Infrastructure | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Permian Natural Gas Flaring Said Likely to Hit 1 Bcf/d-Plus Until Pipeline Cavalry Arrives

Natural gas flaring in the Permian Basin could exceed 1 Bcf/d at some point this year before the first of the major pipeline takeaway projects comes online, according to data compiled by analysts with Sanford C. Bernstein & Co. LLC.

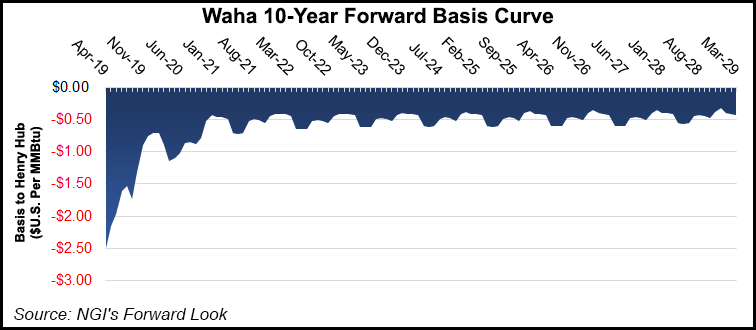

The forward curve hit $1.8 from Henry Hub in the shoulder month, and “we believe gas could go to zero for short periods if we run out of takeaway in the spring until October,” said analyst Jean Ann Salisbury and her colleagues.

Gulf Coast Express, the first of only two Permian gas pipelines now underway, is set to come online in October, relieving some of the pressure. Sponsors Kinder Morgan Inc. (KMI), DCP Midstream LP and Targa Resources Corp. are building the 42-inch diameter pipeline to carry close to 2 million Dth/d from the Waha hub in West Texas to the Agua Dulce hub near Corpus Christi.

It now appears “very unlikely” that Permian producers may have to shut in some wells as available capacity is filled up and thereby cutting off more takeaway, Salisbury said.

Natural gas spot prices in West Texas reached a new nadir Monday. The entire Permian region on average traded at negative 43.0 cents/MMBtu on the day as producers showed a willingness to pay as much as $1.210/MMBtu to offload their associated gas volumes, Daily GPI prices show.

The Railroad Commission of Texas (RRC) has been “quite supportive” of gas flaring, said Salisbury, but without more capacity to move copious amounts out of the basin, producers “will be forced to sign up for a new pipe.”

The RRC typically issues a standard 45-day permit that allows as much flaring as required, and extensions may be requested.

The only other pipeline sanctioned to move Permian supply south is the Permian Highway Pipeline (PHP), a 2.1 Bcf/d system that would move gas to Agua Dulce and on to Katy near Houston. Partners are KMI, EagleClaw Midstream Ventures LLC and Apache Corp. PHP is not scheduled to begin service until late 2020.

The gas project “best positioned” to achieve a positive final investment decision (FID) next could be the 2 Bcf/d Bluebonnet Market Express, sponsored by Williams and Brazos Midstream, because of interconnects into the Transcontinental Gas Pipe Line, aka Transco, said Bernstein analysts.

However, Williams wants “more than a 10-year signup,” which the exploration and production companies “have been hesitant to sign.”

Several other gas pipelines await sanctioning, including:

“None of the pipeline options in the hunt…seem to be making major progress, but we believe this summer when flaring rises significantly, one will move forward,” Salisbury said. “Bluebonnet seems to be the most likely at the moment, in our view, but we think Williams would need to get to 15 year-plus terms and five-six times multiple to get any sort of positive investor response in the current anti-capital expenditure climate.”

Bernstein analysts every quarter review flaring data reported to the RRC and New Mexico’s Oil Conservation Division (OCD). For October, the latest complete month, flaring/venting at the wellhead in the Texas Permian districts was estimated at 360 MMcf/d. The Texas districts that make up the Permian are defined as 7C, 8 and 8A.

Monthly statistics are typically revised higher by around 50 MMcf/d as operators issue reports, Bernstein analysts noted.

The “true volume” of Texas Permian flaring in October was closer to 400 MMcf/d, versus 310 MMcf/d in July.

“Another 100-150 MMcf/d of flaring in New Mexico, based on data reported to the OCD, brings us to an estimate of 0.5 Bcf/d (4%) of flaring/venting in the total Permian in 4Q2018,” Salisbury said.

Permian producers flaring the most gas between July and October were led by Sable Permian Resources LLC, followed by Surge Energy and WPX Energy Inc., according to Bernstein. Callon Petroleum Co., Energen Corp., SM Energy Inc. and EP Energy Corp. also reported increased flaring. (Energen became part of Diamondback Energy Inc. at the end of November).

Bernstein analysts said satellite data from the National Oceanic and Atmospheric Administration suggested that only 60% of flared volumes in the Texas Permian were reported in 2017 or about 300 MMcf/d, versus 180 MMcf/d reported in the RRC dataset.

With no major FIDs besides the two KMI-led pipelines now underway, takeaway from the massive basin could be curtailed “in the spring shoulder month until October, which will lead to a sharp rise in flaring (and hopefully more FID signups),” said analysts.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |