EIA Storage Data Offers Few Surprises, Keeping Natural Gas Futures Steady

Natural gas futures prices charted a relatively tranquil pattern Thursday after the Energy Information Administration’s (EIA) weekly storage report showed a 36 Bcf withdrawal from U.S. stocks that was in line with estimates.

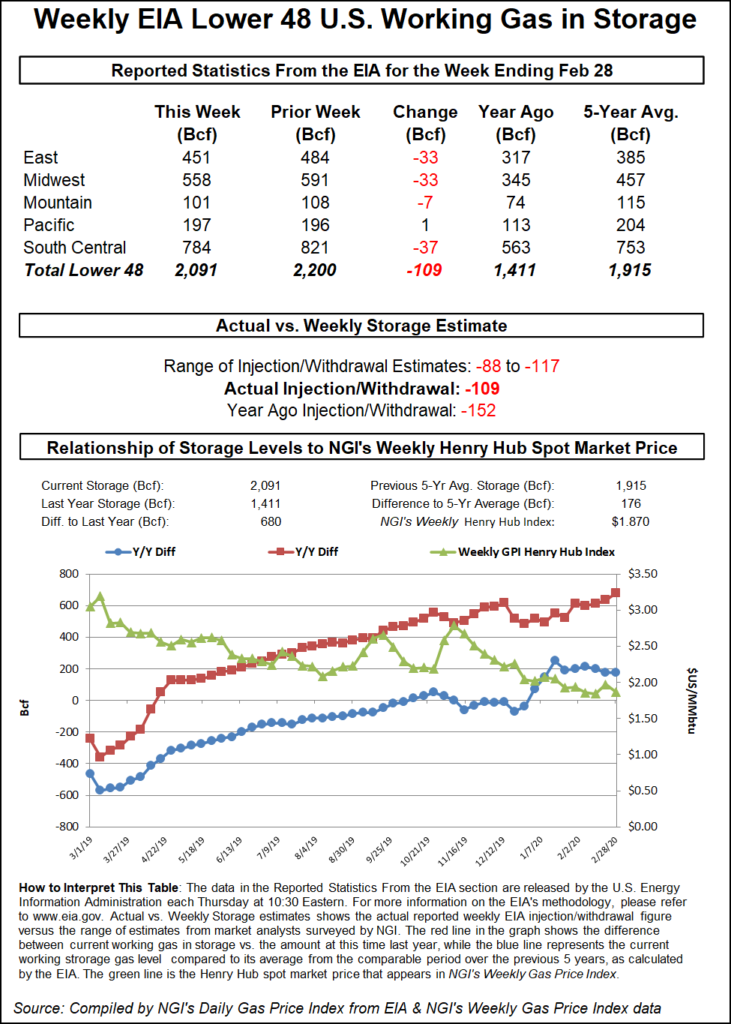

The 36 Bcf figure for the week ended March 22 compares to a five-year average withdrawal of 41 Bcf and a 66 Bcf pull recorded in the year-ago period. With temperatures rapidly warming and forecasts showing minimal lingering cold shots heading into April, estimates suggest this week’s report could also mark the end of the withdrawal season.

As the report crossed trading screens at 10:30 a.m. ET, the May Nymex futures contract went as high as $2.729 and as low as $2.709, but over the next 20 minutes most of the action occurred between $2.715 and $2.725, roughly in line with the pre-report trade from earlier in the morning.

By 11 a.m. ET, May had climbed to around $2.735, up 1.6 cents from Wednesday’s settle.

Prior to the report, a Bloomberg survey showed estimates ranging from a withdrawal of 29 Bcf to a 54 Bcf pull. Intercontinental Exchange futures had pointed to a 32 Bcf withdrawal. NGI’s storage model had predicted a withdrawal of 40 Bcf.

Bespoke Weather Services had called for a 34 Bcf withdrawal and viewed Thursday’s report as “neutral overall.”

“It was quite loose compared to last week and the five-year average, but prices are already off significantly week/week to reflect that loosening,” Bespoke said. “The market consensus was relatively close to the 36-37 Bcf level as well, and we have not seen prices move much since the release of the number.

“Modestly supportive overnight weather may prevent prices from really bleeding off, but cash back under $2.65, loose daily balances, and expectations of a warming April should keep prices under pressure even after this neutral EIA print.”

Total Lower 48 working gas in underground storage stood at 1,107 Bcf as of March 22, 285 Bcf (20.5%) below last year’s stocks and 551 Bcf (33.2%) below the five-year average, according to EIA.

By region, the East and Midwest both saw net withdrawals of 20 Bcf for the week. The Pacific region injected 8 Bcf overall, while Mountain region stocks finished flat week/week.

Chat participants on energy-focused social media platform Enelyst had been expecting the unexpected from the South Central region this week, but changes to stocks there offered few surprises based on comments following Thursday’s report. EIA recorded a net 4 Bcf withdrawal in the South Central, with a 7 Bcf withdrawal from nonsalt offsetting a 2 Bcf injection into salt.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |