five natural gas-directed units left the patch, offsetting the addition of two oil-directed. The 1,022 domestic rigs compares with 1,008 active units a year ago, according to BHGE.

Four land rigs departed for the week, offsetting the return of one rig in the Gulf of Mexico (GOM). Twelve horizontal units packed up shop, offsetting the addition of eight directional units and one vertical unit.

The Canadian rig count dropped two units to end the week at 66, down sharply from 102 rigs running in the year-ago period. The combined North American rig count finished at 1,088, down from 1,110 a year ago.

Among plays, the Marcellus posted the largest net decline for the week, as six units exited the play to drop its total to 62. That still outpaces the 55 rigs running there a year ago, and the losses in the Marcellus were offset partially by three rigs rejoining the patch for the week in the neighboring Utica Shale.

Also among plays, the Arkoma Woodford, Cana Woodford and Haynesville Shale each saw two rigs exit for the week, while two rigs returned to action in the Permian Basin. The Eagle Ford Shale dropped one unit from its total to fall to 77 rigs, up slightly from 75 rigs a year ago.

Among states, with units shifting around in the Northeast, Pennsylvania posted a net decline of three rigs for the week, while West Virginia saw a net decline of one unit overall. Those losses were offset partially by one unit rejoining the patch in Ohio, BHGE data show.

Elsewhere among states, Texas added three rigs overall, while one rig went to work in Kansas. Meanwhile, Oklahoma posted a net loss of three rigs, while two rigs packed up in New Mexico.

The U.S. upstream sector could see a major shake-up now that Chevron Corp. has formalized its plans to acquire Anadarko Petroleum Corp. in a blockbuster $33 billion deal that expands its armada in the U.S. onshore, deepwater Gulf of Mexico (GOM) and in the liquefied natural gas export business.

The combined portfolios of Chevron and Anadarko would create the leading U.S. producer, with forecast production of more than 1.6 million boe/d, according to GlobalData.

“The deal is the largest acquisition by a supermajor since Royal Dutch Shell plc acquired BG Group for $53 billion in 2015,” GlobalData upstream analyst Jonathan Markham said.

Meanwhile, the unconventional revolution in the U.S. onshore continues to break records, as domestic crude production reached 11.96 million b/d in December, the highest level in U.S. history, the Energy Information Administration (EIA) said earlier in the week.

Annual U.S. crude production totaled 10.96 million b/d in 2018, up 1.6 million b/d (17%) compared with 2017, according to the agency, which said the most recent numbers continue a sharp growth trend over the past decade that coincides with the widespread adoption of horizontal drilling and hydraulic fracturing.

Growth should continue in 2019 and 2020, according to EIA, which projects U.S. crude output will rise to 12.3 million b/d in 2019 and 13.0 million b/d in 2020.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |