Markets | NGI All News Access | NGI The Weekly Gas Market Report

Traded Natural Gas Volumes In Mexico Up 15% in February

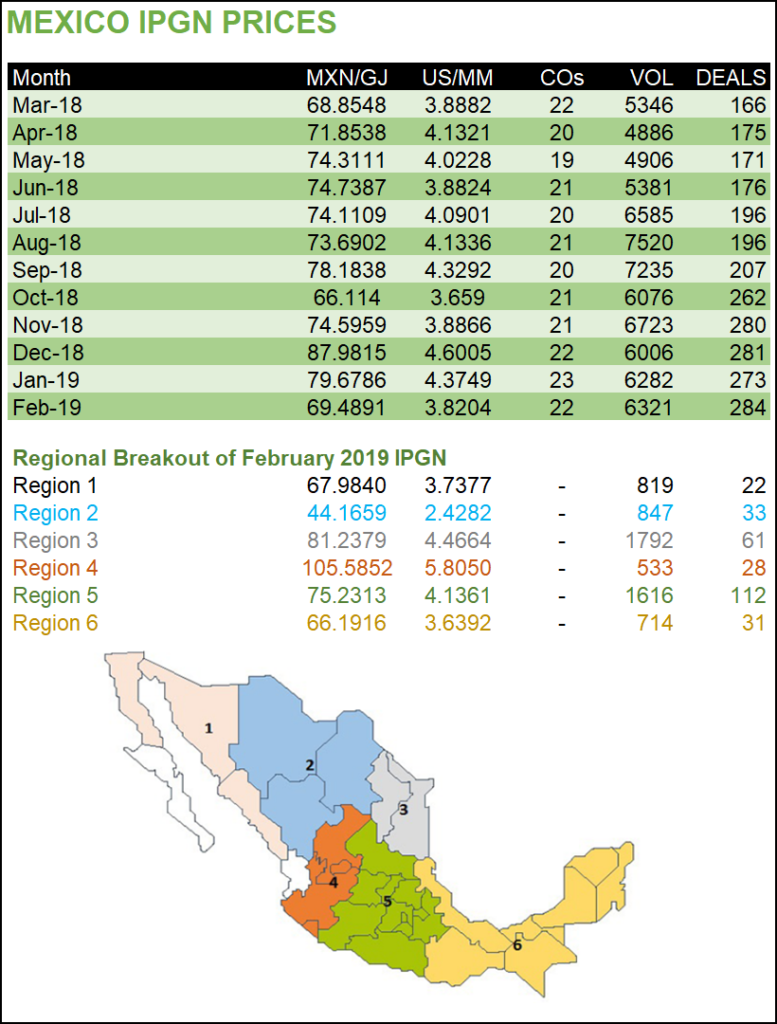

Natural gas marketers in Mexico transacted 284 deals for a total average volume of 6.321 Bcf/d in February, up from 153 deals for 5.496 Bcf/d in the same month a year ago.

Prices averaged 69.4891 pesos/GJ ($3.8204/MMBtu), compared to 80.4542 pesos/GJ ($4.5567/MMBtu) in February 2018, according to the latest IPGN monthly natural gas price index published by the Comisión Reguladora de EnergÃa (CRE).

The IPGN compiles prices reported to the CRE by marketers and is meant to serve as a reference until the market develops enough liquidity for third-party indexes to emerge.

Given Mexico’s overwhelming dependence on gas imports from the United States, market participants typically price gas using a U.S. index such as Waha, Houston Ship Channel or Henry Hub, plus the cost of transport via the Sistrangas national pipeline network.

Imports accounted for 64% of Mexico’s natural gas consumption in December 2018, the most recent month for which data is publicly available, according to Mexico’s Comisión Nacional de Hidrocarburos (CNH). Excluding gas consumed by national oil company Petróleos Mexicanos (Pemex), imports accounted for 90% of consumption.

CRE divides Mexico into six trading regions. Of these, northwestern region 3 and central region 5 saw the highest trading volumes in February, at 1.792 Bcf/d and 1.616 Bcf/d, respectively.

These amounts compare to 1.657 Bcf/d and 2.002 Bcf/d in February 2018.

Region 3, which comprises the border states of Nuevo León and Tamaulipas, includes the city and surrounding area of Monterrey, which is poised to emerge as “a very efficient…energy hub, with significant liquidity,” according to Talanza Energy Consulting’s David Rosales, midstream and downstream partner.

Regions 2 and 6 posted the largest year-on-year proportional increases in trading volumes at 206% and 99.2%, respectively.

Region 2, which entails the northern states of Chihuahua, Coahuila and Durango, contains the El Encino area of Chihuahua. El Encino has become an important outlet for gas produced in the Permian basin of West Texas and Southeastern New Mexico, especially since TransCanada Corp.’s 670 MMcf/d El Encino-Topolobampo pipeline entered service last year, according to a recent report by RBN Energy LLC.

Energy analyst Rosanety Barrios told NGI recently that once the final three sections of Fermaca’s Waha-Guadalajara pipeline system enter operation, and once a planned interconnection between this system and the SISTRANGAS national pipeline network at El Encino is complete, “you would have another clear point [at El Encino] where a hub could be established.”

Region 6, meanwhile, covers the Tehuantepec isthmus and Yucatan peninsula in southeastern Mexico. The Sureste, or southeastern, basin, accounts for the majority of oil and gas output by state-owned Petróleos Mexicanos (Pemex).

The pending reconfiguration of the Cempoala compressor station and completion of Transcanada and Infraestructura Energética Nova’s (IEnova’s) 2.6 Bcf/d Sur de Texas-Tuxpan marine pipeline are expected to ease supply constraints in region 6 and allow Pemex to reinject more gas into its Sureste basin oil wells in order to enhance recovery rates.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |