E&P | NGI All News Access | NGI The Weekly Gas Market Report

U.S. E&P Capex Discipline ‘Not Just Lip Service,’ Says Raymond James

Global oil and gas capital spending had been on the rise for two straight years, but the collapse in oil prices late last year puts a kibosh on a “massive escalation” in expenditures anytime soon, according to Raymond James & Associates Inc.

The energy analyst team led by Pavel Molchanov on Monday published its annual capital expenditure (capex) survey of global operators. “The main culprit for the anticipated 2019 oilfield spending growth rate slowdown was clearly the late 2018 collapse in oil prices that hit right in the middle of U.S. budgeting season,” analysts said.

In the annual survey of operators during 2018 that comprise an estimated 70% of global upstream investment, capex overall rose about 15% year/year, slightly more than budgeted originally, mostly because of higher spend by U.S. exploration and production (E&P) companies.

However, this year, “global oilfield spending is currently set to rise by only about 5%,” with U.S. E&Ps leading the reductions.

“We remain convinced that sustaining global oil supply growth at recent rates will ultimately require further spending increases, which is an uncertain prospect as more management teams respond to shareholder pressure for capital discipline,” Molchanov and his colleagues said.

One year ago, the Raymond James team had predicted that global upstream oilfield investment would increase by 12% during 2018, with evenly distributed increases across various geographies. Based on the new capex survey, last year’s spend overall rose by a slightly larger-than-expected 15%, led by a 29% increase among U.S. large-cap E&P companies.

“However, we are seeing a mirror image of that in 2019,” analysts said. “Given the dramatic oil price fall-off in 4Q2018, right as companies were setting 2019 budgets, initial U.S. budgets are averaging a 9% drop. Alongside modestly rising budgets outside the U.S., global spending is set for only a 5% uptick in 2019.”

In the big picture scheme of things, “capital discipline across the industry is not just lip service — it is for real.” This year’s capex eventually may surpass initial budgets, “but in view of the industry’s newfound discipline, don’t hold your breath for massive escalation in spending.”

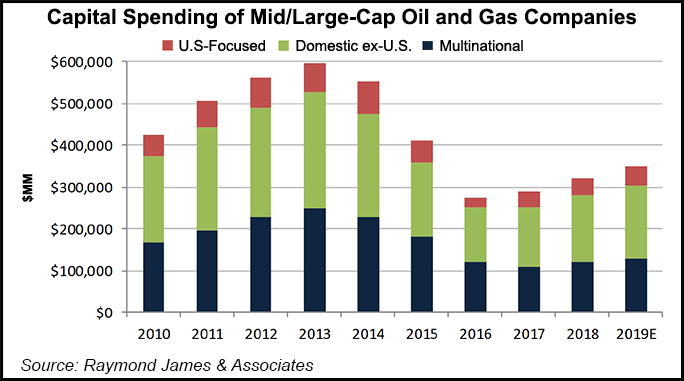

Aggregate global capital spend for the annual 50-company survey peaked in 2013 at $595 billion. What followed were three years of “brutal austerity,” with capex cumulatively down 54% to $275 billion. Green shoots of a recovery began to appear in 2017, with capex up 5%, followed by a 15% increase in 2018. However, last year’s capex overall still were 44% below the 2013 peak.

Global oilfield spending this year is predicted to be up 5% to $350 billion, according to the survey. Considering the “magnitude of the cutbacks during the downcycle, 2019 spending still equates to a cumulative global drop of 41% from the peak levels of 2013,” Molchanov and team said.

“To clarify, this 41% drop comprises a combination of lower activity levels as well as lower industrywide costs. The relative proportions of these two variables naturally differ from region to region and from company to company.”

Capex in countries where the industry is dominated by state-run enterprises is difficult to discern, particularly from countries that are members of OPEC, the Organization of the Petroleum Exporting Countries.

The Raymond James team focused on a sample of 50 large operators that disclose financials, including 19 U.S.-focused that are pure plays or close. Another 17 are focused in a single country outside the United States, including Canada, and 14 are diversified multinationals. Every kind of upstream activity is in the survey, from conventional, shale/horizontals, deepwater, oilsands, enhanced recovery, liquefied natural gas and frontier exploration.

“The large-cap U.S. E&Ps have genuinely embraced capital discipline, and smaller companies seem to be following their example,” analysts noted.

Based on capex budgets that were using $53/bbl West Texas Intermediate (WTI) oil prices going into 2019, U.S. E&P cash flow generation this year is forecast to be down 7%, with capex down 11% and the rig count down 2%.

“Given that our full-year 2019 oil price forecast calls for back-end-loaded recovery (toward $75 WTI in 4Q2019), we envision that many E&Ps will end up outspending their initial budgets, as they gain more confidence in improving oil prices toward the end of the year.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |