Infrastructure | E&P | NGI All News Access

Permian Leads Oil-Focused Rebound as BHGE U.S. Count Jumps by 19

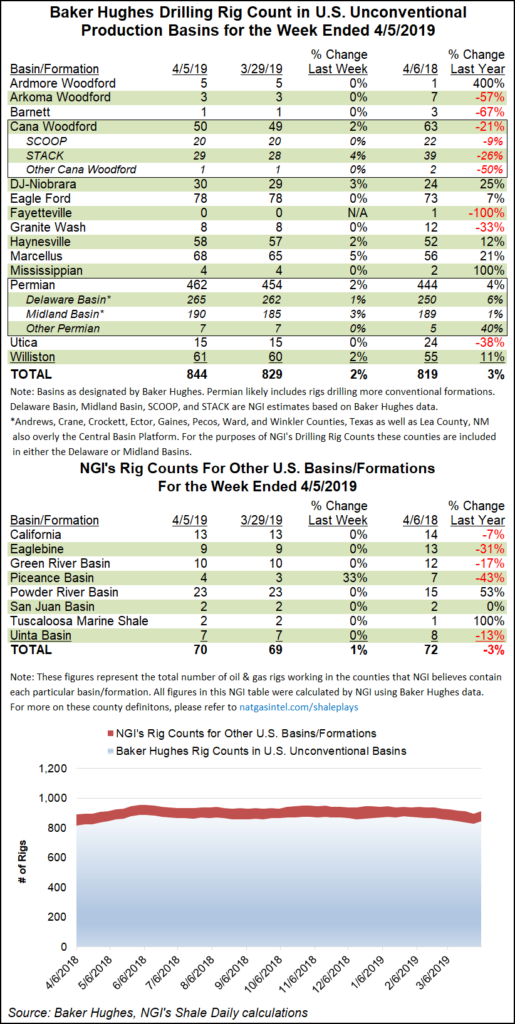

A sharp rebound in onshore drilling activity — mostly oil-directed — pushed the U.S. rig count 19 units higher to 1,025 for the week ended Friday (April 5), according to data from Baker Hughes, a GE Company (BHGE).

The United States added 15 oil rigs and four natural gas-directed rigs to finish 22 units ahead of its year-ago tally of 1,003. The net gain in the domestic count came from land drilling; the addition of one inland waters rig offset the departure of one from the Gulf of Mexico. Six directional units and three vertical units returned to action for the week, along with 10 horizontal units, according to BHGE.

The Canadian rig count fell 20 units to finish the week at 68, down from 111 a year ago. The combined North American rig count ended the week at 1,093, down from 1,114 in the year-ago period, according to BHGE.

Among major plays, the Permian Basin and the Marcellus Shale saw the largest gains for the week. In the Permian, where production growth has contributed to severe negative natural gas spot prices in recent weeks, eight rigs returned to action. That left the West Texas and southeast New Mexico play sitting at 462 rigs overall, up from 444 a year ago.

Meanwhile, the Marcellus picked up three rigs for the week to grow its tally to 68 from 56 in the year-ago period. Elsewhere, the Cana Woodford, Denver Julesburg-Niobrara, Haynesville Shale and Williston Basin each added one rig to their respective tallies for the week.

Among states, Texas (up eight) and West Virginia (up four) posted the largest weekly increases, roughly mirroring the net gains in the Permian and Marcellus. New Mexico added three rigs, while Alaska and Colorado each added two. North Dakota gained one rig, while Oklahoma and Pennsylvania each saw one rig depart for the week.

BHGE also released its latest international rig count Friday, which showed 1,039 combined rigs active in March across Latin America, Europe, Africa, the Middle East and Asia Pacific. That’s up sequentially from 1,027 in February and 972 counted in the year-ago period.

The average U.S. rig count for March was 1,023, down from 1,049 in February but up from 989 in March 2018. The average Canadian rig count last month was 151, down from 230 in February and down from 218 in March 2018.

Selling onshore U.S. oil and natural gas assets proved more difficult during the first quarter, and properties for sale, mostly in the Permian Basin, have declined as operators cautiously prowl for buyers, according to Drillinginfo.

Domestic merger and acquisition (M&A) deal values plunged to a record 10-year low in the first three months, the Austin, TX-based data analytics company said Thursday. The slump that began late last year carried into the new year, with 1Q2019 dealmaking by exploration and production (E&P) companies and other operators falling to $1.6 billion, down 91% sequentially and 93% year/year.

The turnaround followed a total of $82 billion in M&A activity during 2018, which was a four-year record high.

“The market for upstream deals came to a halt in late 2018 with the combined pullback in oil prices and equities,” said Drillinginfo M&A analyst Andrew Dittmar. “Since then, oil has rebounded by 20% and E&P stocks are up 15%, albeit with nearly all those stock price gains taking place in early January. However, deals haven’t returned in a meaningful way and we believe that is being largely driven by Wall Street.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |