Infrastructure | E&P | NGI All News Access | Permian Basin

Stonepeak Snapping Up Oryx Permian Crude Operations for $3.6B

Stonepeak Infrastructure Partners agreed Tuesday to pay $3.6 billion to purchase nearly all of the assets of Oryx Midstream Services, the largest privately held gathering and transportation oil operator in the Permian Basin.

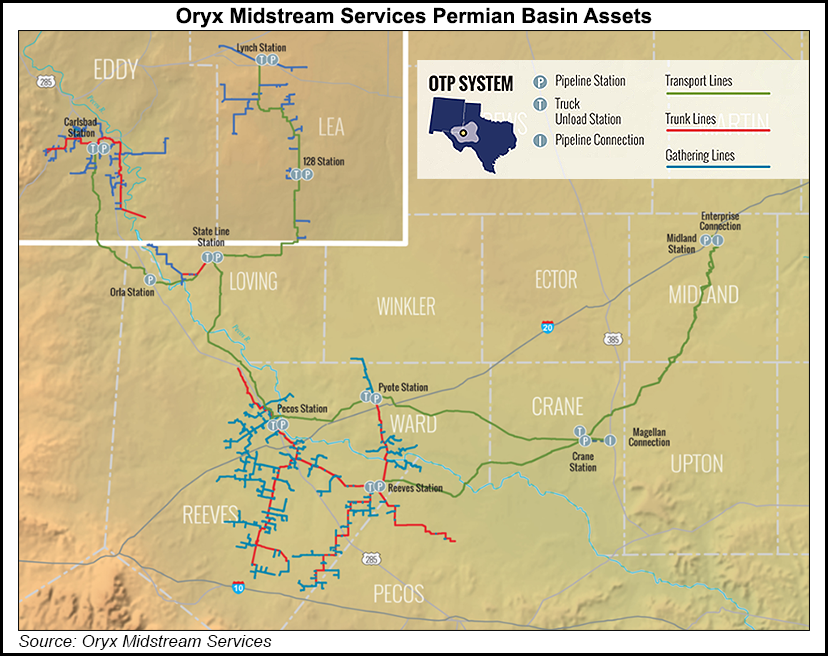

The Midland, TX-based operator owns and operates an oil gathering and transportation system underpinned by nearly one million acres under long-term dedications from more than 20 customers. It has 2.1 million bbl of storage and around 1,200 miles of pipeline in-service and under construction spanning eight counties in Texas and two in New Mexico.

Once the remaining part of an Oryx system under construction is completed, total Delaware transportation capacity is slated to exceed 900,000 b/d.

Substantially all of Oryx Southern Delaware Holdings LLC and Oryx Delaware Holdings LLC were sold by affiliates of private equity (PE) sponsors Quantum Energy Partners and Post Oak Energy Capital, cornerstone Permian producers Concho Resources Inc. and WPX Energy Inc., and other investors. Oryx is retaining its name and headquarters in Midland. The leadership team, led by CEO Brett Wiggs and CFO Karl Pfluger, also would remain in their current roles and are investing alongside Stonepeak in the transaction.

“We are grateful for our productive five-year relationship with Quantum and Post Oak, whose knowledge and industry expertise were strong factors in our growth and success to date,” Wiggs said. “As we begin our next chapter and new partnership with Stonepeak, we look forward to the operational and capital support they will provide our team as we continue to aggressively grow our footprint in the Permian Basin.”

Stonepeak is a PE with more than $15 billion of assets under management. Partner Jack Howell, who heads the energy business, said Oryx was “the most attractive private Permian midstream asset Stonepeak has evaluated, and we view it as a strategic platform and a core North American crude infrastructure asset…

“Our critical focus will be on continuing to provide Oryx’s diversified customer base with best in class service offerings to accommodate their growing production while also pursuing new commercial opportunities across the value chain.”

Barclays, acting through its investment bank, advised Stonepeak, while Jefferies LLC and Citi acted as financial advisers to Oryx and its sellers. Shearman and Sterling LLP and Vinson & Elkins LLP served as legal counsel to Oryx. Stonepeak was represented by Hunton Andrews Kurth LLP and Sidley Austin LLP with regards to the transaction, and Simpson Thatcher & Bartlett LLP, its fund counsel. Latham & Watkins LLP represented the lender group.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |