NGI Data | Markets | NGI All News Access

Bullish Natural Gas Storage Data No Deterrent for Bears; Permian Cash Climbs Again

After a couple of days at a stalemate, natural gas bears took control over the futures market Thursday as they brushed off slightly bullish storage data and looked ahead to what could be a substantial improvement in storage deficits in the weeks ahead. The Nymex May gas futures contract fell 3.6 cents to settle at $2.664/MMBtu, and June slipped 3.4 cents to $2.708.

Cash prices in the Permian Basin and in Western Canada continued to strengthen in an otherwise soft spot gas market where most other regions posted declines. The NGI Spot Gas National Avg. fell a penny to $2.365.

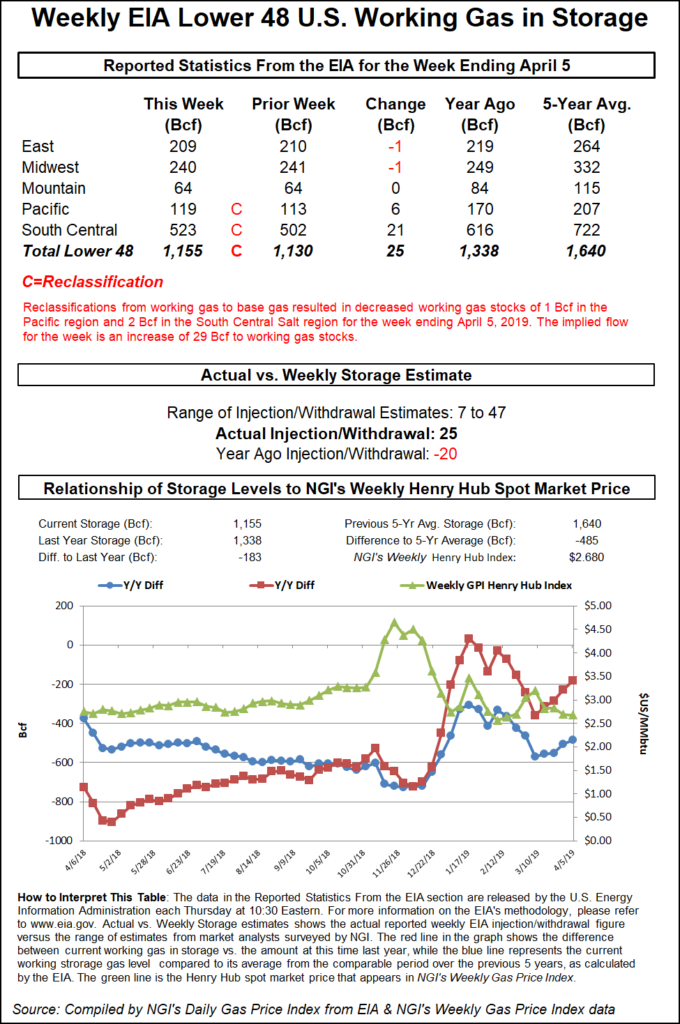

With only modest changes seen in weather data during the last few days, all eyes were on Thursday’s Energy Information Administration (EIA) storage report. The EIA reported that implied flows reflected a 29 Bcf injection into storage inventories for the week ending April 5. The net change week/week, however, was a smaller 25 Bcf build, due to multiple reclassifications in the Pacific and South Central regions that moved some stocks into base gas, rather than working gas.

The EIA’s reported build came in much larger than last year’s 20 Bcf withdrawal and the five-year average injection of 5 Bcf. It was, however, smaller than estimates that had pointed to a build of a few more Bcf.

Nevertheless, Bespoke Weather Services viewed the EIA report as neutral. Even though the implied flow was a miss to the bullish side this week, the firm believes the miss simply negates the bearish miss the market saw in last week’s report. “Even at 29 Bcf, it is still reflective of balances that are currently quite loose.”

Other analysts also noted that this week’s EIA data was likely a true-up of last week’s overstated injection. “Average the last two weeks together, and everything makes sense,” said Jacob Meisel, head of gas fundamental research at a New York energy trading firm. “Each week in isolation is harder to justify.”

Meanwhile, continued loose balances point to another hefty injection versus the five-year average next week as well, according to Bespoke. On Wednesday, Tudor, Pickering, Holt & Co. said there was a potential for the EIA to report a 100 Bcf-plus build, which would be five times the five-year average. Most analysts, however, are estimating a build closer to around 90 Bcf.

Broken down by region, the EIA reported a 1 Bcf withdrawal in the East and in the Midwest, a 6 Bcf net injection in the Pacific after a 1 Bcf reclassification to base gas and a 21 Bcf net injection in the South Central. Salt facilities reported 12 Bcf in implied flows, although 2 Bcf was reclassified to base gas.

Working gas in storage as of April 5 stood at 1,155 Bcf, 183 Bcf below last year and 485 Bcf below the five-year average, according to EIA.

Thursday’s drop — while modest — came as Lower 48 production has remained off from earlier post-winter highs. Although supply declines are common at the beginning of the month, production data is normally revised higher in the days following. That has not been the case this month, and production has actually continued to retreat, according to Genscape Inc.

“It is common this time of year to see pipelines and producers take advantage of weak shoulder-season demand and prices to conduct maintenance,” Genscape senior natural gas analyst Rick Margolin said.

For the past five days, Genscape estimates production has averaged a bit under 86.7 Bcf/d. This makes for a roughly 0.85 Bcf/d decline to the previous week, and is more than 2 Bcf/d off from March 31, when production rebounded to what was then a 121-day high.

Since the close of March there have been more than 1.1 Bcf/d of declines in Gulf Coast region output; nearly 0.73 Bcf/d of declines out of the Permian; about 0.59 Bcf/d of declines out of the rest of Texas; and 0.3 Bcf/d lower output from the Northeast. The declines out of Gulf have come from the Haynesville in North Louisiana, which appears related to planned maintenance on a collection of interstate pipes, as well as suspected field maintenance by producers in the area, as is common for this time of year. There is also about 0.3 Bcf/d of loss from offshore areas, likely due to processing plant maintenance, according to Genscape.

“Permian production has been in retreat after cash prices cratered into unprecedented negative territory. We are seeing declines across multiple interstate gathering and processing points, as well as their receipts from intrastate systems,” Margolin said.

Looking ahead, without any early-season heat on the horizon, analysts see additional downside risk for natural gas prices. However, there is strong technical support that would likely make for an increasingly jagged slide, according to EBW Analytics Group.

A modest tightening of market conditions in May, however, appears likely to help firm support and lay the ground for a modest seasonal rebound into summer. “A combination of slower production growth, rebounding liquefied natural gas exports from Sabine Pass, growing pipeline exports to Mexico with the completion of the Sur de Texas pipeline, and potential for bullish summer forecast shifts relative to current mildly bearish expectations all point to the possibility for bullish trends by late May,” EBW CEO Andy Weissman said.

Spot gas prices were mixed but mostly lower Thursday, even as a strong spring storm with heavy rain and snow tracked across the Midwest, leaving chilly conditions with overnight temperatures in the 20s and 30s, according to NatGasWeather. The southern United States was expected to remain very warm to locally hot with highs in the 70s to 90s, while mild conditions were forecast for the West Coast and wet conditions in the Northwest.

There could also be minor production disruptions in the storm’s most affected areas due to heavy snow and strong winds through Friday, the firm said.

Meanwhile, another cool shot was forecast to sweep across the northern and central United States Saturday through Tuesday, with lows of 20s and 30s making for stronger national demand before a projected warm-up late next week.

Midwest next-day gas fell across the region, with Chicago Citygate slipping 3 cents to $2.585.

Over in the Midcontinent, ANR Pipeline updated the restrictions at the Eunice Total location due to its continued compressor maintenance in Louisiana adding another impactful day, further limiting deliveries by up to 222 MMcf/d for Friday’s gas day.

This maintenance has been going on since February with one very impactful day so far, according to Genscape. ANR announced Wednesday that deliveries would be further restricted by an additional 125 MMcf/d down to 875 MMcf/d for Friday, and then continue to be restricted to 1,000 MMcf/d through April 30.

Deliveries at Eunice Total have averaged 1,010 MMcf/d with a maximum of 1,097 MMcf/d over the past 30 days, therefore limiting up to 222 MMcf/d on April 12, Genscape analyst Anthony Ferrara said. “Notably, Eunice Total has continued to operate above the restricted maintenance capacity throughout this event.”

On the pricing front, ANR SW prices fell more than a nickel to $2.18, while ANR SE in South Louisiana rose 2.5 cents to $2.60.

Small declines were seen throughout most of Texas, except in the Permian Basin. After climbing 50 cents on Wednesday, Waha spot gas jumped another 18.5 cents Thursday to average 43.5 cents. Other regional prices also strengthened but remained well below $1.

On the East Coast, Tenn Zone 6 200L led the Northeast with a nearly 20-cent decline to $2.72, while points along the Transcontinental Gas Pipe Line fell a little less than 15 cents.

Appalachia prices also slid Thursday, with Texas Eastern M-3, Delivery next-day gas tumbling more than a dime to $2.40.

Next week, Texas Eastern Transmission (Tetco) is scheduled to conduct a series of maintenance events that will affect capacity on the Southern 36-inch diameter line in Pennsylvania from Bedford to Marietta. These events include an outage at the Marietta compressor station from April 15 to 22 and cleaner runs from Uniontown to Bedford and then from Bedford to Chambersburg on April 16, 17 and 19.

“Flows along this line will be impacted by as much as 325 MMcf/d compared to the 14-day max, creating pressure for the Texas Eastern M2-M3 spread to widen as M2 export capacity and M3 demand capacity is simultaneously restricted,” Genscape analyst Josh Garcia said.

The overall trend of warming weather in the Northeast should limit cash price upside risk, but weather forecasts have been volatile recently, with massive daily revisions of up to 5 average degrees day/day. However, Tetco is set to conduct additional outages on its Lebanon and Waynesville compressors next week that could add to the M2/M3 volatility, Garcia said.

In Western Canada, NOVA/AECO C spot gas jumped 44 cents to $1.36.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |